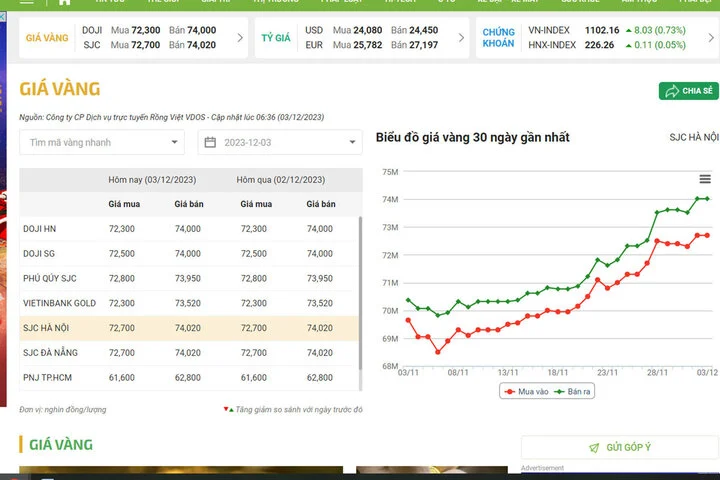

After a day of downward adjustment, on the morning of December 3, domestic gold prices turned around and increased strongly again with the highest increase of 500,000 VND/tael.

Currently, the gold bar prices of the brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang is listed at 72.7 million VND/tael for buying and 74.02 million VND/tael for selling.

In Ho Chi Minh City, SJC gold is still being bought at the same price as in Hanoi and Da Nang but sold at 20,000 VND lower.

The highest domestic gold selling price at 6:30 this morning was 74 million VND/tael.

Thus, compared to early this morning, SJC gold price has been adjusted up 400,000 VND for buying and 500,000 VND for selling.

DOJI in Hanoi kept the buying price the same as yesterday morning at 72.3 million VND/tael but adjusted the selling price up 500,000 VND to 74 million VND/tael.

In Ho Chi Minh City, this brand of gold is being bought at a higher price of VND200,000 but sold at the same price as in Hanoi, up VND150,000 for buying and VND500,000 for selling.

Phu Quy SJC is buying gold bars at 72.8 million VND/tael and selling at 73.95 million VND/tael, an increase of 400,000 VND in buying price and 450,000 VND in selling price compared to early this morning.

PNJ gold bar price is listed at 72.7 million VND/tael for buying and 73.9 million VND/tael for selling, an increase of 300,000 VND in both directions. Meanwhile, Bao Tin Minh Chau adjusted the price up by 480,000 VND in buying and 470,000 VND in selling to 72.9 million VND/tael and 73.95 million VND/tael, respectively.

World gold price today

According to Kitco, the world gold price recorded at 6:30 a.m. today, Vietnam time, was at 2,071.880 USD/ounce.

Converted at the current exchange rate at Vietcombank, the world gold price is about 59.943 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is still 12.757 million VND/tael higher than the international gold price.

Gold prices continue to rise sharply. (Illustration photo).

World gold price closed the trading week at 2,071.8 USD/ounce, higher than the old record recorded in 2020.

The precious metal hit a record high after comments from Jerome Powell, chairman of the US Federal Reserve (FED). The comments from the FED chairman came less than two weeks before the last policy meeting of the year.

In this statement, although it was noted that it was too early for the market to be confident that the FED would cut interest rates and that the policy was currently in a tightening range, the FED had completed raising interest rates and was preparing to move towards monetary easing next year.

With the news released at the end of the trading week, the financial market speculated that the US had completed its interest rate hike and reacted favorably to gold prices. Experts said that gold had a strong recovery before Christmas and it is entirely possible to expect this precious metal to continue to increase from now until the end of this year.

This could be the start of a bigger move for gold with “bright days ahead,” said Naeem Aslam, chief investment officer at Zaye Capital Markets.

“We believe that the Fed has reached the peak of its rate hike cycle. There is a realistic chance that the Fed will cut rates by the end of the first quarter of next year. However, the threat remains persistent inflation. If we do not see CPI fluctuating at 3% or even lower, the Fed may keep rates at current levels until the end of the first half of the year,” said Naeem Aslam.

Gold Price Forecast

The latest Kitco News Weekly Gold Survey shows that both analysts and retail investors remain bullish on gold in the near term, with 53% of Wall Street analysts and 65% of retail investors expecting gold to rise next week.

The impending rate cut and the retreat in the US dollar will support the yellow metal’s near-term rally, said Forexlive.com currency strategist Adam Button, adding that seasonal factors this month are also driving gold higher.

Gainesville Coins market analyst Everett Millman also believes that gold is being supported by strong seasonal factors. Millman cited that for the past six years, gold has always increased during Christmas. “I don’t see that being any different, even though the price is really at the top of the range,” he said.

However, the expert said what is really driving gold prices now is the recent shift in Fed interest rate expectations, triggered by comments from Fed Governor Waller earlier this week that he sees inflation trending down.

From a technical perspective, senior analyst Jim Wyckoff said that gold remains in an uptrend and the upward momentum will continue next week.

Still, some are cautious about gold’s performance next week. Marc Chandler, CEO of Bannockburn Global Forex, said the market may be pricing in a rate cut too early.

“I think a solid jobs report next Friday could push gold back to $2,006 an ounce and then $1,992 an ounce,” Chandler said.

According to VTC News

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)