By joining hands with many major hotel brands in the world, investors are actively exploring the high-end resort market, promising an exciting competition in the next 5 years.

|

Capital contributor, labor contributor

As a senior staff of Accor Group, Mr. Xavier Grange has gradually become accustomed to flights between Vietnam and France. Talking to reporters of Dau Tu Newspaper, he said that he does not often travel to a specific country, but 3 months ago, he came to Vietnam to handle work. In November 2024, he was in Vietnam again to participate in the signing ceremony of cooperation between Accor and Doji in the operation and management of the Sofitel Diamond Crown Hai Phong Hotel Project - the fourth hotel under the Sofitel brand in Vietnam.

His next trip is scheduled for early 2025.

“In recent years, Vietnam has emerged as an ideal destination for the luxury hotel segment. Not only for Accor Group, but globally, Vietnam is in the Top 5 fastest growing markets in the hotel sector, especially in the luxury segment,” said Mr. Xavier Grange, Global Senior Development Director of the Sofitel, MGallery and Emblems brands.

In the next 5 years, the luxury hotel and resort segment in Vietnam will become the market leader, instead of the current economy hotel segment.

Sofitel, MGallery and Emblems are hotel brands in the “luxury” collection, managed by the Accor Group from France. Accor is one of the largest hotel operators in the world with 45 brands, from the economy to the luxury segment. Accor hotel brands are divided into many different collections, the highest being “luxury”, then “premium”, “midscale” or “economy”…

In Vietnam, Accor has recorded its presence since 1991, through the management and operation of Sofitel Legend Metropole Hanoi - the hotel known as "miniature Paris in the heart of the capital" and the first 5-star hotel in Vietnam.

Without directly investing capital, Accor chooses to join hands with owners, investors, and real estate developers to bring international standard resort services. The hotel chains will have the characteristics of each Accor brand, designed by the group, then responsible for management and operation on behalf of the investor.

However, each hotel has its own unique architectural features and is in harmony with the local culture, rather than developing in a uniform style like many other international hotel chains.

Mr. Xavier Grange revealed that the Sofitel brand has 2 hotels in Vietnam. Accor Group is signing contracts with investors to develop 2 more Sofitel hotels in the future. Similarly, the MGallery hotel brand currently has 7 facilities and will soon have 5 new facilities. “The total number of Sofitel and MGallery hotels will nearly double in the next 5 years. This is a surprising rate compared to the average growth rate that Accor recorded in the luxury segment of other countries, with an increase of 8-10%/year,” said an Accor representative.

In the fourth quarter of 2024 alone, Accor signed cooperation agreements with two major Vietnamese investors, including Doji Group and Alphanam Group, to develop luxury hotel projects in Hai Phong and Sapa.

Although Vietnam lags behind Thailand in the development of high-end hotels and resorts in the region, this is the room for investors to find opportunities to invest. “Investors in high-end hotel projects are pouring into Vietnam. I can clearly feel that. Investors believe that the Vietnamese market has not developed to its potential and they are willing to invest. Vietnam has direct flights, many beautiful cities, and an area stretching from North to South, so it has both mountains and sea. But does Vietnam have many luxury hotels? Obviously not,” said Mr. Xavier Grange.

Future competition problem

According to a McKinsey report published in May 2024, demand for luxury travel and high-end accommodations is expected to grow faster than any other segment of the travel industry. This is partly due to the rise of the global affluent class – individuals with a net worth of $1 million to $30 million. Demand for luxury travel is also coming from the “aspirational” group, which is described as individuals with a net worth of $100,000 to $1 million. Many of them are young and willing to pay a premium for high-end travel options.

The report also points out some characteristics of luxury customers, such as traveling more frequently than the general population, so they value experiencing new places, rather than popular destinations. Holidays that involve sunbathing or beach activities are the most popular trips for luxury travelers.

In the Asia-Pacific region, Vietnam is emerging as one of the key resort markets, possessing many ideal conditions for the development of the luxury hotel and resort segment. The number of millionaires in Vietnam has doubled in the past 5 years (according to research by Bain & Company), becoming a promising consumer force for high-end services. "We estimate that the ratio of Vietnamese guests to international guests at Sofitel and MGallery is 60/40," said a representative of Accor Group.

According to Savills, Vietnam currently ranks second in the region (excluding China) in terms of the number of resort real estate projects under development, after India. With 191 projects providing approximately 49,800 rooms expected to be operational by 2028, Vietnam is considered one of the most important markets in the region. Notably, nearly 75% of the projects under development are in the mid- to high-end segment, of which approximately 70% of the new supply is expected to be branded by international hotel chains, especially luxury hotels.

Despite possessing a lot of potential, when investing in the high-end hotel and resort segment, investors will have to face a number of important problems.

Firstly, the shift to new areas, when some central cities no longer have much room. According to Savills, currently, most luxury hotels are concentrated in Ho Chi Minh City, Hanoi and Phu Quoc (accounting for about 50% of the total number of luxury projects). In the coming time, the market will witness the emergence of luxury resort projects in new destinations such as Phu Yen, Sapa, Ninh Binh and Vinh Phuc. These locations stand out with their unique local culture and natural landscapes, promising to attract many domestic and foreign tourists.

Second, competition between hotels. In fact, demand for resort real estate is recovering strongly, especially from international tourist markets, but the ability to capture this demand depends largely on the management capacity of each hotel.

To increase their competitive advantage in an increasingly fierce market, many owners have considered the problem of converting or upgrading their brands to a more upscale segment. For example, the Hilton Hanoi Opera Hotel (Hoan Kiem District) is being upgraded to become the first Waldorf Astoria-branded project in Vietnam. Similarly, Meliá Ba Vi Mountain Retreat (Ba Vi District) will be repositioned as Meliá Ba Vi Mountain, part of the Meliá Collection.

