Digital transformation grows rapidly

From only 1 million customers in 2015, after 7 years, this number has taken a big step forward and reached 8.5 million customers by the end of 2022 (last year alone, TPBank had more than 3.7 million new customers). Purple Bank has just welcomed its 10 millionth customer, equivalent to more than 1.5 million new customers in just the first 6 months of 2023.

New technologies are continuously launched, TPBank application always achieves a high rate of regular customers (increased 4 to 5 times in the past 5 years) and especially the widespread LiveBank 24/7 and LiveBank+ networks have created worthy successes for TPBank, affirming the attractiveness of the digital ecosystem through the highest technology content in banking services in Vietnam.

Customers come to TPBank to make transactions quickly without paperwork.

Many other unique features that only TPBank Mobile application users can experience and be convinced of include money transfer by voice (VoicePay, applying natural language processing technology), money transfer by facial recognition or money transfer in the chat interface (ChatPay)...

Since 2018, TPBank has been the first financial institution in Vietnam to create a virtual assistant called T'aio to answer all customer questions and has been continuously upgraded and developed as a "Siri" of banking applications. In 2022, TPBank also deployed Facepay on a facial recognition algorithm platform with the ability to analyze 50 million faces to easily confirm payments.

Biometric technologies have been introduced into banking transactions early on.

For small shop owners, TPBank is also a pioneer in deploying the SoftPOS contactless payment method, turning phones into card swipers. Just download the TPBank SoftPOS application, shop owners immediately have a top-notch card payment application, without the need for a POS machine.

TPBank SoftPOS accepts payments with all types of cards including Visa, Mastercard, JCB and ATM (with Contactless logo) with outstanding speed of only 5 seconds for a payment transaction.

Recently, 6 million customers using the application on the iOS platform can easily and immediately add TPBank bank cards to Apple Pay wallet. Synchronizing the feature of opening TPBank virtual debit cards through the banking application or at LiveBank 24/7, TPBank has completed the 100% online experience circle, the only one in the market, helping customers from the time of registering to open a card to being able to spend in just a few minutes.

Uniqueness is not easy to copy

When it comes to the breakthrough of digital banking at the present time, LiveBank 24/7 - the first "never-sleeping" automated bank in Vietnam is considered a symbol. A product proudly stamped "Make in Vietnam" serving customers regardless of day or night or holidays since the end of 2016.

After 7 years of presence, 90% of basic banking tasks including cash withdrawal, money transfer, instant card opening (ATM, Debit), non-stop multi-channel transactions between LiveBank and the application have been loved by millions of Vietnamese customers and have become a familiar destination of digital cities...

Customers can go offline when transacting at LiveBank 24/7 after just one registration with biometric identification factors right at the automatic bank thanks to pioneering the application of technology to customer identification (eKYC) based on a series of cutting-edge solutions applied from AI (artificial intelligence), machine learning, biometrics, big data...

LiveBank 24/7 owns a network of more than 500 light points day and night and is constantly upgrading its utilities. In 2022, LiveBank has gone beyond the simple automated bank model, to combine services such as: lockers, battery charging stations, 24/7 vending machines... with the new name LiveBank+, bringing a very interesting banking experience in two major cities, Hanoi and Ho Chi Minh City.

LiveBank 24/7 automatic banking is constantly being upgraded and improved.

Along with integrated technologies aimed at individual customers, TPBank also participated in the development of Open Banking right from the beginning, standing shoulder to shoulder with the leading banks in the world such as DBS, OCBC (Singapore), Citibank (USA)...

By listening and understanding the needs of customers, TPBank implemented Open Banking and OpenAPI solutions (Banking as a Service) from 2018-2019. After only 2 years, the bank has connected nearly 100 different partners, launching more than 2,500 payment services, equivalent to a speed of a connection being established every few weeks.

