The main reason for the strong fluctuations this week was the escalation of global trade tensions. On April 11, China announced that it would raise tariffs on US goods from 84% to 125% in retaliation for previous tariffs from Washington. However, in a surprise move, the US announced a 90-day suspension of reciprocal tariffs on most of its trading partners - a key factor that helped stimulate cash flow and change the market situation in the last two sessions of the week.

|

Mr. Han Huu Hau - senior analyst at VPS Securities Company commented: "The positive reaction of the market comes not only from technical factors but also the result of adjusting macro expectations. The US 'stepping back' in tariff policy helps investors to remove some of the negative sentiment and reactivate the buying trend at deep discount prices."

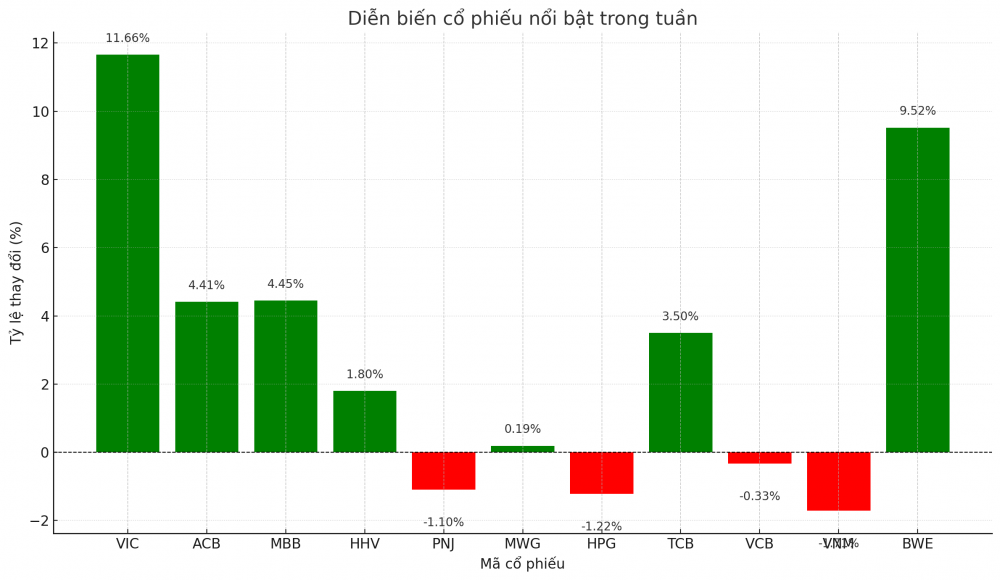

The data shows that the market's strong recovery was led by large stocks. The top 10 stocks with the most positive contributions brought 30.5 points to the VN-Index, notably VCB (+7.5 points), VIC, BID, CTG,... Meanwhile, the group of negative stocks only caused the index to decrease by more than 1 point - a clear demonstration of the dominance of the buyers.

Key sectors such as information technology and finance made a strong breakthrough with an increase of more than 5%. A series of stocks hit the ceiling: CMG, STB, EIB, VND, VIX, SSI, HDB... Not only that, the consumer and telecommunications groups also appeared with purple colors such as MWG, PNJ, FRT, CTR... Although the increase was more modest, the industrial and healthcare groups still recorded "white sell-side" stocks such as VCG, HHV, SCS.

Despite the market recovery, foreign investors continued to sell strongly with a total value of more than VND1,000 billion, of which the HOSE recorded a net selling of more than VND883 billion. However, domestic cash flow and bottom-fishing demand played a key role in the market's spectacular recovery.

|

During the past week, many stocks made a special mark. • VIC (+11.66%): Stock increased strongly with Rising Window candlestick pattern, volume exceeded average, MACD crossed Signal Line showing that short-term uptrend is still strong. • ACB (+4.41%) and MBB (+4.45%): Despite a sharp decline at the beginning of the week, these two stocks rebounded strongly thanks to bottom-fishing demand. BSC and VCBS both recommend buying with significant potential for price increases. • HHV (+1.8%): Estimated 44% increase in Q1/2025 profit helps HHV maintain purple color in the last session of the week. VCBS reasonably values the stock at VND15,537. • PNJ (-1.1%): Affected by taxes and gold materials, however, attractive valuation (P/E 2025 = 12x) makes SSI recommend buying with a target price of VND 97,500/share. • MWG (+0.19%): Caught up in the market "storm" but received support from Pyn Elite Fund. VCBS recommends buying with a target price of VND 77,105. • HPG (-1.22%): Despite a slight decrease during the week, HPG is recommended to buy due to the recovering technical signals and strong cash flow to catch the bottom at the end of the week. • TCB (+3.5%): Recovered from MA200 with Marubozu candle. AGR recommends buying below VND 24,100/share. • VCB (-0.33%): This strong pillar stock shows signs of recovery, RSI and Stochastic create positive signals. • VNM (-1.71%): Affected by general market trends although the business still maintains its internal strength. • BWE (+9.52%): Rarely maintained the ceiling increase momentum, recommended "hold" with target of 42,100 VND/share. |

According to Ms. Hong Van - Head of Data Analysis, Financial Information Services, FiinGroup: “The recovery momentum last weekend largely came from psychological factors and policy expectations. However, the medium-term trend still needs further confirmation from Q1 business results and domestic monetary policy. Investors should choose stocks with good fundamentals, less directly affected by external risks.”