“Hotel management contracts usually last for 10-15 years and many contracts from the wave of luxury hotel development in 2008-2010 are now nearing their expiration date. Therefore, investors are considering repositioning their brands and upgrading to higher segments to renew themselves,” said Mauro Gasparotti, Director of Savills Hotels.

With luxury hotel projects being implemented, investors choose the most popular option of buying franchises from international corporations such as Accor, Marriott, Hilton... Thereby, resorts and high-end hotels can gain many benefits such as optimizing profitability, because the management unit has experience in operation and management; improving services and operating procedures according to international standards.

In particular, the hotel has access to a global customer base that is already available in the databases of international corporations, without having to spend a lot of money on advertising and marketing. “We have a large number of loyal customers worldwide. When a new hotel opens, we will send information for them to refer to and decide. Sometimes, customers do not like a certain country, such as they have not decided to visit Vietnam, but if there is a new hotel with a different design, they may still choose it,” Mr. Xavier Grange revealed.

According to the assessment of Accor representative, in the next 5 years, the luxury hotel and resort segment in Vietnam will become the market-leading segment, instead of the current popular hotel segment. However, the problem for each hotel is how to increase customer spending. For example, MGallery hotel in Thailand can reach an average spending level of 1,000 Euro/guest, although MGallery is not a very luxurious segment, while in Vietnam, although he did not share specific figures, Mr. Xavier Grange said that "there is still a long way to go".

Source: https://baodautu.vn/batdongsan/nha-dau-tu-rot-tien-vao-khach-san-hang-sang-d231465.html

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

![[Photo] Students of the Academy of Posts and Telecommunications visit the editorial office of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/51093483a84448ccb39d59333ead674e)

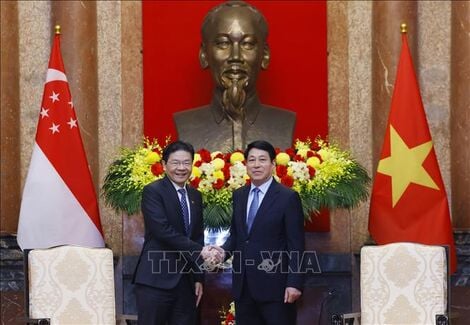

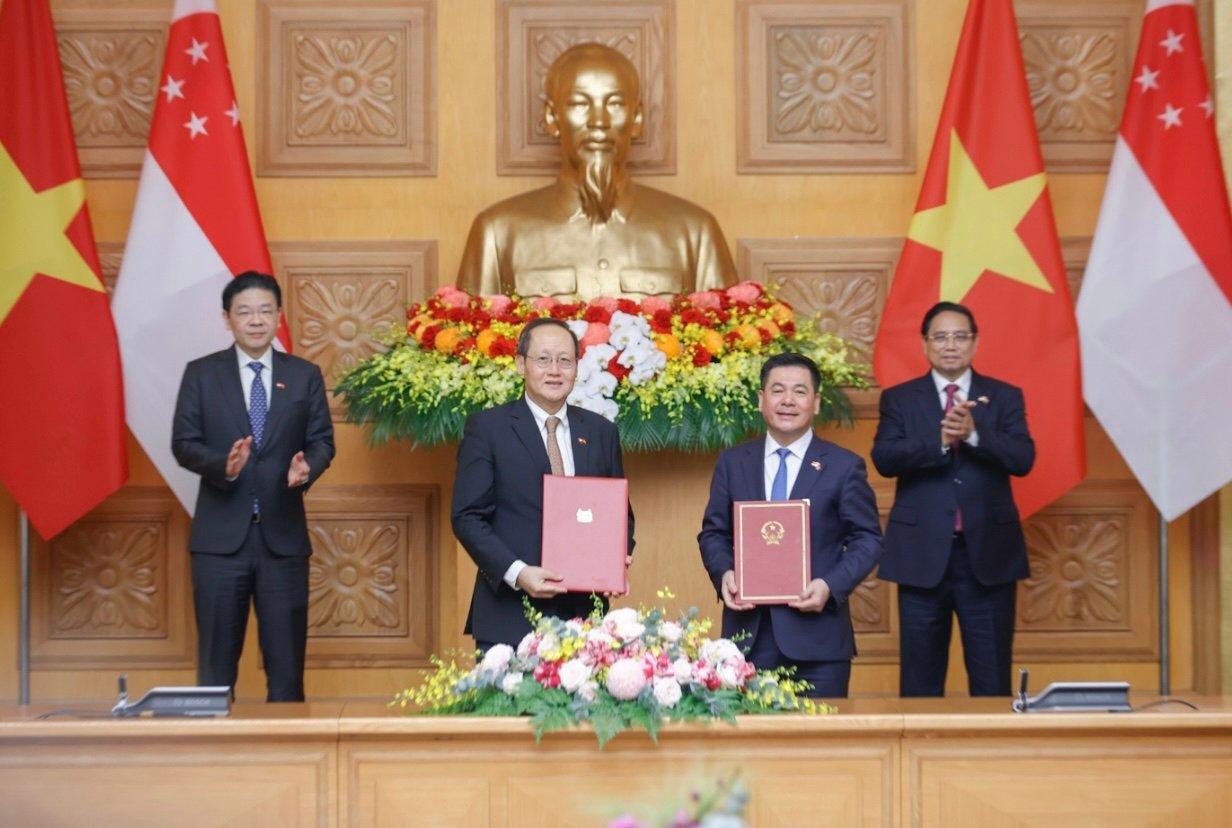

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] Prime Minister Pham Minh Chinh attends the launching ceremony of the "Digital Literacy for All" Movement](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/a58cb8d1bc424828919805bc30e8c348)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

Comment (0)