The market fluctuated in the session of November 22 due to the strong differentiation in many stock groups. Investors became more cautious because today was the session of "bottom fishing" goods, the VN-Index fell below the 1,200 point mark.

Foreign investors return to net buying after a month of continuous selling, VN-Index struggles fiercely

The market fluctuated in the session of November 22 due to the strong differentiation in many stock groups. Investors became more cautious because today was the session of "bottom fishing" goods, the VN-Index fell below the 1,200 point mark.

Closing in green after two sessions of recovery, VN-Index traded sideways and ended with a slight decrease. Previously, the market was quite sideways right at the opening. Investor sentiment became more cautious because today was the session where the amount of "bottom-fishing" stocks fell below the 1,200-point mark into accounts. The caution caused strong differentiation among stock groups.

The VN-Index's attempt to increase points also occurred immediately after that, but the increase of the indices could not be maintained for long due to weak demand, causing the general market to lose momentum to increase. However, the VN-Index was still pulled up in the second half of the morning session. However, the developments in the afternoon session were not positive as the differentiation in many stock groups remained strong.

Although the supply of bottom-fishing stocks on November 20 was not too strong, weak demand continued to cause the indices to fall below the reference level. Selling pressure from foreign investors was no longer as strong as in previous sessions, so the general market was not under too much pressure.

At the end of the trading session, VN-Index stood at 1,228.1 points, down 0.23 points (-0.02%). HNX-Index decreased 0.47 points (-0.21%) to 221.29 points. UPCoM-Index increased 0.2 points (0.22%) to 91.7 points.

In the whole market today, there were 338 stocks increasing but there were also 369 stocks decreasing while there were 833 stocks remaining unchanged and not traded. The market recorded 36 stocks increasing to the ceiling and 28 stocks decreasing to the floor. There were not many industry groups attracting attention in today's session when the main trend was strong differentiation.

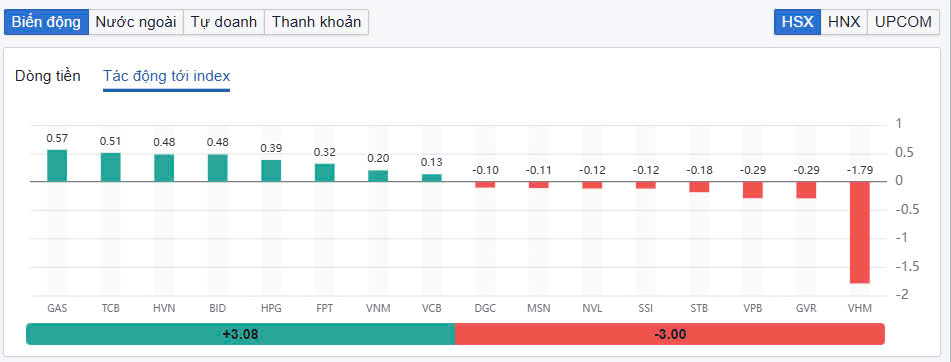

In the VN30 group, 13 stocks increased while 11 stocks decreased. GAS, TCB, BID... were the stocks that had the most positive impact on the VN-Index. Of which, GAS increased early and was the main support for the market. At the end of the session, GAS increased by 1.47% to 69,200 VND/share with a contribution of 0.57 points to the VN-Index. Similarly, TCB also contributed 0.51 points with an increase of 1.29%. TCB had a fairly stable trading session when it maintained a good green color despite the times when the market was under strong pressure.

On the other hand, VHM, GVR, VPB, STB... are the stocks that have the most negative impact on the VN-Index. Of which, VHM fell sharply by 3.9% to VND41,600/share. Vinhomes has closed the largest deal in the history of Vietnam's stock market. Accordingly, this enterprise has purchased a total of 247 million shares with an estimated value of about VND11,000 billion. Previously, the company registered to buy 370 million shares, the volume of unpurchased shares was about 123 million shares.

|

| Top stocks strongly impact VN-Index. |

In addition to the VN30 group, HVN increased by 3.39% and was also one of the stocks with the most positive impact on the VN-Index. It is known that on the afternoon of November 25, the National Assembly will discuss in the hall solutions to continue to remove difficulties caused by the impact of the Covid-19 pandemic so that Vietnam Airlines can recover soon and develop sustainably.

The real estate and securities groups had negative fluctuations when most of them were in red. In the real estate group, DXG decreased by 2.61%, NVL decreased by 2.22%, NTL decreased by 2.15%, CEO decreased by 2.1%. Similarly, in the securities group, BSI decreased by 1.57%, FTS decreased by 1.55%, SHS decreased by 1.52%.

Total trading volume on HoSE today reached 534.4 million shares, equivalent to a trading value of VND12,758 billion, up 4.75% compared to the previous session. Negotiated transactions accounted for VND2,235 billion. Trading values on HNX and UPCoM reached VND813 billion and VND518.8 billion, respectively.

HPG is the stock with the largest trading value today but its value is only 451 billion VND. FPT and VHM traded 390 billion VND and 382 billion VND respectively.

|

| Foreign investors returned to net buying for the first time after more than a month of continuous selling. |

Foreign investors ended their net selling streak by net buying again VND31 billion. In today's session, HDG was the strongest net buyer with VND242 billion. TCB and FPT were net bought VND106 billion and VND60 billion, respectively.

On the other hand, SSI topped the net selling list with VND106 billion. VCB and HPG were net sold VND82 billion and VND58 billion, respectively. Including today's session, the net selling value of foreign investors has reached more than VND92,000 billion, one and a half times the record net selling figure in 2021.

Source: https://baodautu.vn/khoi-ngoai-mua-rong-tro-lai-sau-thang-rong-ra-ban-vn-index-giang-co-quyet-liet-d230707.html

Comment (0)