In the trading session on October 12, the banking group continued to prosper with the strongest increase coming from NVB shares of National Citizen Commercial Joint Stock Bank with 0.83%, followed by BAB and BID also increasing by approximately 1%, contributing to the increase of VN-Index in the morning session. However, on the downside, there are still 5 big names that have not been able to catch up with the slight recovery trend of the market such as VCB, VPB, STB, HDB, OCB.

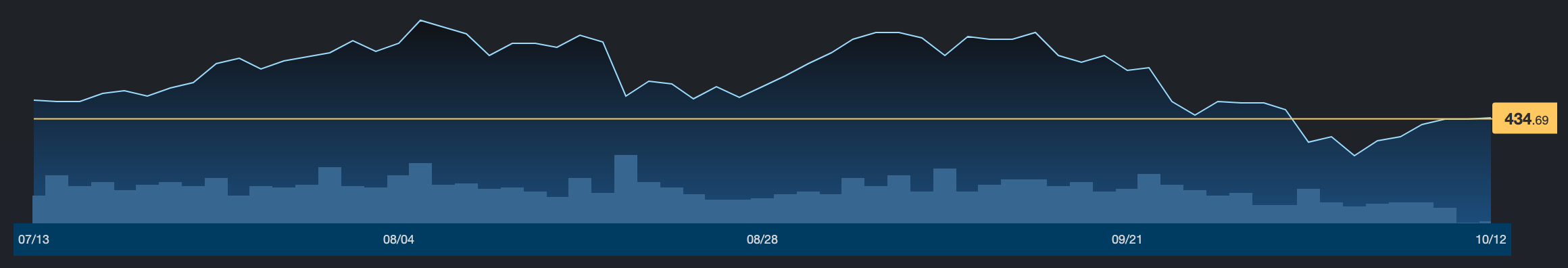

According to Fiintrade, the banking index is currently at 434.77 points, up 0.02% from the reference level of the day. The industry's matched liquidity on the morning of October 12 reached more than VND535 billion, showing no signs of recovery. Meanwhile, last week, the industry's average liquidity reached VND1,900 billion/session.

Foreign investors traded cautiously with a small amount of liquidity. They continuously bought net in STB, HDB, SHB, VCB, while some codes were sold net such as VPB (more than 1 million shares), BID (nearly 300,000 shares).

The banking industry is currently lacking short-term profit growth momentum, and its stocks are "weaker" than the general market.

Banking sector index developments (Source: Fiintrade).

According to SSI Research's estimated business results, some banks with profit growth in the third quarter of 2023 include ACB, CTG, HDB, MBB, STB, VCB. Meanwhile, the banks that are going backwards mentioned by SSI include BID, MSB, TCB, TPB, VIB, VPB.

In the Big4 group, Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV - HoSE: BID) is the only unit that SSI estimates a decrease in business results in the third quarter. The analysis team commented that although credit growth and mobilization remained good at 8.4% and 7.2% compared to the beginning of the year as of the end of September, pre-tax profit is estimated to decrease by about 10 - 12% compared to the same period due to provisioning. SSI also expects BIDV to actively handle debt to maintain the bad debt ratio at a reasonable level.

On the private side, Vietnam Technological and Commercial Joint Stock Bank (Techcombank - HoSE: TCB) is estimated by securities experts that TCB's net interest income ratio (NIM) will continue to face pressure in the third quarter of 2023 due to the flexible interest rate mechanism applied to some customers.

Meanwhile, capital costs have not improved much as banks have had to reduce the ratio of short-term capital for medium and long-term loans to below 30% from October 1, 2023. This ratio of the bank was 31.6% at the end of June 2021. Accordingly, SSI forecasts that Techcombank's pre-tax profit will reach about VND 5,700 billion - VND 5,900 billion in the third quarter of 2023, a decrease of 12 - 15% compared to the same period.

Referring to the prospects of the entire banking industry in the coming time, Mr. Tran Ngoc Bau - CEO of WiGroup paid attention to net interest income and provision expenses because these are two indicators that structure bank profits. A bank that wants to grow in net interest income needs to improve NIM and credit growth.

In 2023, both NIM and credit growth will be difficult. Currently, the net interest income ratio is in a state of slight decline, especially in the second and third quarters of 2023. Mr. Bau also forecasts that in the fourth quarter, this index will not recover.

In addition to net profit growth, investors also pay attention to the average profitability, average cost of capital and credit growth of banks. Regarding provisioning costs, although bad debt has increased rapidly, provisioning costs have not increased in the past 2-3 years. This helps banks have good profits because they do not have to increase costs for provisioning.

However, the current problem, according to WiGroup CEO, is that the system's bad debt coverage index has rapidly decreased from 150% to about 100%. Therefore, in the coming time, banks will have to increase their provisioning costs. Because bad debt is forecast to peak in the fourth quarter of 2023.

"The second quarter of 2024 is the right time for the banking industry to grow again," Mr. Bau commented .

Source

Comment (0)