VN-Index continued to regain the 1,200 point mark after losing it yesterday. A series of stock groups recovered strongly despite a decline in liquidity.

Contrary to what investors feared after the panic session at the beginning of the week, the stock market had a relatively positive performance when it closed above 1,200 points. The indices were all pulled above the reference level right from the beginning of the trading session when a series of stock groups stopped falling and started to recover.

At times, selling pressure continued to be pushed to a high level, causing some concerns to return, and the indices also "lost steam". At times, the VN-Index fell below the reference level. However, demand quickly appeared and helped the general market recover. The VN-Index and HNX-Index then both remained above the reference level until the end of the session. The 1,200-point mark is still a good support level for the market and the VN-Index continued to regain this level after losing it yesterday.

The market focus today is on the group of securities stocks. Unlike the previous session when only a few small stocks recovered, in today's session, most securities stocks performed positively. BSI was pulled up to the ceiling price. BVS increased by 6.9%, FTS increased by 6.9%, FTS increased by 6.7%. Large securities stocks such as HCM increased by 5.65%, SSI increased by 3.38%, VCI increased by 5.4%.

The real estate stock group also recorded many stocks recovering, DXG increased by 5.7%, CEO increased by 4.5%, NLG increased by 3.7%.

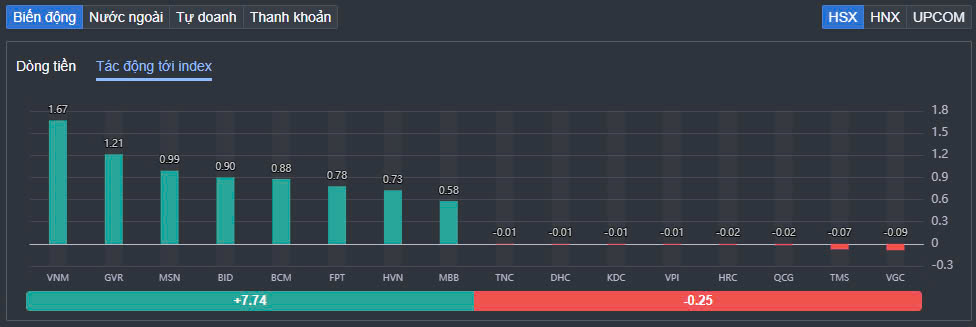

In the VN30 group today, there were no stocks that decreased in price and only 2 stocks that were referenced, TCB and VIC. Meanwhile, VNM increased by 4.76% and was the stock that had the best impact on the VN-Index, contributing 1.67 points. GVR increased by 4.15% and contributed 1.21 points. MSN, after being sold off heavily at the end of yesterday's session, also recovered and increased by 3.8%, contributing 0.99 points to the VN-Index.

On the other hand, stocks that negatively impacted the VN-Index were mostly small and mid-cap stocks. VGC fell sharply by nearly 2% and was the stock with the worst impact on the VN-Index, taking away 0.09 points. The next stocks with negative impacts were TMS, QCG, VPI, etc.

|

| Vinamilk shares contributed the most to the recovery session of VN-Index. |

HBC shares attracted attention when they increased by 5.65% after the news that Mr. Le Viet Hung, the brother of HBC Chairman Le Viet Hai and also a senior advisor of Hoa Binh Construction, had just registered to buy 500,000 HBC shares from August 8 to September 6, 2024 for the reason of supplementing the investment portfolio. Previously, the Group received information about the compulsory delisting decision from the Ho Chi Minh City Stock Exchange due to the undistributed profit after tax as of December 31, 2023 being negative VND 3,240 billion, exceeding the company's actual contributed charter capital of VND 2,741 billion.

At the same time, HBC continued to send a written response to HoSE, affirming that it did not agree with the grounds HoSE applied to consider mandatory delisting of HBC shares. Hoa Binh hopes that HoSE will consider and weigh before making a decision to delist the company's shares.

At the end of the trading session, VN-Index increased by 22.21 points (1.87%) to 1,210.28 points. The entire floor had 383 stocks increasing, 58 stocks decreasing and 49 stocks remaining unchanged. HNX-Index increased by 3.75 points (1.68%) to 226.46 points. The entire floor had 128 stocks increasing, 56 stocks decreasing and 41 stocks remaining unchanged. UPCoM-Index increased by 1.43 points (1.58%) to 92.22 points.

Total trading volume on HoSE reached 688.8 million shares, down 33% compared to the previous session, equivalent to a trading value of VND16,356 billion, of which negotiated transactions accounted for more than VND2,500 billion. Trading value on HNX and UPCoM reached VND1,186 billion and VND540 billion, respectively.

|

| Foreign investors net sold in the session of August 6. |

Foreign investors net sold 730 billion VND on HoSE alone in today's session. VJC was the most net sold by foreign investors with about 357 billion VND and most of it was done through agreements. Besides, FPT was also net sold 114 billion VND. In the opposite direction, VNM was the most net bought with 205 billion VND. MSN and HVN were net bought 42 billion VND and 39 billion VND respectively.

Source: https://baodautu.vn/hoi-phuc-sau-phien-hoang-loan-vn-index-lai-vuot-1200-diem-d221776.html

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)