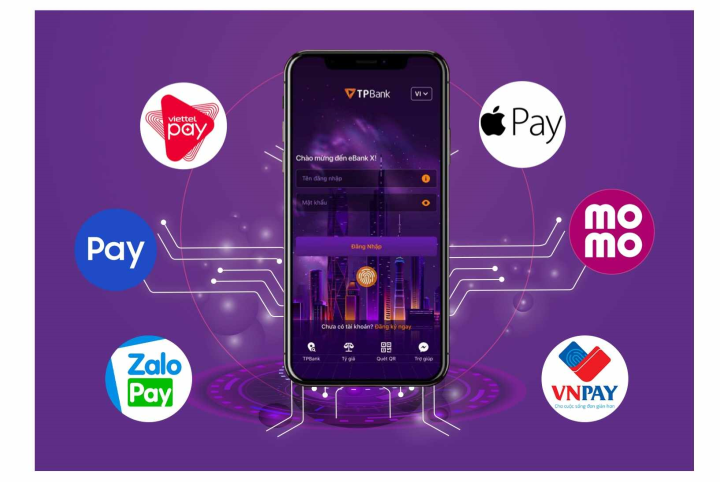

With that breakthrough, the bank has covered all financial and payment needs (Beyond banking) of customers from education, healthcare, entertainment, public services, fee payments, e-wallets... Up to now, TPBank has connected with 12 e-wallets and is one of the banks with the largest wallet connection service coverage rate in Vietnam. Purple Bank owns the leading digital ecosystem for 3 consecutive years according to Asian Banker.

TPBank continues to raise the level of technology application for corporate customers to a new level when deploying the digital document system. This is a market-leading feature deployed in Vietnam. This feature allows customers to draft, sign and submit documents completely online anytime, anywhere, without the need for additional hard copies.

Green and sustainable development from digital “DNA”, pioneering and leading

To make breakthrough changes in technology to bring new experiences and convenience to customers, TPBank really makes a breakthrough from within the bank.

TPBank's technology team has put 500 robots into operation and is capable of creating an average of 5 robots per week to meet internal operating procedures to replace human resources in performing simple, repetitive tasks such as data entry, data analysis, etc., helping to reduce human resources costs, while increasing accuracy and security.

The representative of the purple bank added that applying technology helps the bank optimize business operations and increase competitive advantages many times over. " TPBank maintains an average annual growth rate of 30-40%, but the number of employees only increases by 4-5% each year. Simple operations are solved with technology ," said TPBank General Director Nguyen Hung.

Mr. Nguyen Hung - General Director of TPBank shared about the technology system.

After implementation, the bank saved millions of USD; cost savings are expected to increase by 20% from 2024. The appearance of robots at TPBank is a pioneer in raising the level of automation in digital operations, improving customer experience and optimizing operating costs.

The trend of developing diverse, effective and high-speed digital banking in Vietnam in recent years has brought many practical values to the community and society, especially customers benefiting from the revolution with many Pioneering marks. TPBank is on the way to conquer new milestones and new achievements commensurate with its leading position in digital transformation of the banking industry.

Recently, Purple Bank was honored in the top 5 private banking brands in Vietnam thanks to its outstanding achievements on the path of digitalization. According to Mr. Alex Haigh, Managing Director - Asia Pacific Region of Brand Finance: "TPBank's commitment to innovation is clearly demonstrated by the impressive score of 9.9/10 in the research attribute "Innovation".

Purple Bank has made many outstanding marks on its digital innovation journey.

Previously, the 15-year-old financial institution also received a series of awards from The Asia Banker, IDG Vietnam and AIBP as the best digital bank and digital ecosystem, outstanding digital transformation bank, bank with innovative products and services, etc.

A series of outstanding digital products and services have been and are being exploited such as AI, Big Data, Machine Learning... applied strongly and widely to all core services. TPBank is leading the way to a new stage of the 4.0 revolution - the digital innovation stage.

TPBank is one of the banks with the largest coverage rate of e-wallet connection services.

TPBank sets a higher goal of expanding its customer base, thereby becoming an important factor contributing to the Government and State Bank's project that all Vietnamese people will be able to use banking services, of which 90% will use digital banking services. This will help customers save time, effort, travel costs/cash withdrawals... making customers' lives easier thanks to the support of digital banking.

Bao Anh

Source

Comment (0)