Gold price today June 23, 2024, SJC gold price this week is stable, while gold ring price falls. The world market is "fluctuating". Analysts have mixed opinions, optimistic sentiment still prevails in the context of geopolitical tension.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 6/23 AND EXCHANGE RATE TODAY 6/23

| 1. SJC - Updated: 06/21/2024 08:24 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 74,980 | 76,980 |

| SJC 5c | 74,980 | 77,000 |

| SJC 2c, 1c, 5 phan | 74,980 | 77,010 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 73,750 | 75,350 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 73,750 | 75,450 |

| Jewelry 99.99% | 73,650 | 74,650 |

| Jewelry 99% | 71,911 | 73,911 |

| Jewelry 68% | 48,417 | 50,917 |

| Jewelry 41.7% | 28,782 | 31,282 |

Update gold price today June 23, 2024

Domestic gold prices were stable last week.

On the morning of June 17, the price of SJC gold bars continued to maintain stability with a selling price of 76.98 million VND/tael, unchanged from the selling price in the previous days. Saigon Jewelry Company (SJC) listed the price of SJC gold at 74.98 - 76.98 million VND/tael (buy - sell), stable compared to the closing price on the afternoon of June 16.

Throughout this week, the price of SJC gold bars has always remained at 74.98 - 76.98 million VND/tael (buy - sell).

On the weekend morning of June 22, the price of plain gold rings at stores all dropped sharply compared to yesterday, a decrease of about 300-500 thousand VND/tael. Previously, on June 21, this type of gold increased by about 700-800 thousand VND/tael.

Specifically, at 9:30 a.m. at SJC Company, the listed price of 24k gold rings was 73.75-75.45 million VND/tael, down 500,000 VND/tael compared to the end of yesterday. DOJI adjusted slightly, down 300,000 VND/tael to 74.7-76.05 million VND/tael. Similarly, PNJ also decreased 500,000 VND/tael to 73.95-75.65 million VND/tael.

According to The Gioi & Viet Nam Newspaper , at 10:38 a.m. on June 22 (Vietnam time), the world gold price at goldprice.org was at 2,320.79 USD/ounce, down 40.22 USD/ounce compared to the previous trading session.

|

| Gold price today June 23, 2024: Gold ring price suddenly 'turns around', world investors 'get scared', this is the reason why optimism still prevails. (Source: Kitco News) |

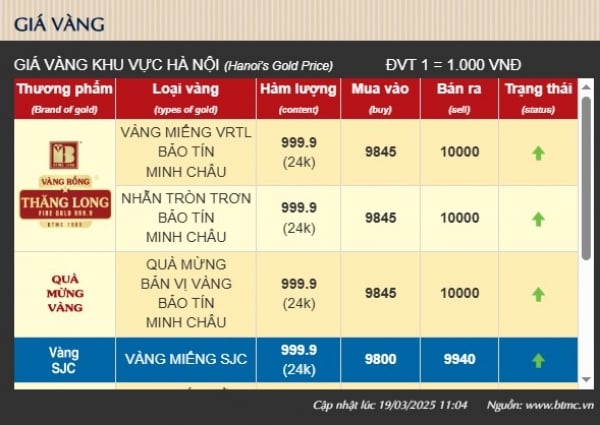

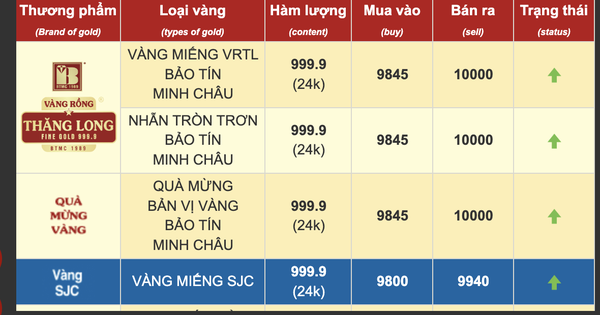

Summary of SJC gold prices at major domestic trading brands at the closing time of June 22:

Saigon Jewelry Company listed at 74.98 - 76.98 million VND/tael.

Doji Group is currently listed at: 74.98 - 76.98 million VND/tael.

PNJ system listed at: 74.98 - 76.98 million VND/tael.

Phu Quy Gold and Silver Group listed at 75.5 - 76.98 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 75.5 - 76.98 million VND/tael; Rong Thang Long gold brand is traded at 74.68 - 75.98 million VND/tael; jewelry gold price is traded at 73.80 - 75.70 million VND/tael.

