Agribank is the leading State-owned commercial bank investing in the development of agriculture, farmers and rural areas. Over the years, Agribank has been implementing many solutions to increase access to capital for customers, support customers, especially customers in the agricultural and rural areas.

| Agribank strengthens security assurance in payment Agribank issues 10,000 billion VND in bonds to supplement long-term capital |

Effectively exploit the "extended arm"

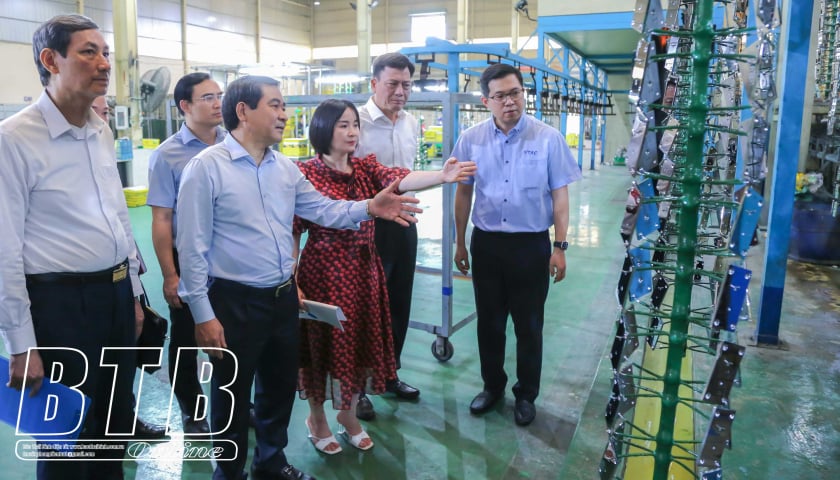

With the advantage of being a bank with a nationwide network, Agribank has had many practical activities, closely coordinating with the Vietnam Farmers' Association and many political organizations in rural areas to cooperate in providing credit capital to serve agricultural production and business.

Since 2016, Agribank and the Vietnam Farmers' Union have signed an Inter-sectoral Agreement to effectively implement Decree 55/2015/ND-CP dated June 9, 2015 of the Prime Minister on agricultural, farmer and rural development (Decree 55) to help members access loans in the fastest way, use loans for the right purposes and effectively. Lending activities through loan groups through the Farmers' Union, throughout the Agribank system until December 31, 2023, have achieved positive results. Currently, Agribank has 92 type I branches implementing cooperation agreements with Farmers' Associations at all levels, establishing nearly 25,000 loan groups in villages, hamlets, communes, wards and towns, with more than 564,000 loan group members, outstanding loans through loan groups through Farmers' Associations reached VND 84,065 billion, an increase of VND 48,453 billion compared to 2016 and an increase of VND 6,597 billion compared to 2022, outstanding loans grew by an average of over 16%/year; average outstanding loans/member reached VND 100 million; average outstanding loans/loan group reached VND 2.4 billion; bad debt ratio was always below 0.5%.

The coordination between Agribank and the Farmers' Association helps support and facilitate households who are members of the Vietnam Farmers' Association to borrow capital and use services at Agribank to develop production, business, services, and consumption in order to increase income, improve living standards, and contribute to limiting black credit in society. Through the loan group, members of the Farmers' Association have increased access to loans, and are provided with payment, money transfer, and insurance products and services by banks in a convenient and effective manner, especially for households and individuals in remote, isolated areas with few conditions to transact with banks. Thereby, it effectively contributes to promoting the role of bank credit in implementing the "Three Farmers" policy, contributing to the development of microfinance for households in implementing the national comprehensive financial strategy.

Lending activities through loan groups ensure good implementation of requirements on improving credit quality and limiting bad debts. The coordination of loan management between bank staff and loan group leaders helps banks promptly grasp information related to loan safety, loan usage purposes of customers, and limit risks affecting loans. The participation of loan group leaders in the process of formulating loan plans and projects of members, disbursement, interest collection, and loan management for loan group members has contributed to reducing the workload for bank staff, increasing labor productivity and saving costs in banking operations. That is the basis for Agribank to reduce loan interest rates for customers.

|

| Agribank enhances capital access for customers through cross-sectoral cooperation with Farmers' Association |

Create all conditions for customers to access capital

In the coming time, Agribank will continue to closely coordinate with socio-political organizations and authorities at all levels to promote credit policy dissemination for agriculture and rural areas, grasp customers' loan needs, and create conditions for customers to access loans quickly and conveniently. Agribank will also publicize and make transparent policies, procedures, and lending conditions based on reform and simplification of administrative procedures to create maximum conditions for customers to access credit capital. Agribank will continue to deploy lending according to the linkage model, lending according to the value chain from production, processing, consumption, and providing payment services in agriculture, especially for agricultural products with high export value; focusing capital resources to promptly meet the needs of businesses and households trading, purchasing, and exporting key agricultural products.

From the results achieved in coordinating the implementation of the inter-sectoral agreement with the Farmers' Association, Agribank has made certain contributions to the success in developing and improving the economic efficiency of households, promoting production and business, solving employment problems, and improving the lives of people in rural areas according to the policies of the Party and the State.

In order for lending activities through loan groups to continue to be implemented more effectively, according to the representative of Agribank, there needs to be synchronous participation of all levels and sectors. The Government and the Ministry of Agriculture and Rural Development have policies to encourage producers and suppliers, consuming agricultural products in production areas, raw material areas to form linkage chains, policies on consumption of domestic and foreign agricultural products, especially clean agricultural development programs, high-tech agriculture, One Commune One Product (OCOP) program, reducing greenhouse gas emissions... to create an investment environment for quality rural agricultural development, thereby creating conditions for Agribank to invest credit capital through the activities of loan groups and linkage groups more effectively.

Training activities to transfer science and technology for agricultural extension in localities need to be promoted, thereby helping to increase crop and livestock productivity; disseminate production and business experiences, highly effective economic models, apply clean agricultural models, high-tech agricultural models in economic regions according to zoning and state planning for all levels of associations and members of loan groups to have good orientation for short-term and long-term production and business plans and projects, and use loans effectively.

The Farmers' Association continues to coordinate with Agribank to deploy the activities of loan groups associated with the digital banking model, implement measures to improve the operational efficiency of loan groups; strictly comply with regulations on loan group operations, limit credit risks; strengthen the bank's inspection and supervision of loan group operations.

Local Party committees, authorities and organizations at all levels in general and the Vietnam Farmers' Union in particular continue to support and coordinate effectively with Agribank in implementing credit policies for agricultural and rural development according to the goals and orientations of local socio-economic development to promote the role of bank credit in developing microfinance for production households and individuals in implementing the Prime Minister's national comprehensive financial strategy to 2025, with a vision to 2030.

In addition to proactively and actively promoting lending activities through loan groups, Agribank has been actively implementing many solutions to increase access to capital for customers through the model of mobile transaction points using specialized cars, card projects and preferential credit programs specifically for customers in the agricultural sector, farmers, rural areas... Agribank proactively and actively effectively implements 07 policy credit programs and 02 national target programs on new rural construction and sustainable poverty reduction, providing over 200 convenient banking products and services with many distribution channels to meet the diverse needs of customers, actively contributing to the development of the non-cash payment market, improving access to banking services for the economy, especially in the agricultural and rural areas. Agribank's agricultural and rural lending ratio in recent years has always accounted for 65-70% of Agribank's economic outstanding loans and 1/3 of the country's agricultural and rural credit.

Source: https://thoibaonganhang.vn/phat-huy-loi-the-tang-kha-nang-tiep-can-von-cho-khach-hang-153614.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)