Gold price today October 12, 2024, accelerated again after 6 sessions of decline. Although the price increase of gold over the past year has been impressive, the precious metal has only just begun a new price increase cycle.

[WIDGET_GOLD_RATE:::SJC:]

Update gold price today October 12, 2024

World gold prices fluctuate at a high level of around 2,640 USD/ounce.

Although the global gold market is struggling to attract new bullish momentum after a recent consecutive price increase, according to a market analyst, this price increase is not over yet.

According to the World & Vietnam Newspaper , the international gold price traded on Kitco News , at 6:15 p.m. on October 11 (Hanoi time), was at 2,639.90 - 2,640.90 USD/ounce , up 10 USD/ounce compared to the previous trading session and continued to increase sharply compared to the same time yesterday.

Gold has once again proven its traditional safe haven value, with no alternative asset class to replace it. Amid a sharp decline in stocks and cryptocurrencies, the yellow metal has risen above concerns about inflation and interest rates to record a gain of 0.85% and trade around a new high of $2,650 per ounce on the spot market.

Analysts at Secure Digital Markets noted that the broader risk-on environment, including cryptocurrencies and stocks, came under pressure after U.S. economic indicators showed persistent inflation and rising unemployment. Specifically, the U.S. Consumer Price Index in September rose 2.4% year-on-year, exceeding the forecast of 2.3%. This changed market expectations, raising the probability of a 25 basis point rate cut in November to 86% from just 80% the day before. Expectations for a rate cut in December also increased to 88% from 79%.

Additionally, hotter-than-expected inflation could strengthen the case against further rate cuts. The odds of no rate cut in November have also increased, with the CME FedWatch Tool showing a 17% chance of the Fed holding rates steady next month.

Although the gold market is struggling to attract new bullish momentum after its recent rally, according to one market analyst, the rally is not over yet. The long-term outlook for gold prices remains bullish, but a strong breakout is unlikely.

Domestic gold prices increased for gold rings.

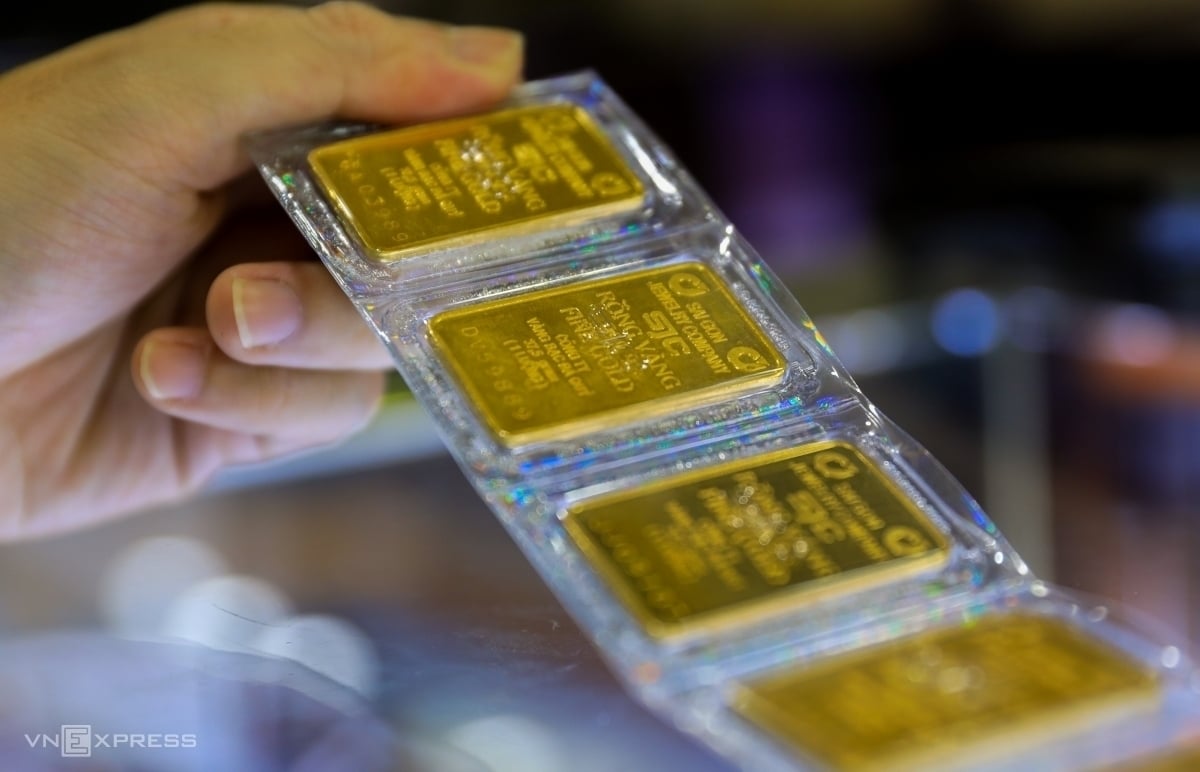

The price of SJC gold bars remains at 82.5 - 84.5 million VND/tael (buy - sell) at major trading brands such as Saigon Jewelry Company, DOJI Group, Phu Quy and Bao Tin Minh Chau...

