Not only self-trading losses, both SHS's lending and brokerage segments decreased simultaneously in the third quarter of 2024.

Saigon - Hanoi Securities Corporation (SHS) has just announced its Q3/2024 Financial Report with less positive results.

Self-employment is the sector that makes SHS suffer the most when the revenue from this activity only reached 61.9 billion VND in the third quarter of 2024, down 68% compared to the same period last year. Meanwhile, the loss from self-employment accounted for 106 billion VND, causing SHS to have a net loss of more than 44 billion VND in this sector.

Along with that, the two other high revenue segments, lending and brokerage, both decreased simultaneously. Specifically, interest from loans and receivables only reached 110 billion VND, down 47%. Brokerage revenue also decreased by 33% compared to the same period last year, bringing in 49 billion VND.

As a result, SHS's pre-tax profit in the third quarter of 2024 was VND74 billion, down 70%. This is the quarter with the lowest profit for SHS since the second quarter of 2023.

Accumulated in 9 months, SHS achieved 952.7 billion VND in pre-tax profit, nearly reaching the profit target set for the whole year of 2024 of 1,035 billion VND.

SHS said that the negative market situation in the third quarter was the reason for the above results. According to the report of this securities company, customer deposits have decreased sharply compared to the beginning of the year. As of September 30, 2024, customer deposits were 989 billion VND, down more than half compared to the beginning of the year, mainly due to the sharp decrease in deposits of securities issuers to pay principal, interest and dividends.

While many securities companies invested heavily in margin lending, this category of SHS did not fluctuate much. The margin lending balance at the end of the third quarter was VND3,666 billion, equivalent to the beginning of the year.

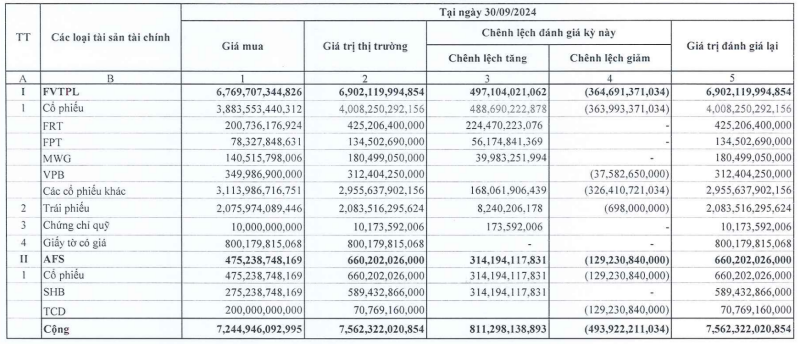

The majority of SHS's assets are allocated to FVTPL assets with a total value of VND6,902 billion, accounting for 53% of total assets and an increase of 37% compared to the beginning of the year. The largest investments are listed stocks (VND3,703 billion) and listed bonds (VND1,694 billion).

The major stocks that SHS is holding include FRT, FPT, MWG and VPB. Of which, VPB temporarily lost 11%. However, VPB has also turned around and had significant increases compared to the end of September. In addition, SHS also temporarily lost more than VND326 billion from other stocks.

As for financial assets ready for sale, AFS, SHS holds 2 codes SHB and TCD. While temporarily earning more than 314 billion VND from SHB, TCD is recording a loss of more than 129 billion VND.

|

| Value of SHS group investments. Source: SHS financial statements |

Source: https://baodautu.vn/lo-tu-doanh-loi-nhuan-quy-iii2024-cua-shs-giam-den-70-d227961.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)