Mr. Hung mistakenly transferred 450 million VND to a stranger. After more than four months, he still has not been able to get the money back because the recipient refused to pay.

Mr. Nguyen Hung (Long An) said that on March 17, he had to pay the seller for the goods. At that time, it was almost late afternoon, he transferred 450 million VND via Internet Banking from his account opened at Saigon Thuong Tin Bank (Sacombank) to the customer's account at Asia Commercial Bank (ACB).

The transaction was completed, he took a screenshot and sent it, but the partner reported that the name was wrong. "After checking again, I realized that I had mistakenly transferred money to a stranger's account with a similar account number and a different name. Panicked, I ran to the Sacombank and ACB branches in Duc Hoa, Long An to report this mistaken money transfer transaction," he said.

Mr. Hung was recognized by the bank and instructed to report to the police. After two days of verifying the incident, Duc Hoa police went to the ACB branch to request to freeze the money that Mr. Hung had mistakenly transferred. "At that time, the police said that the 450 million VND that I had mistakenly transferred had been withdrawn from the recipient's account by 14 million VND," Mr. Hung said.

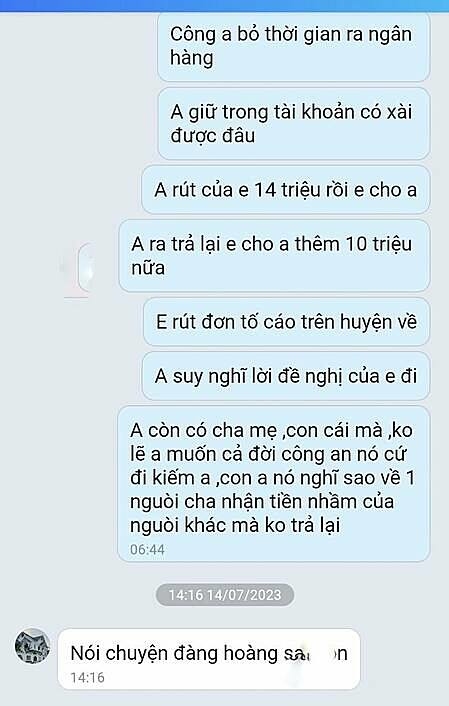

Thanks to the police's support, Mr. Hung got the phone number of the person who received the money and called to negotiate, but this person did not answer the phone. "I texted him that the 14 million VND that had been withdrawn would not be taken back, and offered him another 10 million VND if he agreed to return the money. However, the person who received the money still did not cooperate and texted back that he would bear the consequences of his actions," said Mr. Hung.

One of the messages between Mr. Hung and the recipient of the mistaken money transfer. Photo: Nguyen Hung

Mr. Hung continued to go to Ben Tre police (where the recipient of the money resides) to report and ask for support. When he and the police arrived at the house, the recipient's parents said that their son had gone to Ho Chi Minh City and were still out of reach. After more than 4 months of transferring the money by mistake, Mr. Hung still has not been able to get the money back from the recipient.

Responding to VnExpress , a representative of Long An Provincial Police said they had received the case and were guiding Mr. Hung through the necessary procedures.

ACB Bank also said that it had supported the person who mistakenly transferred money according to regulations, such as contacting the recipient many times but could not reach them. The bank also provided information and cooperated as requested by the police.

Regarding the upcoming handling, this bank said that if the recipient specifies a re-transfer or the court (in case Mr. Hung files a lawsuit) or the police agency makes a decision, ACB will immediately carry out the transaction to refund the money to Mr. Hung's account.

This process is in accordance with the law to avoid cases of intentional fraud, especially in commercial fraud. For example, after the seller confirms that he has received the money and delivered the goods, the buyer can commit fraud by reporting the bank to have transferred the money by mistake and asking the bank to refund the money. In addition, many scammers now often use the trick of transferring money to the wrong account to trick usury or steal personal information to appropriate money in the account...

OTP code sent to account holder's phone number when making online money transfer transactions on banking applications. Photo: Quynh Trang

Regarding the above incident, lawyer Luong Huy Ha, Director of LawKey Law Firm, said that after trying to approach and negotiate with the mistaken recipient but they deliberately did not return it, Mr. Hung can choose one of two legal options: report to the police at his permanent or temporary residence or file a civil lawsuit.

For an amount of money mistakenly transferred from VND10 million or more, the sender can file a criminal complaint with the police due to signs of illegal possession of property according to the 2015 Penal Code. Accordingly, a person who mistakenly receives money and intentionally illegally holds an amount from VND10 million to VND200 million after the sender or the police agency requests payment will be fined from VND10 million to VND50 million or sentenced to non-custodial reform for up to 2 years, or imprisoned from 3 months to 2 years. For an amount over VND200 million, the person illegally holding it can be imprisoned from 1 to 5 years, the lawyer said.

In addition, the lawyer said that Mr. Hung can also file a civil lawsuit in the Court where the defendant, the recipient of the money, resides.

Not only Mr. Hung, transferring money by mistake also often happens to many account holders when making online transactions. Banking experts said there were many cases of customers transferring money to strangers but having difficulty getting it back for many reasons such as not being able to contact the recipient, the recipient's account being abandoned or they were not willing to return the money.

Quynh Trang - Hoang Nam

*Character names have been changed upon request

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)