The last trading week before the long holiday started with a cautious session.

The last trading week before the long holiday started with a cautious session.

After the last session of the week, VN-Index closed at 1,249.11 points and recorded a 1.51% increase for the whole week with trading volume down 11.4% and only 60% of the average level, the stock market witnessed caution continuing to cover the market at the beginning of the week, with weak demand and cautious investor sentiment. VN-Index maintained a slight increase, challenging the strong resistance zone around 1,250 points, despite some slight adjustments due to increased selling pressure after three consecutive recovery sessions before. However, the index still maintained its upward momentum and ended the morning session in light green, recording its fourth consecutive increase.

Market liquidity was not impressive, as transaction values remained low. This reflected the lack of strong cash flow and a clear differentiation between industry groups. While some industries such as banking and manufacturing still recorded slight increases, the real estate and construction groups continued to face difficulties, putting pressure on the general index.

However, foreign investors maintained a net selling trend, focusing on a number of large stocks, which also somewhat affected the overall market sentiment. In addition, international information about Mr. Donald Trump starting his second term as President on January 20, 2025 made investors worried about tariff policies and the impact on exchange rates, creating more uncertainty for the market in the short term.

In the afternoon session, trading was more cautious and the number of stocks decreasing gradually increased. This caused the VN-Index to fluctuate around the reference level with alternating increases and decreases. The index ended the session in light green thanks to the support from some pillar stocks.

At the end of the trading session, VN-Index increased by 0.44 points (0.04%) to 1,249.55 points. Meanwhile, HNX-Index decreased by 0.79 points (-0.36%) to 221.69 points. UPCoM-Index decreased by 0.31 points (-0.33%) to 92.8 points.

The whole market had 326 stocks increasing, 383 stocks decreasing and 865 stocks remaining unchanged/no trading. The market still recorded 27 stocks hitting the ceiling and 12 stocks hitting the floor.

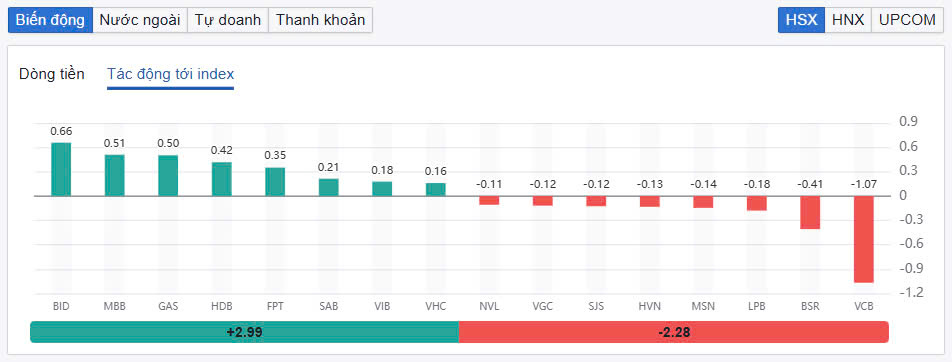

VN-Index increased today mainly thanks to good support from stocks such as BID, MBB, GAS, HDB, FPT and SAB. Of which, BID increased by 1% and was the stock with the most positive impact on VN-Index when contributing 0.66 points. Next, MBB contributed 0.51 points when increasing by 1.63%. HDB also attracted attention when continuing to increase by 2.22% to 23,000 VND/share. Thus, HDB has increased by nearly 9% after bottoming out on January 6, 2025.

|

| Top 10 stocks affecting VN-Index |

On the contrary, stocks such as VCB, BSR, LPB, MSN, HVN... were all in red and had a negative impact on the general market. VCB decreased by 0.86% and was the key factor causing the VN-Index to fluctuate when it took away 1.07 points. The "newbie" on the HoSE floor, BSR, also took away 0.41 points when it lost 2.55% in today's session. This stock was just listed on the HoSE floor on January 17, 2025 with a reference price of VND 21,300/share.