Converted according to the USD price at Vietcombank on June 22, 1 USD = 25,468 VND, the world gold price is equivalent to 72.21 million VND/tael, 4.77 million VND/tael lower than the selling price of SJC gold.

World gold price "jumps"

The global gold market this week saw one of the least dramatic weeks in the past five weeks, but as has been the case recently, it left some “heart-stopping” moments for market participants heading into the weekend.

World gold prices fluctuated this week, influenced by the health of the US dollar and the latest US economic data.

After rising more than 1% and hitting a two-week high in the trading session on June 20, thanks to expectations that the US Federal Reserve (Fed) will cut interest rates this year, gold prices turned lower in the trading session this weekend.

Specifically, spot gold prices fell 1.7% in the last session of this week, down to 2,319.95 USD/ounce. Meanwhile, US gold futures prices fell 1.6%, down to 2,331.20 USD/ounce.

The dollar rose 0.2% to its highest in more than seven weeks, making gold more expensive for holders of other currencies, while 10-year U.S. Treasury yields rose after fresh U.S. economic data.

According to the CME FedWatch tool, investors now see a 63% chance that the Fed will cut rates by September 2024. Lower interest rates reduce the opportunity cost of holding the non-yielding precious metal.

Contradictory psychology

The latest Kitco News weekly gold survey shows that industry experts are indecisive on gold's near-term path, while retail sentiment remains positive.

Marc Chandler , CEO at Bannockburn Global Forex, sees geopolitics pushing bullion prices higher next week.

“US interest rates remain low and although Mexico’s president-elect has appointed a number of market-friendly cabinet ministers, political tensions continue to run high in Europe (EU and UK). And we note rising tensions between China and the Philippines,” he said.

“The yellow metal is testing the 2,368 area and a move higher could be towards 2,388-2,390,” he said.

Meanwhile, Adrian Day , chairman of Adrian Day Asset Management, took the opposite view. He said: “Gold is currently in a short-term trading range and after last week’s rally, it could turn lower next week. The market is in a holding pattern, looking for news on continued Chinese gold purchases as well as clarity on US inflation and employment, which will provide insight into the timing of a rate cut.”

However, Darin Newsom , Senior Market Analyst at Barchart.com, sees gold prices trending higher next week.

“A short-term uptrend for August has emerged on the daily chart of the contract, with August hitting a new four-day high of $2,5379.50 on Thursday. While early next week may see renewed mild selling interest, the contract should be higher again by next Friday,” Newsom wrote.

Analysts at CPM Group also predict higher gold prices in the next week or two.

“A range of political, economic and financial market issues could push gold higher, to $2,400 if not $2,450 over the period. A stronger US dollar is unlikely to be a negative for gold,” they said.

“However, the surge is likely to be short-lived and will dissipate after the first week of July,” analysts warned.

This week, 14 Wall Street analysts participated in the Kitco News Gold Survey, and their responses were a perfect balance of ambivalence and uncertainty on the precious metal’s near-term outlook. Five experts, or 62%, expect gold prices to rise next week, while an equal number of analysts predict prices will fall. The remaining four, or 28%, expect gold to trade sideways next week.

Meanwhile, 209 votes were cast in Kitco’s online poll, with Main Street investors remaining bullish on the yellow metal. 114 retail traders, or 55%, predict gold prices will rise next week. Another 38%, or 18%, predict the yellow metal will trade lower, while 57 respondents, or 27%, see prices moving sideways next week.

Gold appears to be in the doldrums for the summer, but there is a lot going on beneath the surface, said Daniel Pavilonis, senior commodities broker at RJO Futures.

“Basically everywhere you look, on the issue of de-dollarization, interest rates, debt, political uncertainty, I still think that is very positive for gold. But maybe there is a little pause here,” he said.

On Friday's slide in gold, Pavilonis said he thinks the Fed's hawkish comments may have been to blame.

And Kitco Senior Analyst Jim Wyckoff said traders appear to be looking to buy next week.

“Short-term technicals have turned more bullish for gold and silver this week, which is inviting chart-based speculators to buy into the market,” he said.

Source: https://baoquocte.vn/gia-vang-hom-nay-2362024-gia-vang-nhan-bat-ngo-quay-xe-nha-dau-tu-the-gioi-thot-tim-day-la-ly-do-khien-tam-ly-lac-quan-van-bao-trum-275747.html

Comment (0)