Positive signals

According to Ms. Nguyen Thi Huong Thanh, Deputy Head of the Tax Department of Region VII in Tuyen Quang province, in March 2025, total domestic revenue reached 175.5 billion VND, accumulated to 724.4 billion VND as of March 27. In the first quarter, total domestic budget revenue is estimated at 859.4 billion VND, completing 22.7% of the estimate assigned by the Prime Minister and 16.1% of the estimate assigned by the Provincial People's Committee. In particular, many important revenue items have made positive progress, showing the recovery of the economy and efficiency in tax management. Specifically, revenue from the non-state economic sector reached 32.1%, personal income tax reached 54.1%, registration fee reached 27.2% and fees and charges reached 32.5%. These are stable revenue sources, contributing positively to the provincial budget from the beginning of the year.

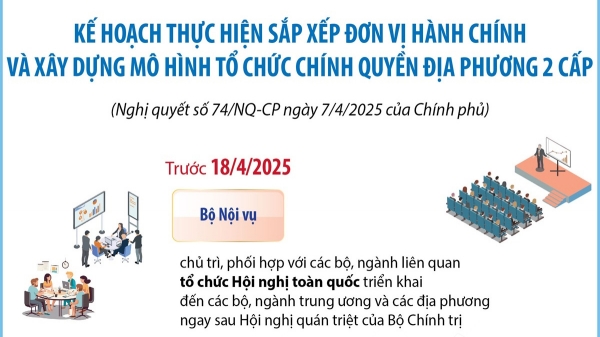

Officers of the Tax Department of Region VII in Tuyen Quang province handle tax administrative procedures for taxpayers.

However, to achieve the 2025 budget collection target, the Tax sector needs to continue focusing on slow-progressing revenue items, especially land revenue and some important taxes. One of the major obstacles in the current budget collection work is the very low progress in land use fee collection. As of March 27, this revenue only reached 5.4% of the central budget estimate and 2.5% of the provincial budget estimate. The main reason is that districts and cities have not yet organized land auctions in 2025, and urban area projects have not yet completed the documents to determine financial obligations to pay the budget.

In addition, the implementation of tax reduction policies according to the National Assembly's resolutions also significantly affected budget revenue. Specifically, Resolution No. 60/2024/UBTVQH15 reduced environmental protection tax on gasoline, oil, and grease by 50%, while Resolution No. 174/2024/QH15 continued to reduce value-added tax rates from 10% to 8%. These two policies caused the provincial budget to lose about VND110 billion in revenue in the first quarter.

It is forecasted that in the second quarter of 2025, land revenue will continue to face difficulties when tax deferral and reduction policies are expected to be issued. Accordingly, the extension of tax and land rent payment deadlines could reduce budget revenue by over VND80 billion. In addition, the policy of reducing land rent by 30% in 2024, if implemented in the second quarter, will continue to reduce budget revenue by about VND10 billion.

Solutions to increase budget collection

Faced with this reality, the Tax sector is focusing on implementing drastic solutions to increase budget revenue right from the beginning of the year. Comrade Truong The Hung, Deputy Head of the Tax Branch of Region VII, said: The budget revenue target in the second quarter of 2025 is 965 billion VND, a decrease of 80 billion VND compared to the original plan due to the impact of tax exemption and reduction policies. To ensure the completion of the budget revenue collection task, the Tax sector recommends that the Provincial People's Committee direct the People's Committees of districts and cities to proactively coordinate with the sectors to organize auctions to collect land use fees in the second quarter of 2025; direct sectors and investors of Urban Area Projects to speed up the implementation of procedures for land allocation, land lease, and transfer of documents to determine financial obligations to the tax authorities.

At the same time, the Tax sector will promote tax management, focusing on key solutions such as: Propagating and supporting taxpayers, especially implementing new tax policies that will take effect from the beginning of 2025; guiding businesses and individuals to make tax settlements in accordance with regulations and promoting the application of digital technology in tax declaration and payment; tightening tax management for business households, implementing the Project to innovate tax management to ensure no budget loss; strengthening tax inspection and examination, strictly handling cases of tax evasion and long-term tax debts to ensure fairness in fulfilling financial obligations to the State.

Despite many challenges, with the initiative and determination in implementing solutions, the Tax Department of Region VII in Tuyen Quang province expects to achieve positive results in the second quarter of 2025. Good budget collection results contribute to ensuring resources for socio-economic development and creating favorable momentum to complete the financial plan for the whole year.

Source: https://baotuyenquang.com.vn/chu-dong-thu-ngan-sach-tu-dau-nam-209628.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

![[Photo] National Assembly Chairman successfully concludes official visit to Uzbekistan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/9/8a520935176a424b87ce28aedcab6ee9)

Comment (0)