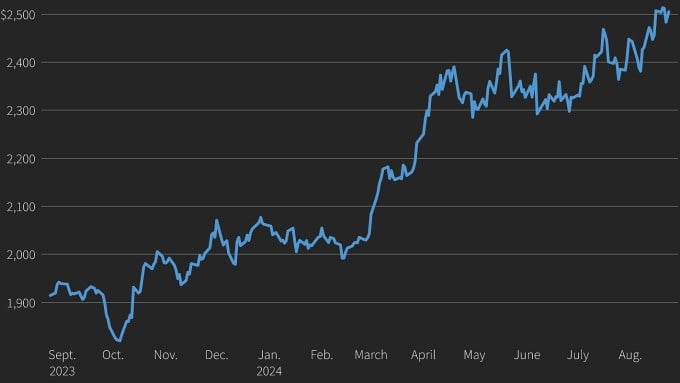

At the close of trading on August 23, the world spot gold price increased by nearly 28 USD to 2,512 USD per ounce. The reason was the decrease in USD and US government bond yields, after comments hinting at a September interest rate cut by US Federal Reserve (Fed) Chairman Jerome Powell.

In a speech at the Jackson Hole conference yesterday, Powell said it was "time" for the Fed to cut interest rates and that inflation was approaching its 2% target. This was his clearest statement yet on easing monetary policy.

The Dollar Index, which measures the greenback against a basket of major currencies, fell 0.8% following the news. The yield on 10-year US government bonds also fell, making gold more attractive to buyers outside the US.

"Markets have reacted to Powell's speech. He was vague but somewhat open about the timing of policy adjustments. Gold prices will continue to rise ahead of the September Fed meeting. We will see how many rate cuts there are this year," said Tai Wong, a precious metals trader in New York. Gold prices typically benefit in a low-interest-rate environment because the precious metal does not pay fixed interest.

Bart Melek, head of commodity strategy at TD Securities, said that in the short term, gold could see some more selling and profit-taking. "But in the long term, the market will do well because the Fed is not worried about inflation and will try to keep the labor market from deteriorating," he said.

Investors are now betting on a 60% chance of the Fed cutting rates by 25 basis points (0.25%) in September. The probability of a 50 basis point cut is 40%.

US stocks also rose yesterday after Powell's speech. The S&P 500 rose 1.1%. The DJIA rose 1.1% and the Nasdaq Composite rose 1.47%. Technology stocks have benefited in particular from low interest rates. Nvidia and Tesla both rose more than 4% on Friday.

TB (according to VnExpress)Source: https://baohaiduong.vn/gia-vang-the-gioi-quay-dau-tang-manh-391145.html

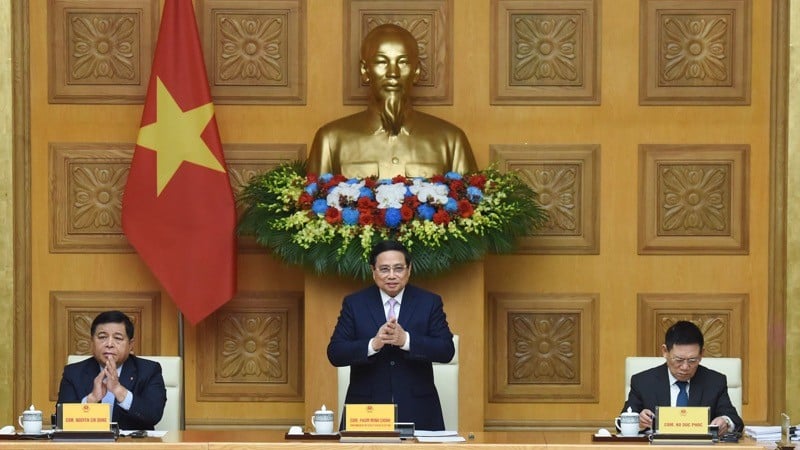

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)