"Commander" managing the hundred billion dollar floor

In February 2021, Mr. Le Hai Tra, member in charge of the Board of Directors of Ho Chi Minh City Stock Exchange (HOSE) was appointed to the position of General Director.

HOSE is the largest stock exchange in Vietnam, with a current capitalization of about 200 billion USD.

Mr. Tra was born in 1974 and has a master's degree in public administration, with a double major in leadership and financial market analysis from Harvard Kennedy University. Mr. Tra received the prestigious Hubert H. Humphrey Scholarship from the US State Department for a training program in Strategic Management and Finance at Boston University (2003).

After working for a foreign auditing company, in 1997, Mr. Tra returned to Vietnam and worked at the Department of Securities Market Development (State Securities Commission); participated in the secondment task force and made certain contributions to the preparation process for the establishment of HOSE.

In 2006, Mr. Tra held the position of Deputy Director of the Ho Chi Minh City Stock Exchange (the predecessor of HOSE), then became a standing member of the Board of Directors of HOSE. Mr. Tra was assigned to be in charge of the Executive Board of HOSE in 2016. He transferred to the Board of Directors in July 2017, after Mr. Tran Van Dung left the position of Chairman of the Department to move to the position of Chairman of the State Securities Commission (SSC).

Before Mr. Tra was appointed to the position of General Director in February 2021, HOSE left this position vacant for a long time and also at the time when the floor fell into a state of trading congestion, causing frustration for investors (late 2020, early 2021).

Mr. Tra is considered by investors as a "breath of fresh air" for senior leaders in the securities industry. First of all, expectations are set to resolve the congestion problem that peaked in early 2021.

After raising the minimum trading lot from 10 to 100, Mr. Tra proposed raising it to 1,000 units to reduce the total number of trading orders by 40-50%, while indirectly promoting the development of investment funds and the fund management industry.

At the time when the stock manipulation cases at FLC Group and Louis groups were discovered, Mr. Le Hai Tra emphasized that the way to prevent this activity is that the management and supervision apparatus of the stock market must have sufficient authority and must strictly handle violations from civil to criminal.

At the time when the two cases of Trinh Van Quyet and Do Thanh Nhan (Louis group) began to be exposed, Mr. Tra told the press that stock manipulation is always a potential risk in any stock market in the world.

Under Mr. Tra, in 2021, HOSE spent nearly VND500 billion to monitor the stock market. Market monitoring costs have the largest proportion in the cost structure, accounting for nearly 71%.

In 2021, HOSE recorded a sharp increase in revenue and paid more than VND 2,300 billion to the state budget and superior agencies, 4.6 times higher than the previous year. This was also the year when the Vietnamese stock market broke out, grew strongly and led ASEAN in terms of growth rate of transaction value and capitalization on the stock market. The VN-Index set a historical peak of more than 1,500 points.

HOSE's capitalization at the end of 2021 reached more than 5.8 million billion VND, equivalent to about 237 billion USD.

Quickly disciplined

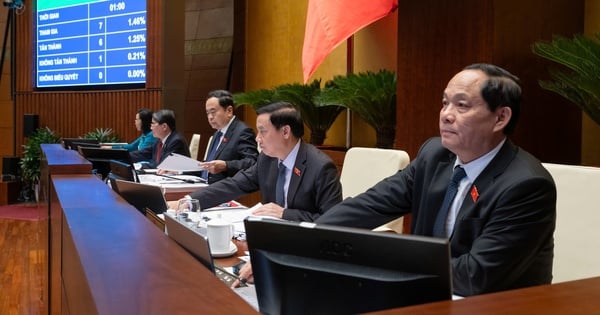

Despite great expectations, Mr. Le Hai Tra was only in the position of General Director of HOSE for a short time and was disciplined.

On the afternoon of May 18, 2022, the Central Inspection Committee decided to expel from the Party Mr. Le Hai Tra, Party Secretary, General Director of HOSE and a number of other individuals of the Party Committee of the State Securities Commission for violating the principle of democratic centralism and working regulations; lack of responsibility, lax leadership, direction, lack of inspection and supervision, allowing a number of organizations and individuals of the Commission to commit many violations and shortcomings in advising on the development of institutions, policies and implementation of state management of securities activities and the securities market; allowing a number of organizations and individuals to violate the law, manipulate the market, and make illegal profits.

Up to now, investors have known why there is a phenomenon of "a happy child passing through the eye of a needle", with the stock manipulation case of Trinh Van Quyet and the FLC group of stocks. This is the most notable case in the history of the stock market, in terms of scale, blatant loss and repetition.

The peak was the "underground sale" of 74.8 million FLC shares by Mr. Trinh Van Quyet on January 10, 2022. Many subsequent sell-offs with a floor sale surplus of several thousand billion VND and the FLC group of shares caused shareholders to lose thousands of billions of VND.

The results of the additional investigation into Mr. Trinh Van Quyet's stock market manipulation have shown the story of "an elephant passing through the eye of a needle" and the fact that HOSE leaders "knew it was wrong but still did it", helping Trinh Van Quyet embezzle thousands of billions of dong.

In addition to the leadership role of the former HOSE leader Tran Dac Sinh in getting Faros Company (ROS) to increase its capital but get listed on HOSE, Mr. Tra (at that time a member of the Board of Directors, permanent Deputy General Director, independent member of the HOSE Listing Council) took advantage of his position and power while performing his official duties.

Specifically, although Mr. Tra clearly knew that Faros' financial audit report was in violation because "there was no basis to determine the actual contributed capital", during the appraisal process, Mr. Tra consulted twice with the members of the listing council and all agreed that Faros did not meet the conditions, requiring the company to explain.

But on August 23, 2016, when the Listing Council received the company's explanatory report, although there was no time to study it, in the afternoon meeting of the same day, Mr. Tra and the members of the council agreed with this report.

After that, the group of defendants continued to agree to list FLC Faros (ROS) shares, resulting in Mr. Quyet and his accomplices being listed with 430 million ROS shares formed from fake capital contributions.

At the Investigation Agency, Mr. Sinh and Mr. Tra admitted their crimes and stated that the reason for helping the former Chairman of FLC was because of their acquaintance and also because they wanted HOSE to have revenue from listing fees and securities transaction fees.

Source

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] Prime Minister Pham Minh Chinh meets with Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/41f753a7a79044e3aafdae226fbf213b)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

![[Photo] President Luong Cuong hosts state reception for Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/56938fe1b6024f44ae5e4eb35a9ebbdb)

Comment (0)