Domestic gold prices continue to rise, approaching the 71 million VND/tael mark. At the end of the trading session on November 17, Saigon Jewelry Company listed the price of SJC gold at 69.95 - 70.77 million VND/tael, an increase of 200,000 VND/tael compared to the previous trading session.

The price of gold rings has fluctuated impressively. Compared to the beginning of the year, the price of gold rings has continuously increased sharply, with an increase of more than 4 million VND/tael.

At the end of the session on November 17, the price of gold rings was listed by Bao Tin Minh Chau Company Limited at 59.38 million VND/tael (buy) and 60.33 million VND/tael (sell).

At Saigon Jewelry Company, the price of 1-5 tael gold rings is listed at only VND59.1 million/tael (buy) and VND60.2 million/tael (sell). Meanwhile, Doji Jewelry Group is listing the price at VND59.15 - 60.1 million/tael, respectively.

Phu Nhuan Jewelry Company (PNJ) traded gold rings at a lower price but also reached 60 million VND/tael for selling and 58.95 million VND/tael for buying.

World gold prices quickly jumped to a two-week high after US Treasury bond yields fell, amid investors' increased expectations that the US Federal Reserve (Fed) has completed its interest rate hike cycle and will cut interest rates in the first quarter of next year.

According to CME Group data, the Fed is likely to cut interest rates first in May 2024, then in July and two more times before the end of 2024. If so, the Fed's benchmark interest rate will fall to a range of 4.25 - 4.5%.

According to TG&VN at 7:00 p.m. on November 17, the world gold price on the Kitco exchange was at 1,990 - 1,991 USD/ounce, up 9.2 USD compared to the previous session.

The Philadelphia Fed said manufacturing data was better than expected. Gold markets had little reaction to the data. Investors focused more on easing inflation pressures and growing weakness in the U.S. labor market.

Inflationary pressures in the US are easing, according to newly released economic data. The US consumer price index (CPI) was unchanged in October 2023. The US producer price index (PPI) also fell the most in three years in October.

The Fed previously decided to keep its benchmark interest rate unchanged. However, US policymakers left open the possibility of a rate hike later this year and tighter monetary policy through 2024. Investors remain concerned about a series of short-term risks that could make a soft landing in the economy unlikely.

The US House of Representatives has passed a temporary spending bill to avert a government shutdown, with broad support from lawmakers.

|

| Gold price today November 18, 2023: Gold ring price sets new peak, world 'climbs', series of good signals 'arrive' in the market. (Source: Bloomberg) |

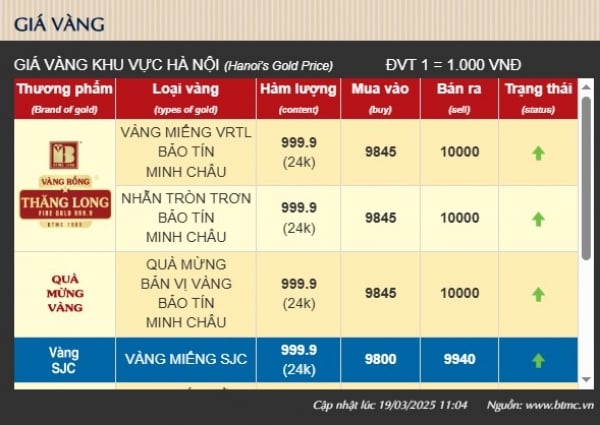

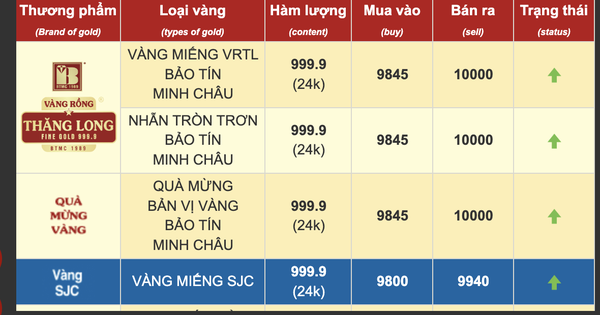

Summary of SJC gold prices at major domestic trading brands at the closing time of November 17:

Saigon Jewelry Company listed the price of SJC gold at 69.95 - 70.77 million VND/tael.

Doji Group currently lists SJC gold price at: 69.95 - 70.75 million VND/tael.

Phu Quy Group listed at: 70.00 - 70.80 million VND/tael.

PNJ system listed at: 69.95 - 70.75 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 70.00 - 70.73 million VND/tael; Rong Thang Long gold brand is traded at 59.41 - 60.36 million VND/tael; jewelry gold price is traded at 58.95 - 60.15 million VND/tael.

Will gold prices rise to $2,200?

In his latest research report, John Ing, President and CEO of Maison Placements Canada, predicts that gold prices will rise to $2,200/ounce.

This expert believes that rising inflation, de-dollarization, rising geopolitical risks, global debt and the rise of populism are good signals for precious metals.

The biggest factor behind most global economic threats, he said, is the growing debt problem in the United States. Mr. Ing noted that since 2008, the supply of Treasury bonds has increased fivefold to more than $25 trillion. This fiscal year saw deficit spending in the United States increase by $1.7 trillion, pushing the debt past $33 trillion.

“America is facing a debt,” he warned.

In addition, signs of slowing inflation have prompted investors to bet that the Fed is done raising interest rates. Lower interest rates increase the appeal of non-interest-bearing assets such as gold.

Saxo Bank commodity strategist Ole Hansen also sees gold maintaining its recent strong gains as long as prices stay above $1,930 an ounce.

"The prospect of lower interest rates and demand from central banks should be strong enough to counter any short-term strength in economic data. The year-end rally in equity markets could dampen demand for gold, but we remain fundamentally bullish on gold," said Ole Hansen.

Source

Comment (0)