With the majority of delegates voting in favor, the National Assembly has just passed a Resolution on the state budget estimate for 2025.

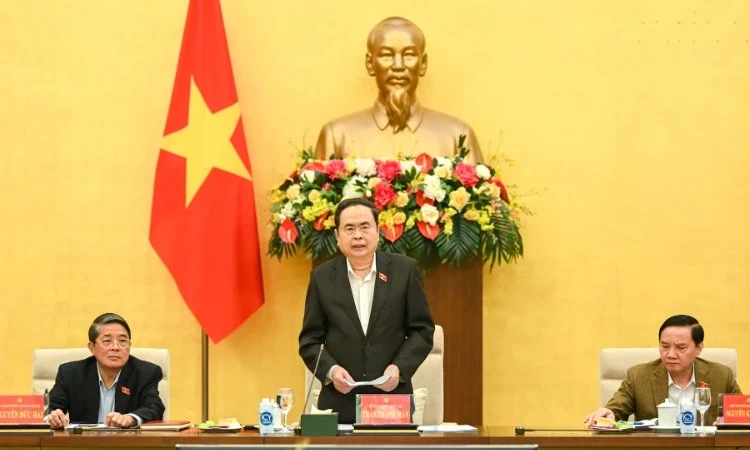

Morning of November 13, continue the program At the 8th session of the 15th National Assembly, chaired by Vice Chairman of the National Assembly Nguyen Duc Hai, the National Assembly voted to pass the Resolution on the state budget estimate for 2025 (including some contents on adjusting and supplementing the state budget estimate), with 428/430 National Assembly deputies participating in the vote in favor, accounting for 89.35% of the total number of National Assembly deputies.

Using 60,000 billion VND of accumulated resources for salary reform of the central budget

Accordingly, the Resolution resolves that the state budget revenue is 1,966,839 billion VND. Using 60,000 billion VND of the accumulated fund for salary reform of the central budget and 50,619 billion VND of the remaining fund for salary reform of the local budget by the end of 2024, the remaining fund will be transferred to the 2025 budget arrangement of ministries, central and local agencies to implement the basic salary level of 2.34 million VND/month.

Total state budget expenditure was VND 2,548,958 billion; the state budget deficit was VND 471,500 billion, equivalent to 3.8% of gross domestic product (GDP).

Regarding the estimate and plan for the central budget capital in 2025 from the source of increased central budget revenue in 2022, the Resolution allows the transfer of the remaining unallocated source of VND 56,136,146 billion of the central budget revenue increase in 2022 to arrange the estimate and plan for public investment from the central budget capital in 2025 for tasks and projects permitted by the National Assembly to use the general reserve of the medium-term public investment plan for the period 2021-2025 in Resolution No. 112/2024/QH15 dated January 18, 2024 of the National Assembly.

Allowing to extend the implementation time and disburse a maximum of VND 579,306 billion of the capital plan from the central budget revenue increase in 2022 that has not been fully disbursed to resolve compensation for site clearance (including the delayed payment) of the National Highway 1 expansion projects through Nghe An province under the central budget tasks arising after these projects have been finalized in 2025...

The Resolution assigns the Government to focus on operating fiscal policies proactively, reasonably, flexibly and effectively; coordinate synchronously, closely and harmoniously with monetary policies and other policies; promptly respond to complex fluctuations in the domestic and international situation, maintain macroeconomic stability, control inflation, promote growth, ensure major balances of the economy; urgently have solutions to overcome the decline in indicators on the ratio of state budget mobilization to GDP and the ratio of tax and fee mobilization to the state budget.

Resolutely implement solutions to strengthen revenue management, restructure revenue sources to ensure sustainability; expand revenue bases; combat revenue loss, transfer pricing, tax evasion; trade fraud, especially in commercial activities based on digital platforms...

No increase in civil servant salaries, pensions, and allowances in 2025

About implementation wage policy, some social policies, National Assembly decided not to increase public sector wages, pensions, allowances social insurance, monthly allowance, preferential allowance for meritorious people in 2025.

Ministries, central and local agencies continue to implement solutions to create sources for salary policy reform according to regulations. Allow to continue to exclude some revenue items when calculating the increase in local budget revenue for salary reform.

Allow from July 1, 2024 to expand the scope of using the accumulated resources for salary reform of the central budget to adjust pensions, social insurance benefits, monthly allowances, preferential allowances for meritorious people and streamline the payroll.

Allow the use of salary reform resources from local budgets to implement social security policies issued by the Central Government and streamline payrolls. Allow localities to use remaining salary reform resources to invest in regional and national connection projects, and key national projects implemented locally according to regulations of competent authorities.

Implemented in cases where the locality has a large surplus, commits to ensuring funding for salary reform and implementing social security policies issued by the Central Government for the entire roadmap to 2030 and does not request support from the central budget.

Ensuring the leading role of the central budget, increasing the initiative of local budgets

Previously, presenting the Report on receiving and explaining the assessment of the implementation of the state budget in 2024 and the state budget estimate in 2025, Chairman of the Finance and Budget Committee Le Quang Manh said that many opinions suggested that the Government urgently direct specialized agencies to promptly develop a plan to amend the State Budget Law, promptly concretize Resolution No. 18-NQ/TW dated September 16, 2022 of the Party Central Committee, and have a mechanism to reasonably and effectively regulate revenue from land use fees and land rents between the Central and local levels.

The Standing Committee of the National Assembly said that, taking into account the opinions of the National Assembly deputies, to ensure the implementation of the policies in the Central Committee's Conclusions, the Standing Committee of the National Assembly requested the Government to direct specialized agencies to urgently study and develop a plan to amend the State Budget Law in general. In particular, study to amend and supplement the regulations on revenue decentralization to ensure the leading role of the Central budget, increase the initiative of local budgets, and implement the division of revenue from land use fees and land rents between the Central budget and local budgets in the spirit of Resolution 18-NQ/TW of the Central Committee. This content is shown in Clause 2, Article 4 of the draft Resolution.

Some opinions suggested that it is necessary to speed up the disbursement of public investment, especially for key national projects, as well as key local projects, and transfer funds from slow-implementing projects to projects with high implementation and disbursement potential. There are concerns about the feasibility of the 95% disbursement plan as reported by the Government.

The Standing Committee of the National Assembly stated that, as stated by the National Assembly deputies, the progress of disbursement of public investment capital in the first 9 months of 2024 of a number of ministries, branches and localities is still slow; the national average has only reached 47.3% of the estimate assigned by the National Assembly, down both in value and proportion compared to the same period; in which foreign capital only reached 24.33% of the plan, lower than the same period (28.37%).

Therefore, in the last months of the year, with the goal of disbursing 95% of the assigned budget, the National Assembly Standing Committee recommends that the Government needs to closely direct, resolutely, proactively find solutions to overcome, enhance the responsibility and initiative of ministries, branches and localities to speed up the disbursement of public investment, especially key national projects, as well as key local projects to ensure the completion of the set goals.

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)