The price of 9999 round smooth gold rings increased again following the increase of the world market.

At Saigon Jewelry Company, the price of gold rings is traded at 81.5 - 82.9 million VND/tael, an increase of 100,000 VND/tael. Bao Tin Minh Chau Company listed the selling price of gold rings at 82.2 - 83.18 million VND/tael, a decrease of 400,000 VND/tael compared to the beginning of the week; DOJI Group traded the selling price of 9999 gold rings at 82.3 - 83.2 million VND/tael, a decrease of 400,000 VND/tael for selling and 420,000 VND/tael for buying compared to the beginning of the week.

Converted according to the USD exchange rate listed at Vietcombank, the world gold price is equivalent to 79.91 million VND/tael, the price of SJC gold bars is 4.59 million VND/tael higher, while the price of gold rings is 3 million VND/tael higher.

|

| Gold price today October 12, 2024: Gold price, proof of 'absolute safety' - precious metal shines again, the $3,000 mark is not far away. (Source: Kitco) |

Summary of SJC gold bar prices at major domestic trading brands at closing times of trading session on the afternoon of October 11:

Saigon Jewelry Company: SJC gold bars 82.5 - 84.5 million VND/tael; SJC gold rings 81.5 - 82.9 million VND/tael.

Doji Group: SJC gold bars 82.5 - 84.5 million VND/tael; 9999 round rings (Hung Thinh Vuong) 82.3 - 83.2 million VND/tael.

PNJ system: SJC gold bars 82.5 - 84.5 million VND/tael; PNJ 999.9 plain gold rings: 81.8 - 82.9 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars 82.5 - 84.5 million VND/tael; Phu Quy 999.9 round gold rings: 81.95 - 82.90 million VND/tael.

The price of SJC gold at Bao Tin Minh Chau is listed at 82.5 - 84.5 million VND/tael. The price of round gold rings at Vang Rong Thang Long is listed at 82.2 - 83.18 million VND/tael.

Will world gold price reach 3,000 USD?

“Gold prices will hit $3,000 as the market faces a major turnaround,” Chantelle Schieven, Head of Research at Capitalight Research, highlighted the unprecedented level of gold prices, in a recent interview with Kitco News.

He noted that while a slower pace of rate cuts could continue to weigh on gold in the near term as investors adjust their market expectations, geopolitical uncertainty continues to support the precious metal.

Geopolitical uncertainty has been a major factor in gold’s nearly 30% rally this year, Schieven said. However, she added that the safe-haven premium remains low as investors are only just starting to focus on specific hotspots, primarily the escalating conflict in the Middle East, where Israeli strikes on Hezbollah prompted Iran to fire a barrage of ballistic missiles.

Rising geopolitical tensions could easily push gold prices up another 10% as a safe-haven asset. In that scenario, $3,000 an ounce is not far away.

However, the expert noted, “if we see an escalation of conflict in the Middle East, I suspect we will see gold prices rise to $3,000 an ounce before the end of the year. But we could also see that 10% increase fall right back if tensions ease.”

Looking beyond short-term volatility, Schieven said gold remains well supported as long-term factors come into focus. She described gold’s potential as something that can transform markets.

“Some of the factors that we see impacting the gold market today are factors that we started tracking and discussing 16 years ago,” said Schieven.

“We always look at issues like rising debt as a long-term factor, but at some point the long term becomes a concern of today. All the little things that we have seen happen over the last two years are now starting to add up and that is why gold is moving higher.”

While gold's rally over the past year has been impressive, the precious metal is just starting a new bull cycle, Schieven said. "We haven't reached the peak of this gold cycle yet. We haven't even reached the euphoria stage where prices can really go up," she said.

Chantelle Schieven made it clear that she remains bullish on the long-term outlook as it is difficult to see how the current supportive environment will change. She pointed out that even if the Russia-Ukraine conflict ends, there will still be significant distrust between Western and Eastern countries. This distrust will continue to weaken the USD as countries develop new trade agreements and diversify away from the USD.

"The world is moving away from globalization. The US dollar is not going away, but its role is weakening and as countries look for alternatives, they will continue to buy more gold," said Head of Research at Capitalight Research.

Source: https://baoquocte.vn/gia-vang-hom-nay-12102024-gia-vang-thu-attracts-dong-luc-tang-moi-chu-ky-len-gia-lai-bat-dau-moc-3000-usd-khong-con-xa-289696.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)