To bring digital banking services to people, especially in rural areas, Agribank Tuyen Quang officers and employees directly go to businesses, stores, units, enterprises, and households to introduce, advise, and support customers about Agribank's convenient products and services; organize propaganda in all communes about new applications and conveniences when making non-cash payments.

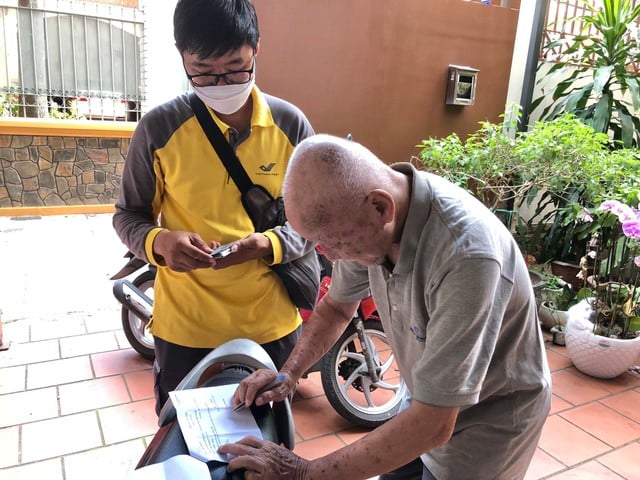

Agribank staff introduce digital financial services to customers.

Ms. Nguyen Thi Van, Thai Binh village 1, Thai Son commune (Ham Yen) excitedly said: She was supported by Agribank staff to install the bank's application on her phone, at the same time helped to create an account, fingerprint and facial biometrics, especially instructed her carefully on how to use electronic banking. Now she is proficient, with these applications, people in rural areas like her who want to pay, transfer money just need a phone to complete the process, do not have to go to the bank, very fast, convenient, accurate.

Agribank's convenient products and services on digital platforms have made it much more convenient for customers in remote areas. Ms. Lan Thi Hien, Hong Quang commune (Lam Binh) said: In addition to transferring and sending money, with Agribank's services, she can shop, book bus tickets, book medical examinations... at any time, without having to travel.

To improve the quality of customer service, Agribank Tuyen Quang has actively popularized a series of utilities and cashless payment applications on the agribank E-Mobile Banking platform to the people, creating a comprehensive experience for customers. Thereby, supporting people to make payment transactions 24/7 without having to go directly to the bank, helping people use online payment services, limit the use of cash, save costs, avoid mistakes in counting, transportation and limit risks for customers. In addition, Agribank also improves the quality of customer service staff, ensuring that each bank staff is a propagandist contributing to promoting digital transformation.

With the goal of moving towards digital banking, meeting the requirements of modern banking management, Agribank Tuyen Quang has focused on developing and modernizing information technology infrastructure associated with human resource development. In particular, Agribank Tuyen Quang has researched and developed digital banking products and services, ensuring safety, security, enhancing experience and increasing customer satisfaction, implementing well the content of card payment and electronic banking to users. On the basis of focusing on implementing many programs to support customers in opening accounts, opening payment cards and installing and using the Agribank Plus electronic banking application. Strengthening cooperation programs to provide services such as salary payment, payment of electricity, water, bills; collection, payment by Agribank's electronic payment means. Agribank also expanded thousands of payment points via QR-Code, VietQR... to facilitate customers in using non-cash payment services. According to statistics from Agibank Tuyen Quang, 80% of customers who register to use e-banking services and use e-banking services have had their biometrics collected, ensuring safety in transactions.

Applying technology, promoting digital transformation, Agribank Tuyen Quang's products and services increasingly meet customers' needs, improve operational efficiency and contribute to increasing the rate of non-cash payments. Thereby, accompanying the banking industry to effectively implement the Government's national digital transformation program until 2025, with a vision to 2030.

Source: https://baotuyenquang.com.vn/phat-trien-cac-san-pham-dich-vu-ngan-hang-so-206877.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)