Gold price today March 18, 2025 on the international market increased again due to the demand for safe haven due to concerns about trade war. SJC gold continued to increase vertically, plain rings approaching 97 million VND/tael.

The price of gold on the Kitco floor at 8:30 p.m. (March 17, Vietnam time) was trading at $2,987.9/ounce, up 0.09% from the beginning of the session. The price of gold futures for delivery in April 2025 on the Comex New York floor was trading at $3,004.5/ounce.

At the beginning of the trading session on March 17 (US time), the world gold price increased slightly. The precious metal market continued to be strengthened by the demand for safe havens amid growing concerns about the global trade war.

Despite US President Donald Trump's efforts to ease trade war tensions and present a clearer plan, concerns in the precious metals market remain, according to Adrian Day, chairman of Adrian Day Asset Management.

However, Mr. Adrian Day commented that central banks will continue to buy gold and this is the factor that pushes gold above the threshold of 3,000 USD/ounce.

Meanwhile, Sean Lusk - co-director of commercial insurance at Walsh Trading - said that precious metal prices could fluctuate in both directions, both up and down, in the short term, because gold prices are strongly affected by daily news.

Neither fundamentals nor technicals are important right now, according to Darin Newsom, senior market analyst at Barchart.com. Gold remains a safe haven amid global economic and political uncertainty.

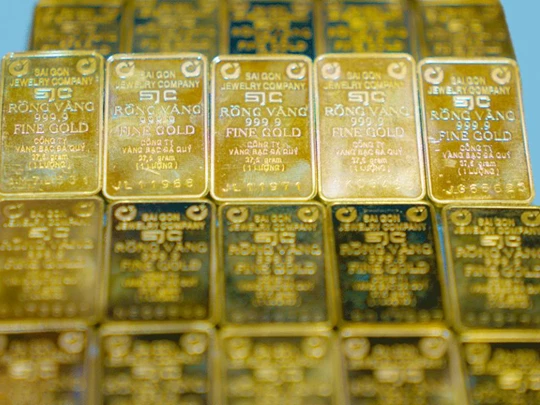

At the end of the session on March 17, the price of gold bars at SJC closed at 94.8-96.1 million VND/tael (buy - sell), an increase of 500 thousand VND per tael for buying and 300 thousand VND per tael more expensive for selling compared to the closing price last week.

Meanwhile, SJC gold rings were listed at 94.7-96 million VND/tael (buy - sell), an increase similar to that of gold bars. Doji gold rings were priced at 95.1-96.6 million VND/tael, an increase of 200,000 VND (buy) and 300,000 VND (sell) per tael compared to the closing price last week.

Particularly at Bao Tin Minh Chau gold brand, the price of SJC gold and plain rings is listed at 92.5-96.8 million VND/tael - an unprecedented high.

Gold Price Forecast

Experts say that while the factors driving long-term gains in gold remain intact, there are still some risks in the current environment with gold prices at such high levels.

Accordingly, gold prices may face some difficulties. The market is about to enter the end of the first quarter, investors will have a profit-taking mentality when gold is anchored at a historical peak. Investors holding gold are at risk.

CPM Group analysts note that profit-taking could push prices down to $2,980 an ounce in the next few days, but maintaining a long-term position is reasonable as major economic and political uncertainties remain.

Alex Kuptsikevich, market analyst at FxPro, commented that the decrease in inflationary pressures over the past week also contributed to the increase in gold prices. In addition, it also created conditions for the US Federal Reserve (Fed) to cut interest rates this year. He expected the Fed to cut interest rates twice by the end of this year.

Source: https://vietnamnet.vn/gia-vang-hom-nay-18-3-2025-sjc-va-nhan-bung-no-tren-dinh-2381669.html

Comment (0)