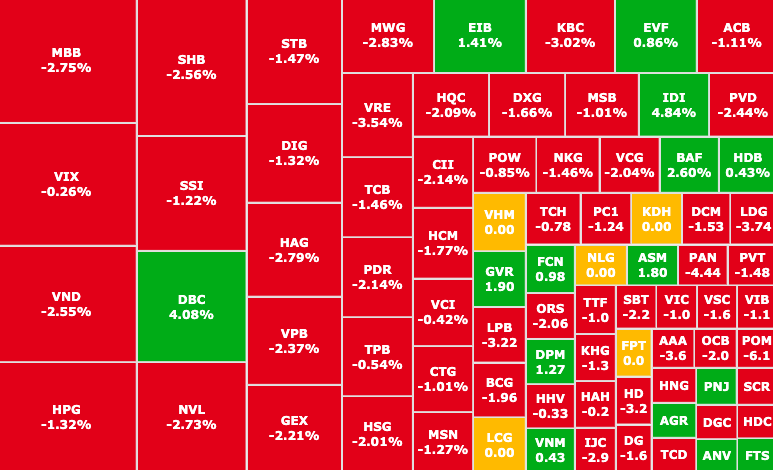

The market is continuously dyed red, however, the group of business stocks of some female entrepreneurs is still actively increasing strongly, playing the role of supporting the growth momentum for VN-Index.

The market continued to be flooded with red with 2 consecutive sessions of strong declines, the total number of points decreased to more than 30 points. Thus, compared to the increase of more than 56 points in the recent long increase, in just 2 sessions, VN-Index quickly lost more than half of its strong effort.

The market was red for two consecutive sessions, "evaporating" more than 30 points.

Liquidity reached 26.5 billion VND, down 25.8% compared to the session on March 8.

The VN30 pillar group is the main pressure-producing group with a series of large stocks plummeting such as VPB (VPBank, HOSE), MBB (MB Bank, HOSE), MWG (Mobile World, HOSE), TCB (Techcombank, HOSE), HPG (Hoa Phat Steel, HOSE),...

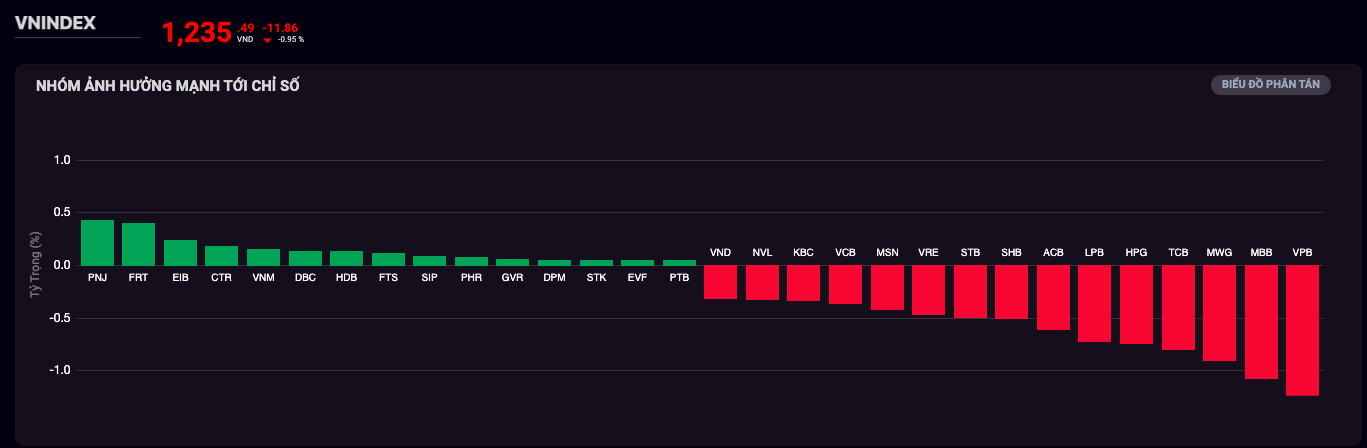

Faced with this development, the group of stocks has a more positive trend, going against the market trend. In particular, a series of stocks of "female generals" unexpectedly led the wave, acting as a pillar for the market's upward trend.

Top 3 positive stocks for VN-Index belong to PNJ, FRT and EIB (Source: SSI iBoard)

Leading the way is PNJ (Phu Nhuan Jewelry, HOSE) of female chairwoman Cao Thi Ngoc Dung. In the context of gold prices continuously increasing sharply, on the floor, PNJ flourished with a 2.6% increase in yesterday's session, the stock value was close to 100,000 VND/share, establishing a new peak since listing on HOSE until now. Thus, since the beginning of the year, PNJ's market price has increased by more than 15%.

Following the developments on the floor, the positive growth chain appeared since the beginning of March.

