Ms. Yen was introduced by an acquaintance to a plot of land in Binh Chanh District (HCMC) with an area of 150 square meters for 2.2 billion VND. After viewing the plot of land, Ms. Yen really liked it. She currently has 1.5 billion VND, if she buys this plot of land, she will have to borrow another 700 million VND. "Although I really like that plot of land, I still do not dare to borrow from the bank at this time, even though the interest rate has dropped a lot compared to 2023. I will consider it again when I see if the interest rate will drop further in the future, or I will find a plot of land that fits my budget so I don't have to worry about the burden of paying off the debt," Ms. Yen shared.

Similarly, Mr. Nam also wants to buy an apartment in District 12 (HCMC), but thinking about having to borrow from the bank, Mr. Nam worriedly said: "If I buy this apartment, I have to borrow an additional 500 million VND from the bank. With a preferential interest rate of 8.5% per year in the first year, but increasing to 11-12% the following year, the amount I have to pay in principal and interest is about 9 million VND per month. This loan puts pressure on my family's economy, so I decided to temporarily postpone buying an apartment and wait for the interest rate to decrease further."

According to a recent survey by Batdongsan.com.vn, 70% of respondents said they would wait for bank interest rates to continue to decrease before taking out a home loan. 65% said that interest rates are still high and very high. Many people believe that with the current interest rates, if home buyers do not calculate well, they will not be able to pay the full interest to the bank on schedule. This is because banks usually only offer preferential interest rates in the first year, depending on the loan package. When that preferential period ends, the floating interest rate according to the market is not easy for salaried workers with unstable income, not to mention other expenses in life. Therefore, for many people who want to take out a home loan, "cut your coat according to your cloth" is the choice at this time.

Many economic experts say that bank loans are a popular option to own real estate without having to save up enough money. Currently, banks offer many home loan packages with diverse interest rates and repayment periods of 15-20 years, with some banks lending for 30-35 years to meet customer needs. However, regardless of the loan term, the most important thing is to ensure the ability to repay the debt.

When deciding on a loan amount, borrowers need to consider the debt ratio so as not to cause too much financial pressure. During the loan processing process, lenders often provide information on the maximum amount that can be borrowed, the principal amount and the monthly interest payment. Since the amount of a home loan is usually not small, individual customers need to carefully assess their financial ability, including detailing their family income and living expenses before determining the loan amount. This helps borrowers maintain control over their monthly repayment ability.

Dr. Su Ngoc Khuong, Senior Director of Savills Vietnam, said that although many banks can provide loans up to 80% of the property value, customers should only borrow about 40-50%. This is considered the "golden ratio" to help maintain a balance between daily life and home loan repayment. For example, if the apartment value is 2 billion VND, the ideal loan amount is 800 million VND, equivalent to 40% of the apartment value. However, to ensure the ability to repay the debt, home buyers need to consider the total income of the family and calculate the amount to be paid each month based on the loan amount, loan term and interest rate.

In fact, since the beginning of 2023, the State Bank has repeatedly reduced operating interest rates, creating conditions to reduce deposit and lending interest rates. Up to now, deposit interest rates have been at their lowest level in the past decade, and home loan interest rates have also cooled down significantly. Lower lending interest rates also mean that financial pressure when borrowing to buy a house is also relieved. However, the preferential interest rate period does not last long, usually 12-24 months, and after the preferential floating interest rate period ends, it will increase again. Not to mention that house prices are still very high, if the source of income is unstable, buyers should not borrow to buy a house.

Source

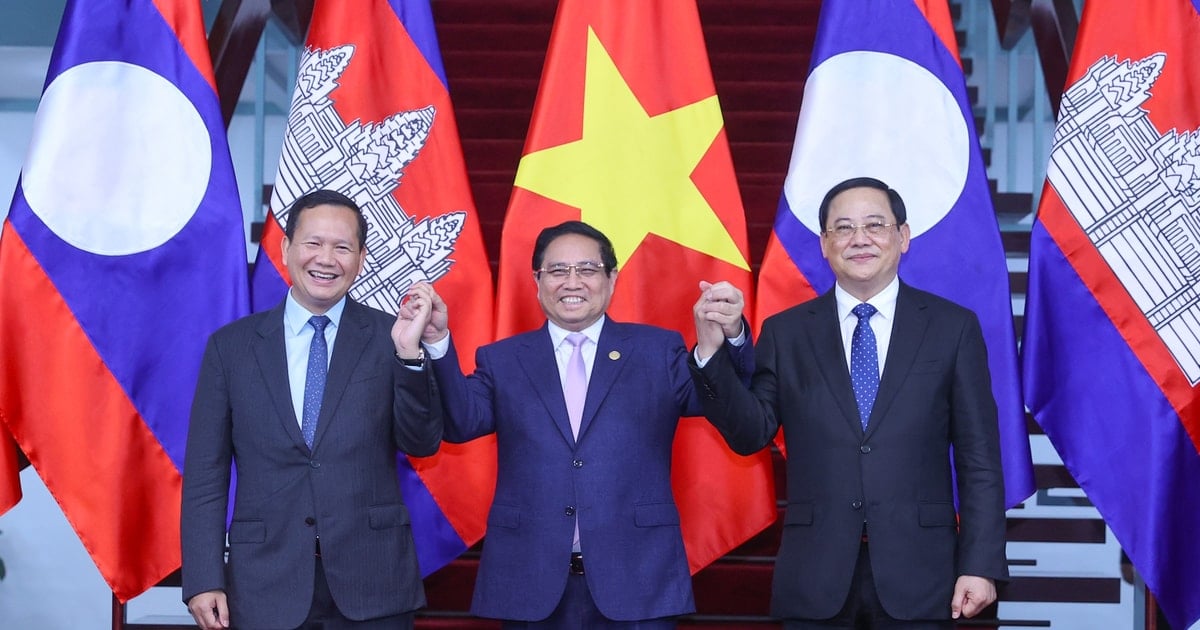

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)