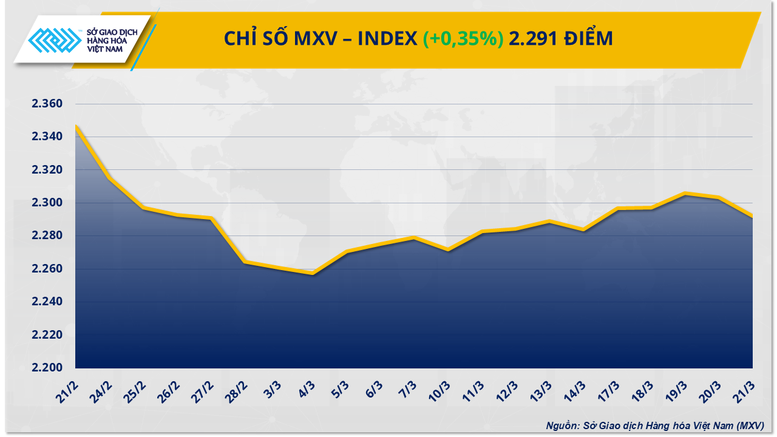

The energy and industrial raw materials group plays a leading role in the overall market's upward trend. According to MXV, world raw material prices will continue to fluctuate this week, mainly influenced by macroeconomic factors and supply and demand.

Oil prices continue to rise

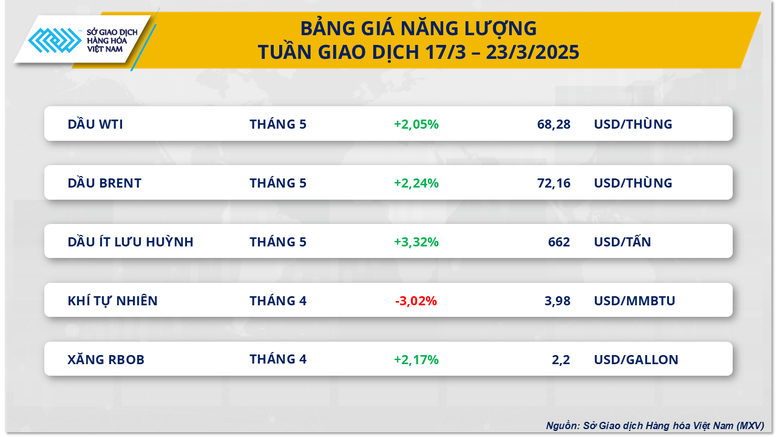

The energy market just closed the second consecutive week of price increases in March 2025 due to geopolitical tensions in the Middle East and production cuts by the OPEC+ group.

Closing, Brent oil price reached 72.16 USD/barrel, up 2.24% compared to last week. WTI oil price for May delivery also increased 2.05%, closing at 68.28 USD/barrel, the highest since the beginning of March.

Another factor supporting higher oil prices is investors' predictions of a recovery in China, the world's largest oil consumer. Retail sales growth, industrial production that did not decline as deeply as feared, and the People's Bank of China's monetary easing policies, along with a report that crude oil imports in January and February increased 2.1% compared to the same period last year, have given the market more confidence in future oil demand.

Coffee prices rise, cocoa falls

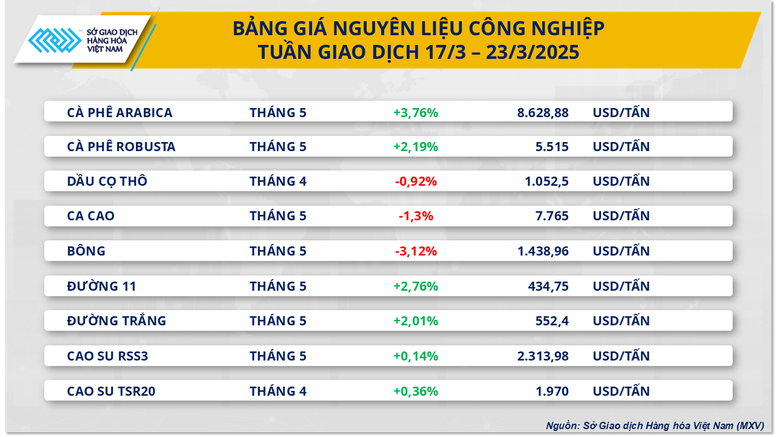

During the trading week of March 17-23, the industrial raw material market continued to record mixed developments. Coffee maintained an impressive price increase, especially Robusta, which remained at a historical high due to supply concerns. In contrast, cocoa prices continued to decline sharply after peaking at the end of 2024.

In the coffee market, Arabica prices increased by 3.76% to $8,628/ton, while Robusta closed at $5,515/ton, up 2.19% compared to last week.

Unfavorable weather conditions in the world’s two leading coffee producers, Brazil and Vietnam, have pushed prices higher this week. According to the meteorological agency Somar Meteorologia, Brazil’s largest Arabica coffee growing region, Minas Gerais, recorded rainfall of only 71% of the historical average in the week ending March 15. Meanwhile, Vietnam, the world’s leading producer of Robusta coffee, is forecast to face hot weather and low rainfall from March 21 to 31, which could negatively affect coffee production this year.

As of March 21, Arabica inventories according to ICE statistics fell to a one-month low of 777,708 bags. In contrast, Arabica inventories rose to a six-week high on Friday (March 21), reaching 4,360 lots.

In the domestic market, recorded on the morning of March 24, coffee prices in the Central Highlands were around 132,900 - 134,000 VND/kg, stable compared to yesterday but increased by about 2,000 VND/kg compared to the beginning of last week.

Vietnam's coffee exports are showing positive signs. Preliminary statistics from the General Department of Customs show that in the first half of March, coffee exports reached 93,898 tons, worth 544.9 million USD, up 25.6% in volume and 28% in value compared to the same period last month. Accumulated since the beginning of the year, coffee exports have reached more than 406,600 tons with a total value of more than 2.2 billion USD.

On the other hand, cocoa prices continued to decline by 1.3% during the week, closing at $7,765/ton. Notably, in the trading session on Friday, cocoa prices fell sharply by 3.79% compared to the reference price. From the peak of $12,193/ton set on December 18, 2024, cocoa prices have plummeted by more than 36%.

The main reason for the decline is an imbalance between supply and demand. The International Cocoa Organization (ICCO) forecasts a surplus of 142,000 tonnes in the 2024-25 season, after three consecutive years of deficits. Increased rainfall in West Africa has spurred new crop growth, boosting output. The latest data shows that ICE-monitored cocoa inventories at US ports have recovered and risen to a four-and-a-half-month high of nearly 1.8 million bags at the end of the week.

On the demand side, the sharp rise in cocoa prices since late 2024 has created many financial risks for traders in terms of capital, prices and profits. In mid-January, major regional cocoa associations in Europe, North America and Asia reported declining quarterly cocoa crushing data, indicating weakening consumer demand.

![[Photo] Nhan Dan Newspaper Youth Union visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/374e4f70a35146928ecd4a5293b25af0)

![[Photo] Prime Minister Pham Minh Chinh meets with the Ministry of Education and Training; Ministry of Health on the draft project to be submitted to the Politburo](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/c0e5c7348ced423db06166df08ffbe54)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia received the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/cdb71275aa7542b082ec36b3819cfb5c)

![[Photo] General Secretary To Lam chairs the Standing Meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/839ea9ed0cd8400a8ba1c1ce0728b2be)

Comment (0)