The trading week of April 8-12 ended with mixed emotions: anxiety, excitement, and then bursting with hope. Strong fluctuations are risks, but also opportunities for quick and courageous investors. When the market has shown its ability to react flexibly to macro information, choosing the right stocks will be the key to overcoming the "big wave".

Source: https://thoibaonganhang.vn/cuoc-loi-nguoc-dong-ngoan-muc-cua-thi-truong-chung-khoan-162671.html

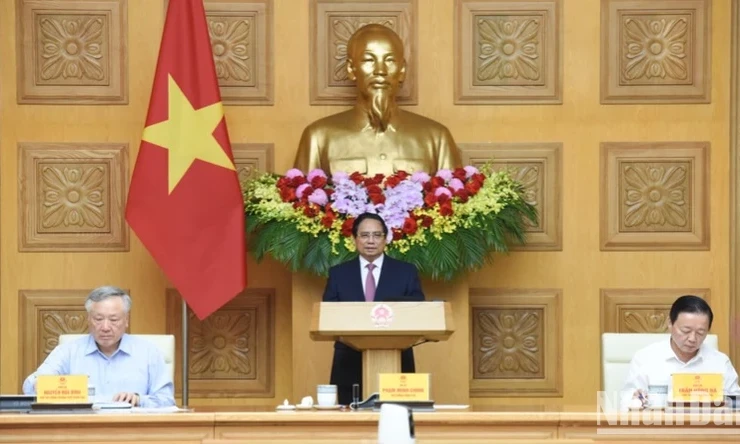

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

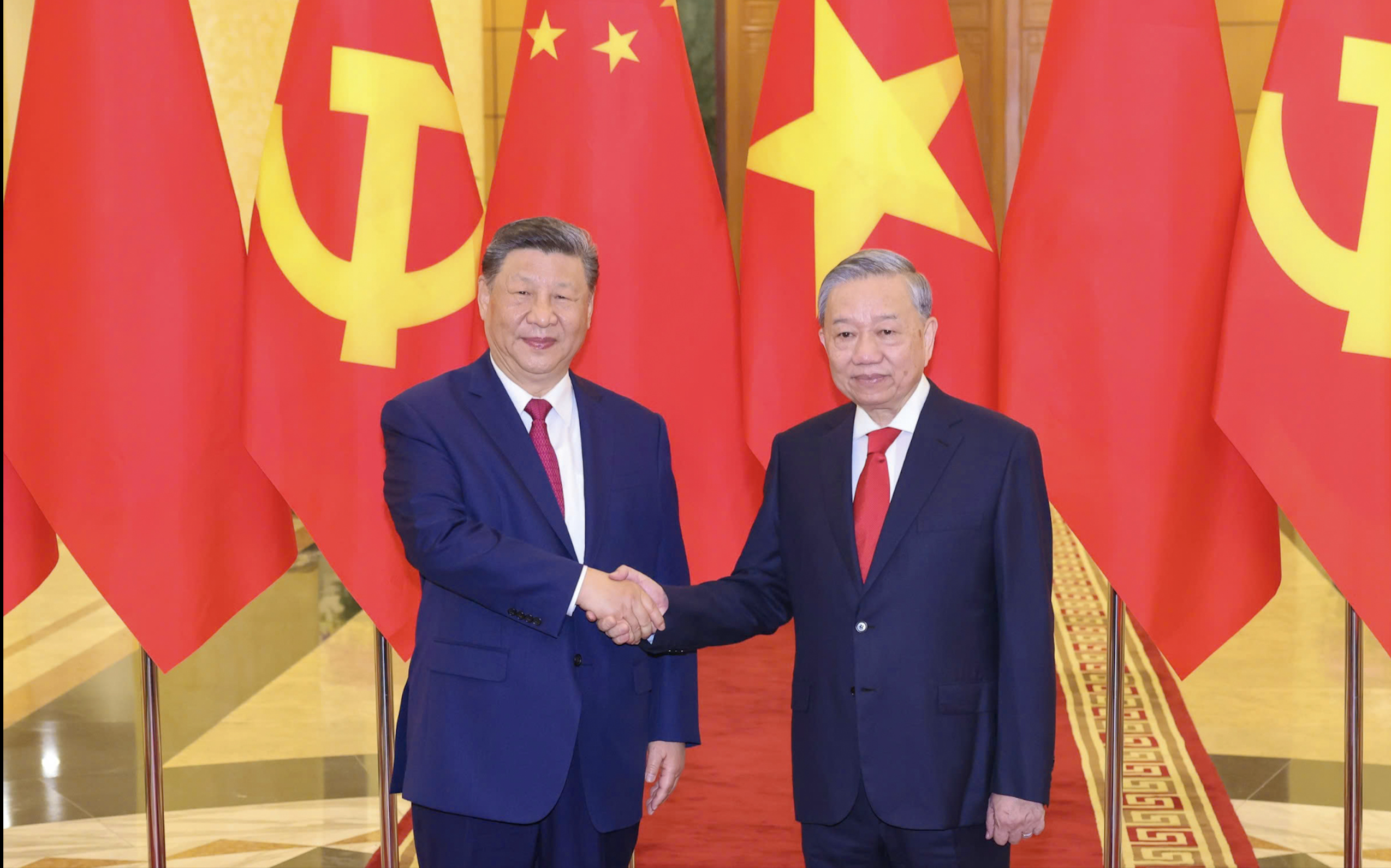

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

Comment (0)