Increase fines 20 times for violating auditing companies: Heavy fines are enough to deter

Some people say that the penalty level in the Draft Law on Independent Auditing is too high, but Deputy Prime Minister and Minister of Finance Ho Duc Phoc said that raising the penalty level would ensure deterrence.

This morning, November 7, the National Assembly discussed in the hall the Draft Law amending and supplementing a number of articles of the Securities Law, the Accounting Law, the Independent Audit Law, the State Budget Law, the Law on Management and Use of Public Assets, the Tax Administration Law, and the Law on National Reserves.

Regarding the Draft Law on Auditing Amendment, a notable provision is to increase the fine by 20 times. Accordingly, the draft stipulates the maximum fine is 2 billion VND (for organizations) and 1 billion VND (for individuals). The current fine is 100 million VND for organizations and 50 million VND for individuals. In addition, the draft also increases the maximum penalty period to 5 years instead of 1 year as at present.

Delegate Thai Thi An Chung (Nghe An) said that the above regulation has many inappropriate points.

Firstly, according to the Law on Handling of Administrative Violations, the maximum fine of VND1 billion is only applied to violations in the fields of management of sea areas, islands and continental shelves, nuclear and radioactive substance management, atomic energy; currency, precious metals, gemstones, banking, credit; oil and gas activities and other mineral activities, environmental protection, and fisheries. Therefore, the maximum fine in the draft revised Law on Independent Audit is not appropriate.

Second, the statute of limitations for penalties proposed in the draft is 5 years, while the Law on Handling of Administrative Violations stipulates a maximum statute of limitations for penalties of 2 years.

Furthermore, currently, the handling of administrative violations in the fields of auditing and accounting is regulated by Decree 41/2018/ND-CP because these two fields are quite similar in nature. If the administrative penalty for auditing is increased, the question is whether it will be increased in the field of accounting or not?

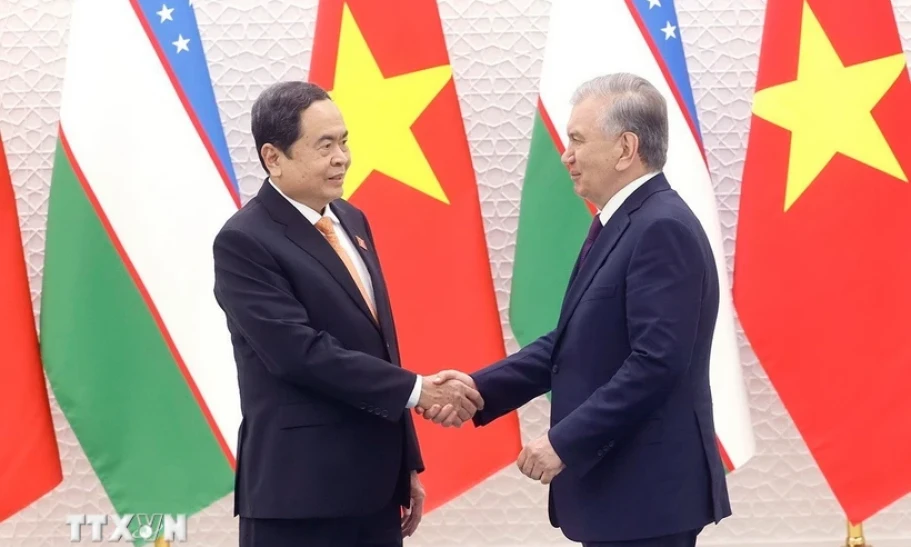

|

| Deputy Prime Minister, Minister of Finance Ho Duc Phoc. |

Delegates also wondered whether raising the fine in the auditing field to be closer to the field with the highest fine, which is securities, is reasonable when compared to the nature, level and consequences of the violation?

It can be seen that violations in the securities sector directly and immediately affect hundreds, thousands, or even millions of transactions and investors. Meanwhile, violations in the auditing sector affect indirectly, with a delay and a much narrower scope of influence.

Delegates agreed with the view that the penalty level and statute of limitations should be increased to ensure deterrence for auditing firms and auditors who violate the law, but suggested that the maximum penalty should only be doubled instead of increasing it 20 times as it is now.

"If the regulations are as drafted, it will certainly affect the development of the independent auditing industry in Vietnam, an industry that needs 3-4 times more personnel than the current number compared to the size of the market," delegate Thai Thi An Chung (Nghe An) suggested.

Delegate Do Thi Lan (Quang Ninh) also said that the regulations on the level of fines and the statute of limitations for fines in the Draft Law on Independent Auditing are not consistent with the current Law on Handling of Administrative Violations. However, this delegate proposed amending the Law on Handling of Administrative Violations instead of lowering the level of fines in the Draft Law on Revised Independent Auditing.

According to delegate Do Thi Lan, increasing the administrative fine for individuals by 20 times is appropriate. For organizations, the maximum administrative fine of 2 billion VND is low, so it should be raised to 3 billion VND (30 times higher than the current regulation). The reason for raising the fine for violating auditing companies is to ensure deterrence and to match the scale of current auditing companies. Currently, many large auditing companies have revenues of over 500 billion VND, even some companies have revenues of 1,000 billion VND, so raising the fine is appropriate.

Responding to the opinion that the fines for auditors and auditing companies are too high, Deputy Prime Minister and Minister of Finance Ho Duc Phoc said that if the fines are imposed at the current level, it will not be enough to deter. Therefore, in this specific field, heavy fines are needed. The statute of limitations for fines also needs to be extended, because if the regulation is only 1-2 years, many cases will be past the statute of limitations for fines when inspected.

Comment (0)