|

| India's economy is now worth nearly $3.5 trillion. (Source: CNBC) |

After the G20 Summit in New Delhi, the country's stock market skyrocketed.

Economic confidence in the world's most populous country is growing. In August, India joined the club of nations that have sent spacecraft to the Moon, affirming the country's scientific and technological ambitions.

India’s boom comes at a time when China – which has been the engine of global growth for decades – is seeing its economy slow. With a host of advantages in its favor, New Delhi is quickly emerging as a potential successor, from its growing young population to its sprawling manufacturing base.

“There is no denying that the Indian economy is poised for a boom. Several reforms implemented over the past few years have paved the way for solid growth,” said Eswar Prasad, a professor at Cornell University.

The country is also receiving significant interest from foreign investors for a number of good reasons."

Digitalization "changes the game"

Over the past few decades, there have been periods of optimism about India, the world’s fifth-largest economy. However, China has continued to “score points” with the world.

The gap between the two Asian economies is huge. India's economy is now worth nearly $3.5 trillion. China, the world's second-largest economy, is worth nearly $15 trillion.

The two economies are expected to contribute about half of global growth this year, with 35% of that coming from China, the International Monetary Fund (IMF) said.

To overtake China as the largest contributor to global growth in the next five years, India must achieve a sustainable growth rate of 8%, analysts at financial services firm Barclays wrote in a report.

This year, the IMF forecasts that India will grow at 6.3%.

China has set an official growth target of around 5%, but the world's second-largest economy is now grappling with growing challenges, such as weak consumer spending and a property crisis.

“The world’s fifth-largest economy has the wherewithal to grow at an annual rate of at least 6% over the next few years. But to achieve 8% growth, India’s private sector needs to step up investment,” Barclays said.

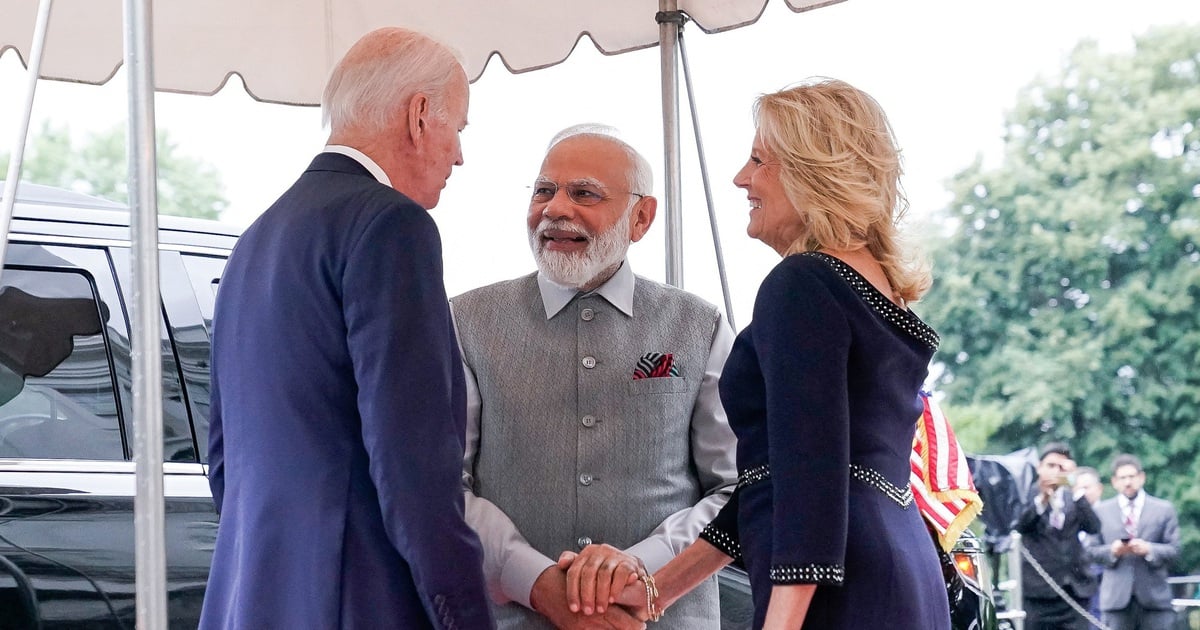

Indian Prime Minister Narendra Modi aims to make the country a $5 trillion economy by 2025. The government is making it easier to do business and attracting more foreign companies to invest.

Like China did more than three decades ago, India is embarking on a massive infrastructure drive, spending billions of dollars to build roads, ports, airports and railways. In this year’s budget alone, $120 billion has been spent on infrastructure upgrades to spur economic expansion.

In fact, India has added 50,000 km to its national highway network, increasing the total length by 50% between 2014 and 2022.

Along with infrastructure, Prime Minister Narendra Modi's country has also built a series of digital public infrastructures that are transforming the country's commerce.

Digitization has been a “game changer” for people and businesses, says Professor Eswar Prasad. For example, the Aadhaar program, launched in 2009, has transformed the lives of millions of Indians. It works by scanning the fingerprints, irises and faces of 1.3 billion people and linking the data to everything from train tickets, bank accounts, tax information, social welfare to mobile phones.

Another platform – the unified payments interface (UPI) – allows users to make instant payments by scanning a QR code. This interface has been embraced by Indians from all walks of life and millions of dollars have flowed into the economy.

| "There is no denying that the Indian economy is poised for a boom. Several reforms implemented over the past few years have paved the way for solid growth. The country is also receiving significant interest from foreign investors for several good reasons," said Eswar Prasad, a professor at Cornell University. |

Last September, Prime Minister Modi cited a World Bank report that said that thanks to digital public infrastructure, India had achieved its financial inclusion goals in just six years, instead of 47 years.

Cannot replace China

India is benefiting from a strategy by global companies to strengthen their supply chains. International businesses are looking to diversify away from China, especially since the rise of US-China tensions and the emergence of Covid-19.

Asia's third-largest economy is also aggressively rolling out a $26 billion manufacturing incentive program to attract companies to set up manufacturing in 14 sectors, including electronics, automobiles, pharmaceuticals and medical devices.

As a result, some of the world’s biggest companies, including Apple supplier Foxconn, are expanding operations in India. But even as India’s clout grows, the country has yet to produce the economic miracle that China produced decades ago.

“India is not like China in the late 1990s and early 2000s,” says Harvard Business School professor Willy Shih. “The Indian government has not removed barriers to foreign investment. In my view, red tape, an unpredictable economy, and a number of non-tariff barriers are the remaining bottlenecks in India.”

For example, in 2016, India suddenly abolished the 500 and 1,000 Rupee notes. This severely affected many people and businesses that relied on cash. Thousands of Indians rushed to banks to exchange their money because these two currencies were so popular.

Meanwhile, in July 2023, India rejected a plan to build an electric vehicle factory by BYD and a local company, citing national security reasons.

India still has too few elements to fill the void left by China's "growth engine," according to a report published in October by HSBC Bank.

HSBC economists Frederic Neumann and Justin Feng point out that the two countries still have differences in consumption and investment. China currently accounts for 30% of global investment, while India accounts for just 5%. "Even if China stopped investing and India tripled, it would still take New Delhi 18 years to catch up to Beijing's investment level," the report says.

In terms of consumption, it will take India another 15 years to equal China's current level.

"This is not to say that India will not have a major impact on the world. We are simply saying that the rise of the South Asian country is not yet enough to replace the world's second-largest economy," HSBC's report concluded.

Source

Comment (0)