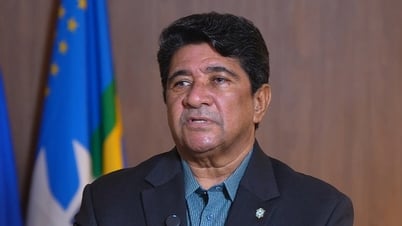

Chairwoman Bui Thi Thanh Huong answers shareholders at the meeting - Photo: NCB

The above information was given by NCB leaders at the 2025 annual general meeting of shareholders recently held in Hanoi .

Ms. Bui Thi Thanh Huong - Chairman of NCB, said that in 2022, when FLC Group - the parent company of Bamboo Airways - encountered difficulties, the bank found a partner who committed to deposit and buy back 200 million shares of this airline.

The proceeds from the transaction are expected to cover all principal and interest. However , Ms. Huong said that after the COVID-19 pandemic, the aviation industry continued to struggle, and Bamboo Airways was no exception.

In that context, the partner buying back the above shares has requested to extend the payment until 2026 at the latest, the chairman of NCB informed.

Ms. Huong also confirmed to shareholders that this investment was recovered as planned. NCB could record an extraordinary income, significantly improving its financial situation. Currently, this bank is still making provisions cautiously.

Notably, NCB shares are under warning after 2 consecutive years of losses, with the market price at 11,600 VND/unit.

Responding to questions from shareholders, Chairwoman Bui Thi Thanh Huong said the bank aims to be profitable by the end of 2025, or 2026 at the latest, thereby removing bank stocks from the warning list.

"A listed company is allowed to lose for a maximum of two consecutive years. By the third year of profit, the bank will operate normally. We expect that in 2026, shareholders will receive more positive information," Ms. Huong reassured shareholders.

According to the audited financial report for 2024, NCB had a provision of VND 1,196 billion at the end of 2024.

Regarding the provisioning for some customers in groups 2 and 5 and the credit facility for FLC Group, the bank said it has developed a roadmap for handling and setting up provisions in the restructuring plan for the period 2023 - 2025, with a vision to 2030, and has been approved by the competent authority.

In addition, in the long-term investment section, NCB said it is investing in many other businesses with a value of nearly 720 billion VND.

Specifically, this bank owns 3.5 million shares with a book value of VND273 billion, equivalent to 3.18% of the charter capital of Saigon - Quy Nhon Mineral Company. More than VND338 billion , equivalent to 16.5 million shares , is being invested by NCB in Saigon Investment Joint Stock Company.

NCB also owns 1.77 million shares, equivalent to 7.02% of Navibank Securities' charter capital. This bank also holds 9 million shares (VND90 billion), equivalent to 9% of the charter capital of Saigon - Binh Thuan Power Plant Development Investment Joint Stock Company.

For most of the above investments, NCB has a divestment plan according to the restructuring plan approved by the State Bank.

The bank also said it had made provisions for these investments according to the restructuring plan. At the end of 2024, NCB had not yet determined the fair value of the above investments.

NCB increased capital to nearly 20,000 billion VND

Also at this year's general meeting of shareholders, NCB presented shareholders with a plan to continue increasing its charter capital by an additional VND7,500 billion through the private offering of 700 million shares, equivalent to 59.42% of NCB's charter capital, with an offering price of no less than VND10,000/share.

The expected issuance time is from the second to fourth quarter of 2025, after the State Bank approves the capital increase and the State Securities Commission notifies it of receiving the registration dossier for private offering of shares.

After completing the capital increase, NCB will increase its charter capital from the current VND11,780 billion to VND19,280 billion. The entire amount of money raised from the offering, estimated at about VND7,500 billion, will be used to supplement capital for business operations.

Source: https://tuoitre.vn/chu-tich-ncb-tiet-lo-ve-viec-ban-200-trieu-co-phieu-bamboo-airways-20250330192338166.htm

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)