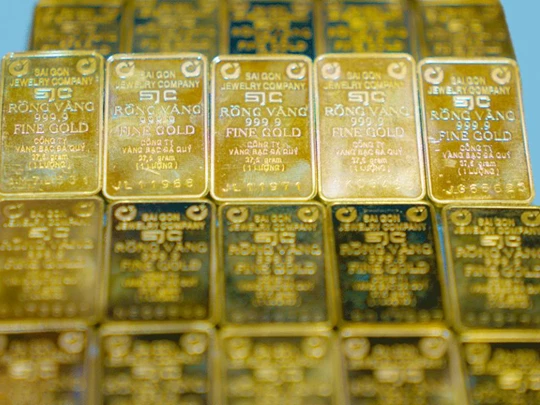

At the end of the session on March 15, the price of gold bars at SJC closed at 94.3-95.8 million VND/tael (buy - sell).

The price of 1-5 chi SJC gold rings is listed at 94.2-95.7 million VND/tael (buy - sell).

Meanwhile, the price of 9999 gold rings at Doji closed the session at 94.9-96.3 million VND/tael.

Today's gold price on Kitco closed the trading week at $2,984/ounce. Gold futures for April 2025 delivery on the Comex New York floor traded at $3,001/ounce.

The world gold market ended the week on a high note when the gold price officially reached a new record high of over 3,000 USD/ounce. Although it decreased after reaching a new peak, analysts still expect the gold price to continue to increase in the coming time. On a weekly basis, the world spot gold price increased by 2.5%.

The US Department of Labor reported that the consumer price index (CPI) in February increased 0.2% month-on-month and increased 2.8% year-on-year.

The core CPI, which excludes energy and food prices, rose 0.2% from January 2025 and increased 3.1% from the same period last year. This is an important inflation measure of the US Federal Reserve (Fed).

Another important indicator is the Producer Price Index (PPI) for February. The US Bureau of Labor Statistics announced that the PPI increased 3.2% year-over-year in February, lower than the previous month's 3.7% and lower than the FactSet forecast of 3.3%.

Core PPI - excluding volatile food and energy prices - fell 0.1% from January, while the previous month rose 0.5% and forecasts were for a 0.3% increase.

The PPI report showed the US economy is cooling. Many traders are betting on the possibility that the Fed will cut interest rates or cut sooner than expected.

While gold is trading near an all-time high, the stock market is in correction territory. The S&P 500 ended the week down 2.4%. The index is down more than 5% this year. Meanwhile, gold prices are up nearly 13%.

The US economic reports come at a crucial time for the US economy and financial markets as trade tensions escalate over US President Donald Trump's tariff policies.

President Trump has shifted his stance on tariffs, imposing and then delaying tariffs on Canada and Mexico and raising tariffs on Chinese goods, roiling global markets. China and Canada have retaliated with their own tariffs, adding to economic uncertainty.

Ongoing geopolitical uncertainty continues to support gold as an important safe-haven asset.

Gold Price Forecast

Gold prices are in a strong uptrend, said Jesse Colombo, an independent precious metals analyst. Weaker equity markets could continue to support gold’s gains.

“The rotation of capital from stocks to gold has just begun, which will create momentum for gold prices for many years to come,” he said.

Gold's historical role as a safe haven makes it popular amid geopolitical tensions and economic uncertainty, said Alex Tsepaev, chief strategist at B2prime Group.

Inflows into gold funds have been growing due to concerns about potential disruptions in global trade as tariff disputes escalate, as well as ongoing conflicts.

Kevin Grady, president of Phoenix Futures and Options, said that while $3,000 an ounce is an important psychological level, traders need to know who is buying and who is selling.

Central banks will continue to buy. Poland has significantly increased its central bank gold holdings. Türkiye and even China have increased their purchases again. It is not only central banks and institutions that are buying gold, investors are also buying gold.

Gold prices are expected to decline slightly after surpassing the $3,000/ounce threshold, according to Marc Chandler, managing director at Bannockburn Global Forex.

Source: https://archive.vietnam.vn/gia-vang-hom-nay-16-3-2025-cao-nhat-moi-thoi-dai-nhan-va-sjc-tang-vot-len-dinh/

Comment (0)