Deputy Analyst of SHS Research: VN-Index expected to surpass 1,300 points, foreign capital will return

VN-Index will surpass the 1,300 point price zone to head towards higher price zones of 1,320 - 1,350 points. With Vietnam's economic prospects and the possibility of upgrading, foreign money will return to the market.

Sharing at the S-Weekends Conference with the theme “ Macro Picture and Discovering Investment Opportunities ”, Mr. Ngo The Hien, Deputy Head of Analysis Department of Saigon - Hanoi Securities Company (SHS) said that globally, inflation has cooled down, interest rates have decreased, and economic growth in European and American countries is recovering.

For Vietnam, economic growth is on the path of strong recovery, with GDP in the third quarter of 2024 increasing by 7.4%, bringing GDP in the first 9 months of the year to 6.82%.

Regarding the stock market , in 9 months, VN-Index increased by 14% - higher than other markets in the region, even neighboring Thailand only increased by 1.08%, the increase was only lower than the Chinese market (increased by 17% in 9 months).

The growth of the VN30 index is superior to the remaining groups, partly reflecting the reality of the Vietnamese economy. As a leading enterprise, it can catch up with market opportunities faster (large resources, good market share, etc.).

Industry groups grew according to the general index, with some groups having outstanding growth in terms of price such as telecommunications up 149.46%, retail up 58.44%, information technology up 57.72%.

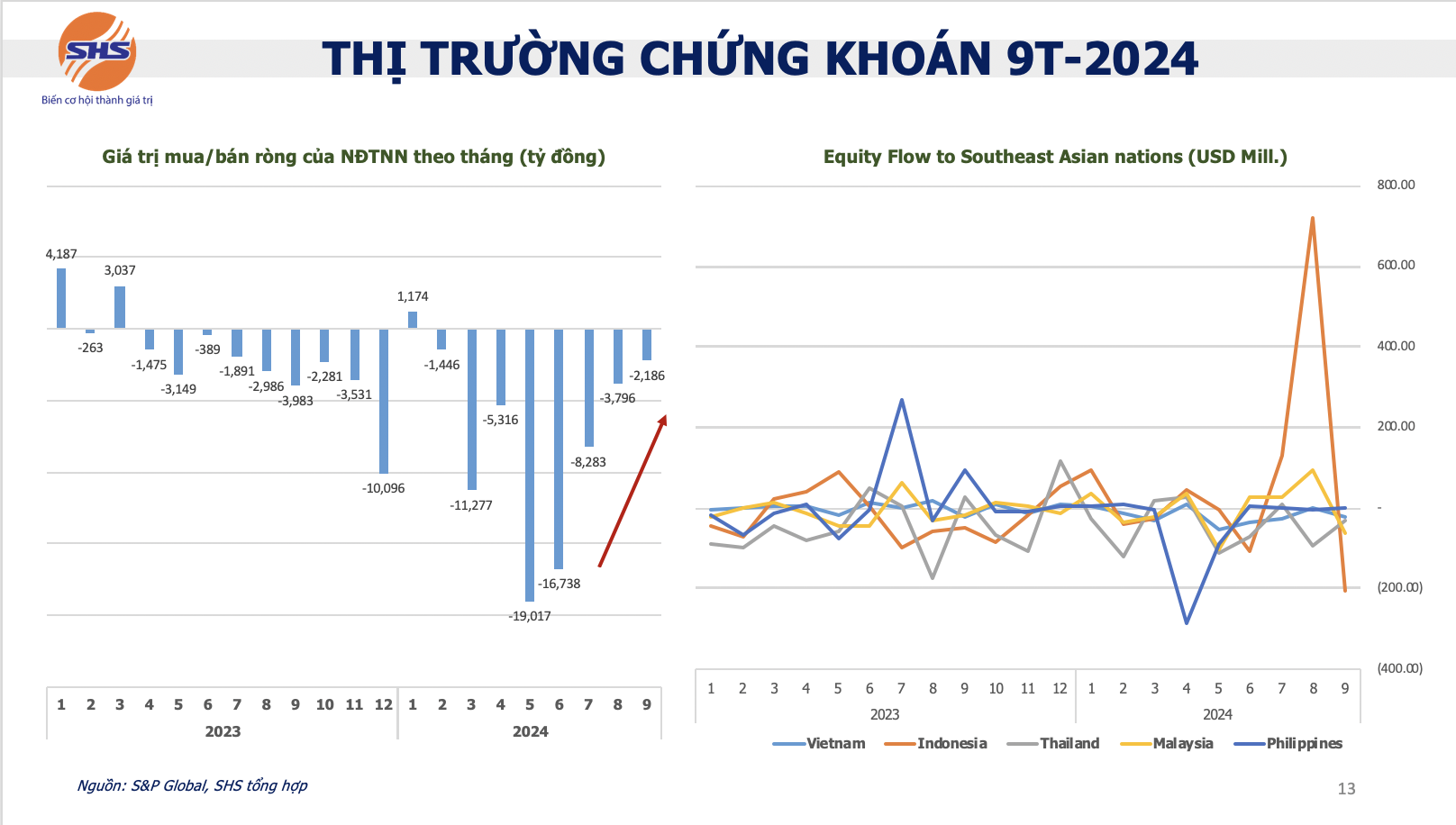

Foreign investors net sold about 2.5 billion USD (63,230 billion VND) in the first 9 months of the year. Investment funds were allocated to many developed and developing markets mainly due to the impact of the US Federal Reserve's (Fed) sharp increase in interest rates. However, the scale of net selling by foreign investors is decreasing month by month.

