The Law amending and supplementing a number of articles of the Securities Law approved on the afternoon of November 29 clearly stipulates six acts considered as stock market manipulation.

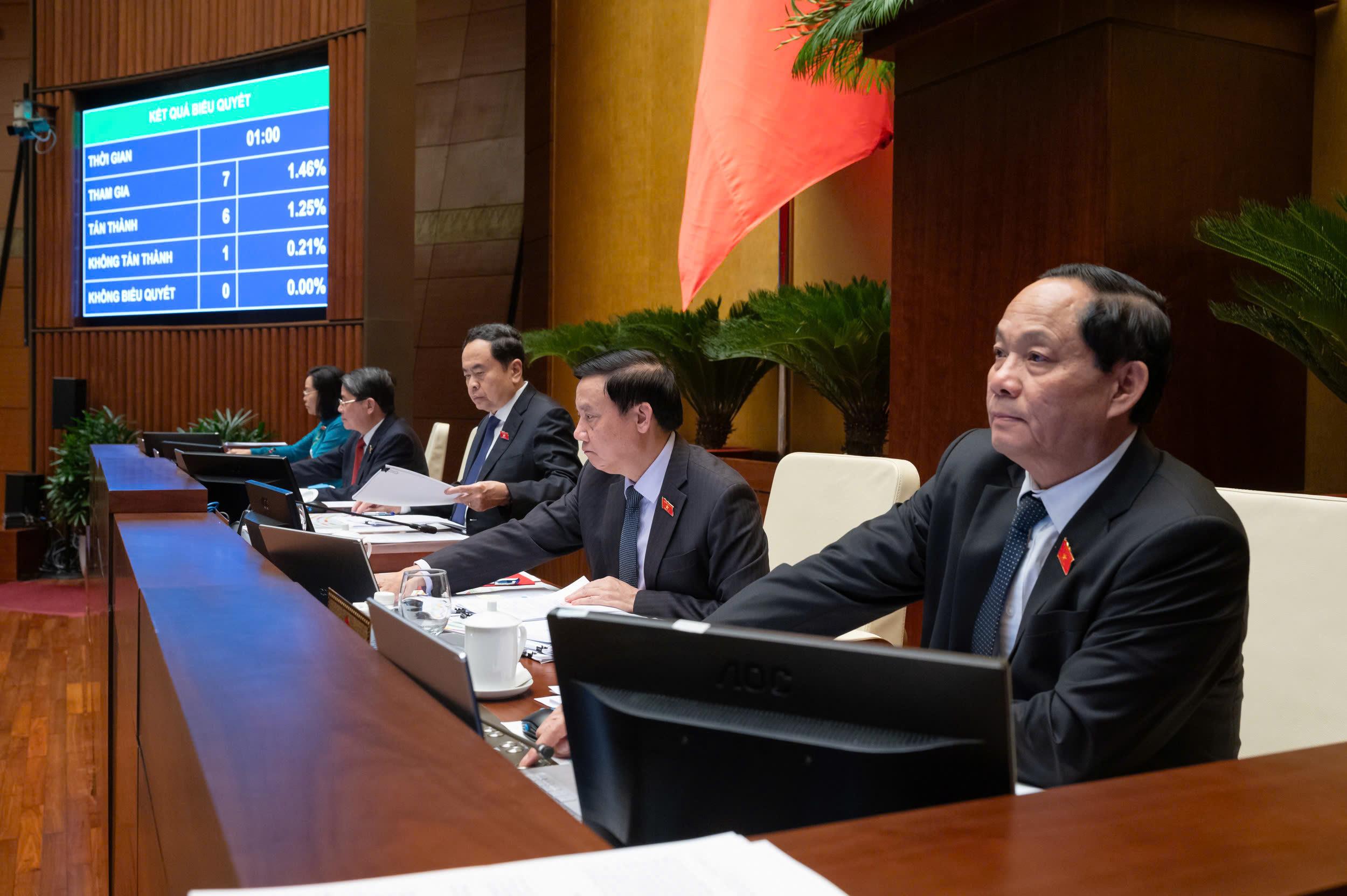

On the afternoon of November 29, continuing the 8th session, with 445/450 delegates participating in the vote, the National Assembly voted to pass the Law amending and supplementing a number of articles of the Securities Law, the Accounting Law, the Independent Audit Law, the State Budget Law, the Law on Management and Use of Public Assets, the Tax Administration Law, the Personal Income Tax Law, the National Reserve Law, and the Law on Handling of Administrative Violations.

National Assembly deputies voted to pass the Law amending and supplementing a number of articles of the Securities Law, the Accounting Law, the Independent Audit Law, the State Budget Law, the Law on Management and Use of Public Assets, the Tax Administration Law, the Personal Income Tax Law, the National Reserve Law, and the Law on Handling of Administrative Violations.

The law recently passed by the National Assembly has detailed regulations on stock market manipulation.

Accordingly, stock market manipulation is the act of using one or more of one's own or another person's trading accounts or colluding to continuously buy and sell securities to create artificial supply and demand;

Placing buy and sell orders for the same type of securities on the same trading day or colluding with each other to buy and sell securities without actually transferring ownership or ownership only circulating among group members to create fake stock prices and supply and demand.

At the same time, continuously buying or selling securities with a dominant volume at the time of opening or closing the market to manipulate securities prices; trading securities by colluding and enticing others to continuously place orders to buy and sell securities, greatly affecting supply and demand and securities prices, and manipulating securities prices.

Stock manipulation is when one directly or indirectly expresses an opinion through the media about a type of security or the organization issuing the security in order to influence the price of that type of security after having made a transaction and held a position in that type of security.

Using methods or performing other trading acts or combining spreading false rumors, providing false information to the public to create artificial supply and demand, and manipulate stock prices.

The law also officially allows individual professional securities investors to buy, trade, and transfer individual corporate bonds under certain conditions.

The Government's initial draft only allows institutional investors to buy, sell, and trade individual corporate bonds. Individual professional investors are only allowed to trade individual corporate bonds issued by credit institutions.

Also according to the provisions of the recently passed law, the administrative fines in this field have been greatly increased. Accordingly, the maximum fine is 2 billion VND for organizations and 1 billion VND for individuals. The law also increases the maximum penalty period to 5 years instead of 1 year as at present.

Stating the National Assembly Standing Committee's view on this penalty level, Mr. Le Quang Manh, Chairman of the National Assembly's Finance and Budget Committee, said that the above fine level is the maximum and only applies to some serious violations of auditing standards that do not reach the level of criminal prosecution.

This Law comes into force from January 1, 2025.

Source: https://www.baogiaothong.vn/nhung-hanh-vi-nao-duoc-coi-la-thao-tung-thi-truong-chung-khoan-19224112916344002.htm

Comment (0)