SHB is in discussions to find a strategic partner that could own up to 20% of the bank's shares, with a valuation of 2-2.2 billion USD.

Reuters, citing informed sources, has just reported that Saigon-Hanoi Bank (SHB) is looking for a long-term foreign strategic investor. According to these sources, financial investors and companies from South Korea and Japan have approached SHB.

The bank is talking to a financial adviser to find a partner. Discussions are ongoing, the sources said, declining to be identified.

The deal is expected to be completed this year or early 2024 and will require approval from the State Bank.

SHB representatives said that the search for strategic partners will not be limited to Asia. The bank declined to comment on other information mentioned by Reuters such as the offering ratio or valuation.

Among the banks in the market, SHB is a rare name in the private banking group that still lacks strategic shareholders. The foreign "room" of this bank is currently only at nearly 7%, much lower than the maximum regulation of 30%. This issue has been questioned by SHB shareholders in recent years.

At this year’s annual shareholders’ meeting, Mr. Do Quang Hien, Chairman of the Board of Directors of SHB, said that the bank is cautious because it wants to find partners who can accompany the bank in the long term. However, SHB leaders admitted that after contacting many partners, most of them only want to invest financially and accompany SHB in the short or medium term. After many years of not being able to choose a strategic partner, this year, Mr. Hien said that the bank will lower its standards.

He said the bank is currently negotiating with a number of large organizations and may finalize a strategic shareholder by the end of this year or early next year.

Recently, the State Bank has approved SHB to issue shares to pay dividends in 2022 at a rate of 18% and issue shares to employees (ESOP). After implementing the above two options, the bank's charter capital will increase to VND36,645 billion, among the top 5 private joint stock commercial banks with the largest charter capital in the system.

Previously, in March, Vietnam Prosperity Bank (VPBank) completed the sale of 15% of its shares for 1.5 billion USD to Japan's Sumitomo Mitsui Financial Group.

Minh Son

Source link

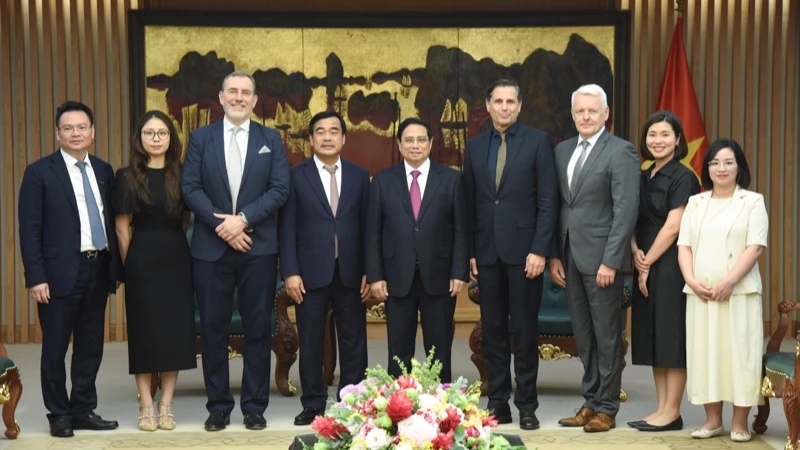

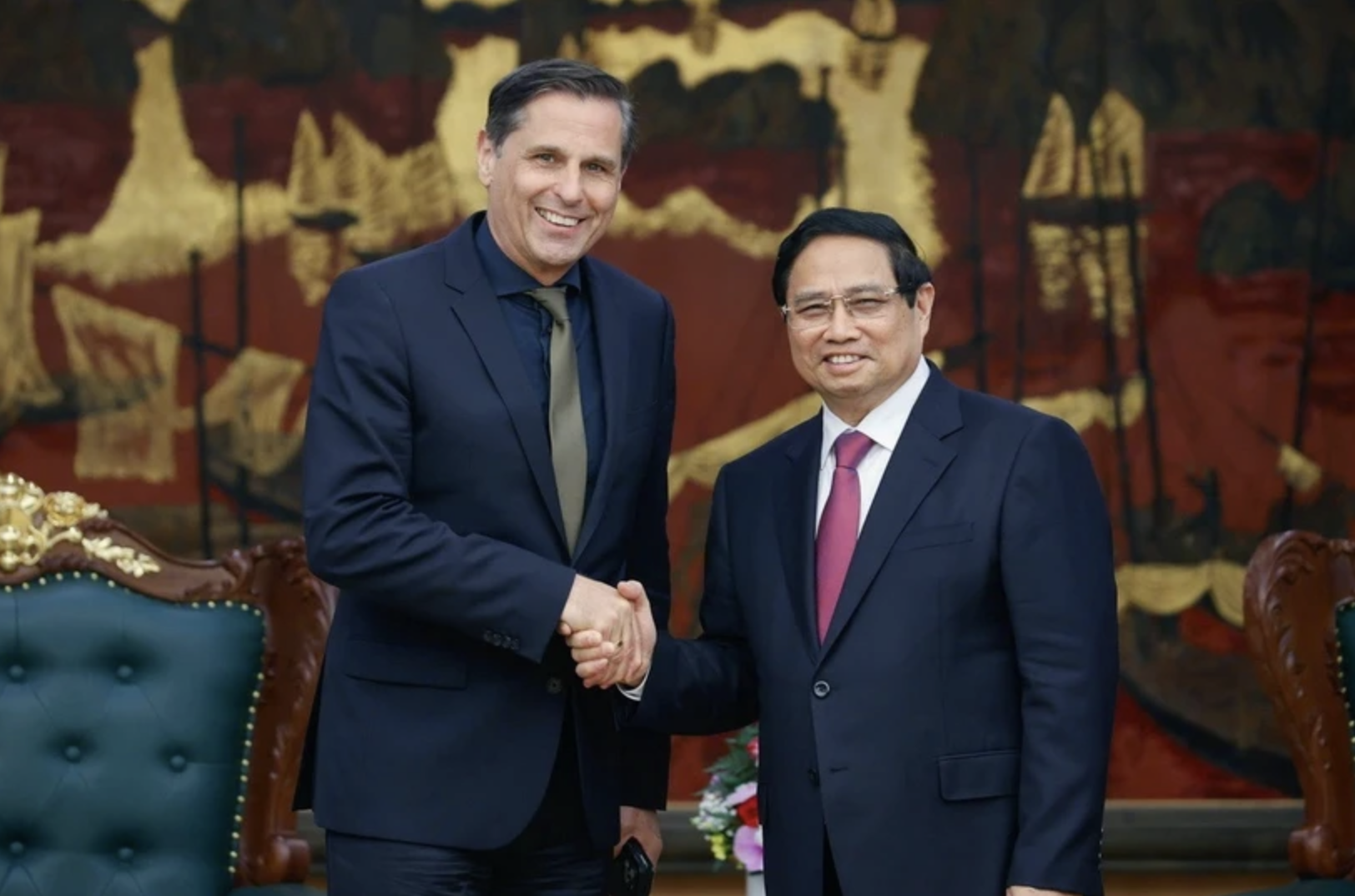

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

Comment (0)