The bright spot of the market in the past 2 years is that foreign investors have been net sellers, but the index has still grown thanks to domestic demand. Previously, foreign money flow had a strong impact on the market, but in the past few years, the trend has reversed, and foreign investors no longer have much impact. It also shows that Vietnamese individual investors are more interested in the stock market, have a more stable mentality, and have better investment thinking.

|

| Foreign net selling momentum is narrowing. |

And the story of upgrading the market, the target of 2025 is to raise it higher (to FTSE's emerging market category 2), Mr. Hien said, when upgrading from a frontier market to an emerging market, it will attract foreign capital, estimated at 700 million USD - 1 billion USD of foreign capital into the market. Accordingly, foreign capital will return to the Vietnamese market and this development is being seen (net selling pressure until September is gradually decreasing, October is having sessions of net buying in the market).

Forecasting for March 2025, FTSE may officially put Vietnam on the upgrade list , after Vietnam's efforts such as the prefunding bottleneck has been removed.

In response to investors' concerns about China's monetary easing policy to support the economy, which has also attracted foreign capital quite well in recent times, which has had an additional impact on the net foreign capital attraction from the Vietnamese market, Mr. Hien said that investment funds are all allocated in many markets, not concentrated in one market. The allocation of the proportion depends on the investment strategy and market outlook.

Mr. Hien predicts that with the trend of interest rates decreasing and inflation decreasing, in 2025, the Fed interest rate may decrease to 3-3.5%, plus Vietnam's economic prospects and the possibility of upgrading, foreign money will return to the market.

VN-Index is currently maintaining accumulation in a narrowing price channel. SHS Research expects that in the fourth quarter, when geopolitical tensions in the world cool down and the third quarter business results of enterprises continue to grow, VN-Index will surpass the 1,300-point price range to move towards higher price ranges of 1,320 points - 1,350 points .

|

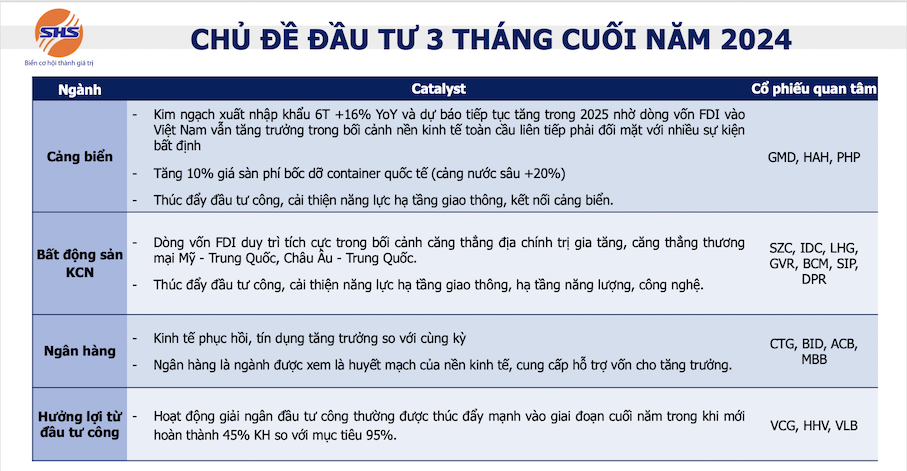

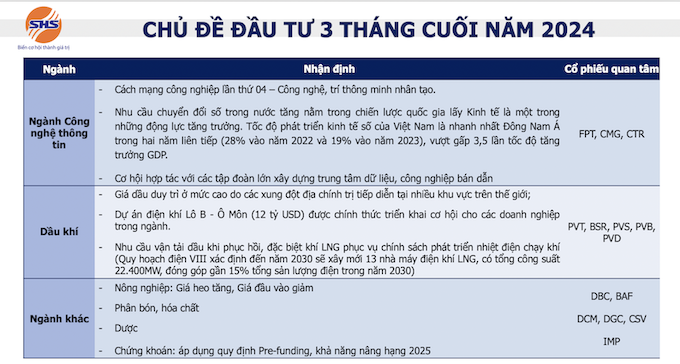

| Investment topic for the last 3 months of 2024. |

|

Source: https://baodautu.vn/pho-phong-phan-tich-shs-research-vn-index-du-vuot-1300-diem-von-ngoai-se-quay-lai-d227436.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)