SGGP

According to the announcement of the US Department of Labor, consumer inflation in May in this country “cooled down” for the 11th consecutive month. This is considered an encouraging signal for policy makers to decide to temporarily suspend interest rates after 10 consecutive increases.

|

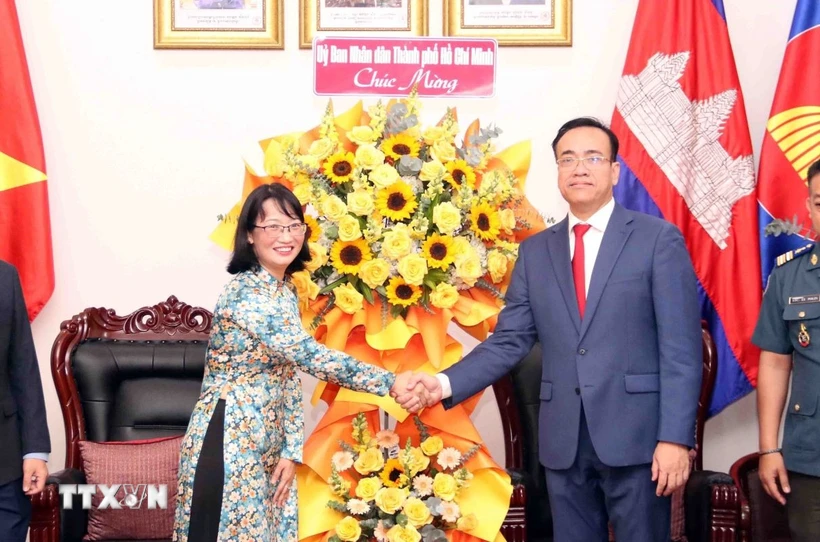

| The headquarters of the US Federal Reserve Bank in Washington, DC. Photo: AFP/TTXVN |

US stocks also saw a rise in trading on June 13 (US time) after May inflation data added to investor optimism. The Dow Jones Industrial Average rose 145.79 points, or 0.43%, to 34,212.12. The S&P 500 gained 30.08 points, or 0.69%, to 4,369.01. The Nasdaq Composite Index rose 111.40 points, or 0.83%, to 13,573.32. The S&P 500 and Nasdaq Composite both hit 13-month highs. Ten of the 11 major sectors of the S&P 500 ended the session higher, with materials and industrials leading the gainers, up 2.33% and 1.16%, respectively.

Amid falling inflation, the value of the US dollar has also declined. The USD index fell 0.3% to 103.3370 points at the end of the trading session on June 13. The EUR exchange rate against the USD increased from 1 EUR to 1.0756 USD in the previous trading session to 1.0790 USD, while the British pound increased from 1 GBP to 1.2505 USD in the previous trading session to 1.2602 USD.

The figures came as Federal Reserve officials began a two-day policy meeting. The consumer price index (CPI) - a gauge of inflation - rose 4.0% in May from a year earlier, according to government data, in line with analysts' forecasts, but down from 4.9% in April. The US CPI in May was at its lowest level in about two years and less than half the record 9.1% recorded in June 2022. US President Joe Biden said this was good news. This shows continued progress in dealing with inflation while unemployment remains at historically low levels. However, economic analysts are cautious that the Fed is looking for a more certain trend of cooling inflation before ending its rate-hiking cycle. The Fed has raised interest rates 10 times, with a total increase of 5 percentage points since March 2022, to around 5%-5.25%.

Several members of the Federal Open Market Committee (FOMC), the Fed’s policymaking body, said they are considering not raising interest rates this month to give policymakers more time to assess the economic impact of recent banking system stress and the recent rate hikes. According to data from the CME FedWatch Tool, there is an 80% chance that the FOMC will decide to pause interest rate hikes at this policy meeting.

Although inflation has cooled from 9.1% in June last year to 4% last month, it remains high for US consumers. If job and wage growth slow and inflation continues to slow, the Fed could hold rates steady again, according to Michael Feroli, chief US economist at JPMorgan Chase. Otherwise, it could trigger a price increase. Oren Klachkin, an economist at Oxford Economics, warned that there is still a risk of a rate hike in the second half of the year.

Source

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)