Meanwhile, the differentiation in the group of small and medium-cap stocks was very strong, but the red color was mostly dominant. In the securities group, stocks such as VDS, VND, SHS, APS, MBS... all decreased in price. VDS fell sharply by 3.9% after announcing negative business results with a loss of about 21 billion VND in the fourth quarter of 2024.

The steel group also recorded many stocks decreasing in price, of which, HPG decreased slightly by 0.19% but NKG decreased sharply by 1.8%, SMC also decreased by 1.83%.

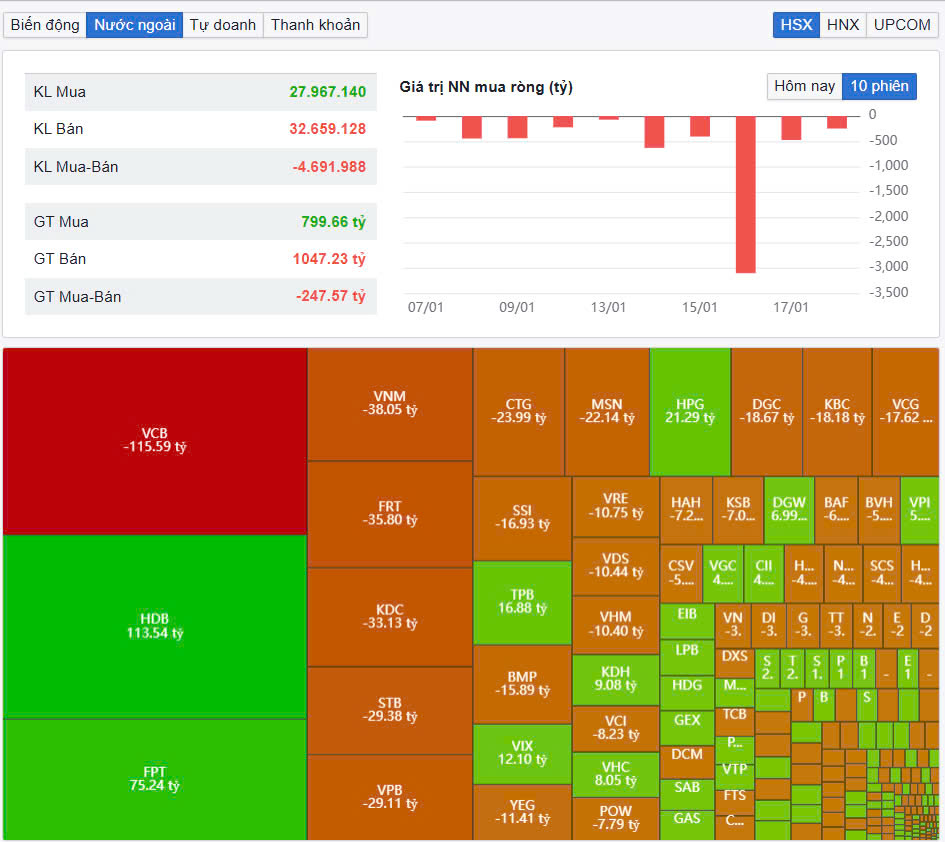

|

| Foreign investors continue to net sell |

Market liquidity remained low. The total trading volume on the HoSE reached 441 million shares, equivalent to a trading value of VND9,995 billion (down 3% compared to the previous session), of which negotiated transactions contributed VND2,200 billion. The trading value on the HNX and UPCoM reached VND677 billion and VND502 billion, respectively. HDB topped the list of strong transactions in the entire market with a value of VND468 billion. FPT and HPG traded VND332 billion and VND257 billion, respectively.

Foreign investors continued to net sell more than 280 billion VND in the whole market, in which, this capital flow net sold the most VCB code with 116 billion VND. VNM followed with a net selling value of only 38 billion VND. In the opposite direction, HDB was net bought with 113 billion VND. FPT was also net bought with 75 billion VND.

Source: https://baodautu.vn/thanh-khoan-yeu-vn-index-xanh-vo-do-long-d241525.html

Comment (0)