Regarding business results, in 2023, PNJ achieved revenue of VND 33,482 billion, a slight increase of 2% over the same period last year. Profit was VND 1,971.5 billion, an increase of nearly 9%. In particular, in the fourth quarter, revenue and profit both increased sharply, by 17.5% and 34.4%, respectively.

With the above results, PNJ believes that, in recent times, the company has actively developed its retail network, increased the number of customers and operated effectively from initiatives to optimize operations and costs.

Next is FRT (FPT Retail, HOSE) . Going against the market trend, despite the negative developments, the stock of businesswoman Nguyen Bach Diep still recorded "high flying" days, increasing by one and a half times since the beginning of the year. Reaching a market price of 154,500 VND/share, a sharp increase of nearly 6% in yesterday's session.

This development caused a series of organizations/investors holding FRT shares to suddenly "win big".

FRT has unexpectedly soared since mid-February (Source: SSI iBoard)

This is said to come from an important factor of FPT Retail - Long Chau Pharmacy Brand. The year 2023 was also the first year that Long Chau's revenue surpassed FPT Shop.

In 2021, Long Chau recorded a profit, "finishing" 2 years ahead of the original plan. Up to now, Long Chau continues to expand by opening 560 new stores in 2023, bringing the total number to 1,497 pharmacies. Notably, the average revenue/pharmacy/month is still maintained at nearly 1.1 billion VND in 2023.

Thanks to that, up to now, FRT's market price has increased 15 times after 4 years (bottoming out in early March 2020).

Regarding business results, FPT Retail recorded accumulated revenue of VND 31,850 billion, up 6% in 2022. However, due to increased costs, after deducting expenses, the company lost VND 294 billion.

In addition, recently, FRT announced the schedule for the Annual General Meeting of Shareholders scheduled for next April.

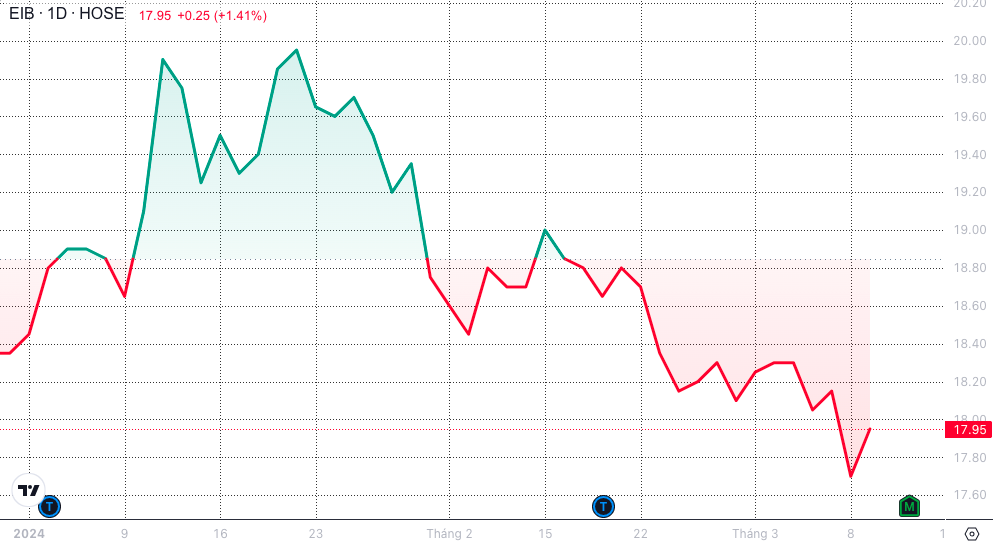

EIB stock price movement from the beginning of the year until now (Source: SSI iBoard)

At the same time, EIB stock (Eximbank, HOSE) suddenly increased again after a series of slight declines before.

This development at EIB goes against the trend of the entire banking sector, when since the beginning of the year, this sector has continuously maintained a positive trend, leading the growth wave. Meanwhile, EIB recorded a rebound in January, but quickly after that, from February until now, EIB has been in a rather gloomy state, even having a period of slight decline.

But up to this point, when the whole market was "red", EIB reversed the trend and increased again, ranking 3rd in the group of stocks that had a positive impact on the VN-Index at 17,950 VND/share.

Business results show that after welcoming the new female chairwoman, Ms. Do Ha Phuong, EIB had a significant recovery in the fourth quarter of 2023 with profits doubling compared to the same period at VND 804.5 billion.

However, this cannot help EIB grow positively for the whole year. 2023 profit at 2,166 billion VND makes EIB "regress" 26.5% compared to the same period in 2022.

Source

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Infographic] Cross exchange rates of Vietnamese Dong with some foreign currencies to determine taxable value from April 3-9](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/29a48fd80b3b46a0963e6449698a292b)

Comment (0)