| Commodity market today, June 24, 2024: World raw material prices fell sharply Commodity market today, June 25, 2024: Cocoa fell sharply to its lowest level in 1 month |

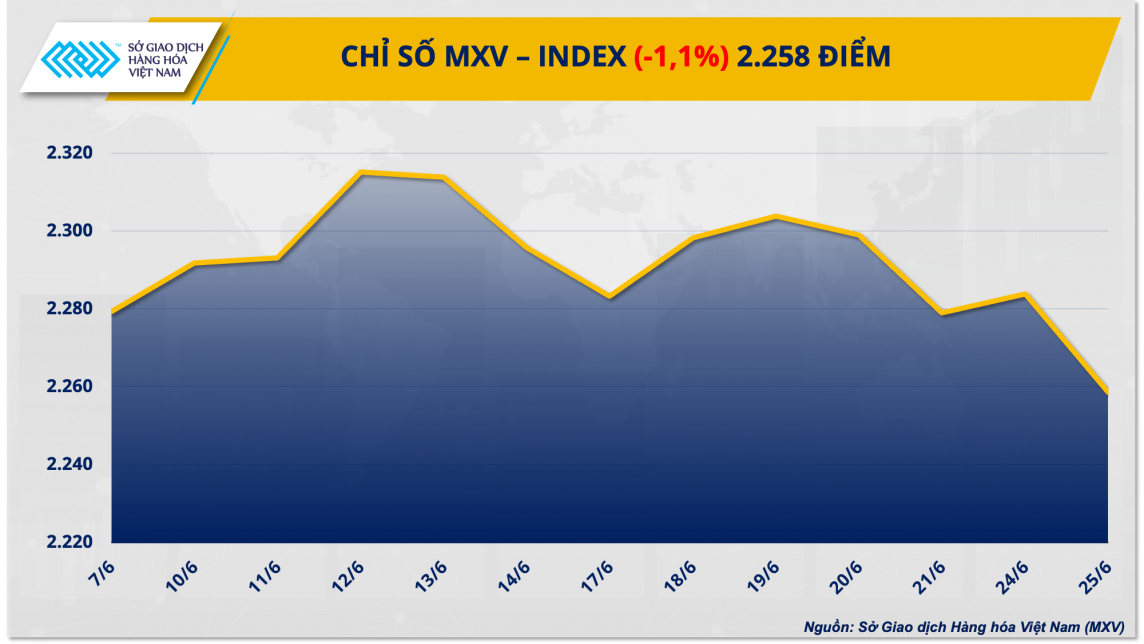

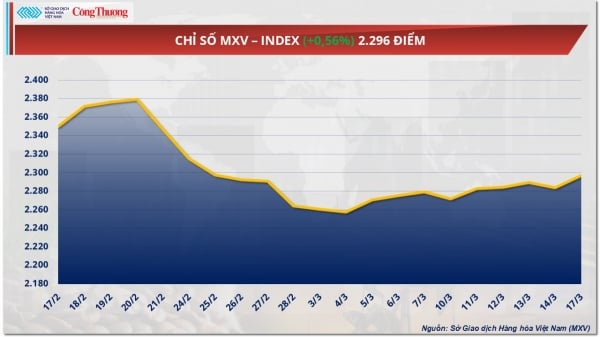

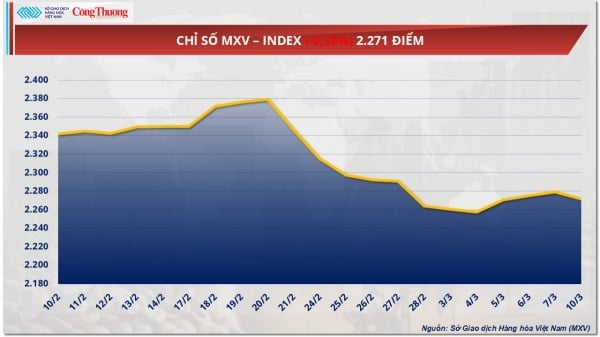

Selling pressure dominated all four groups of agricultural products, industrial materials, metals and energy. This pulled the MXV-Index down 1.1% to 2,258 points, hitting its lowest level since early May.

|

Soybean prices plunge on supply prospects from Argentina

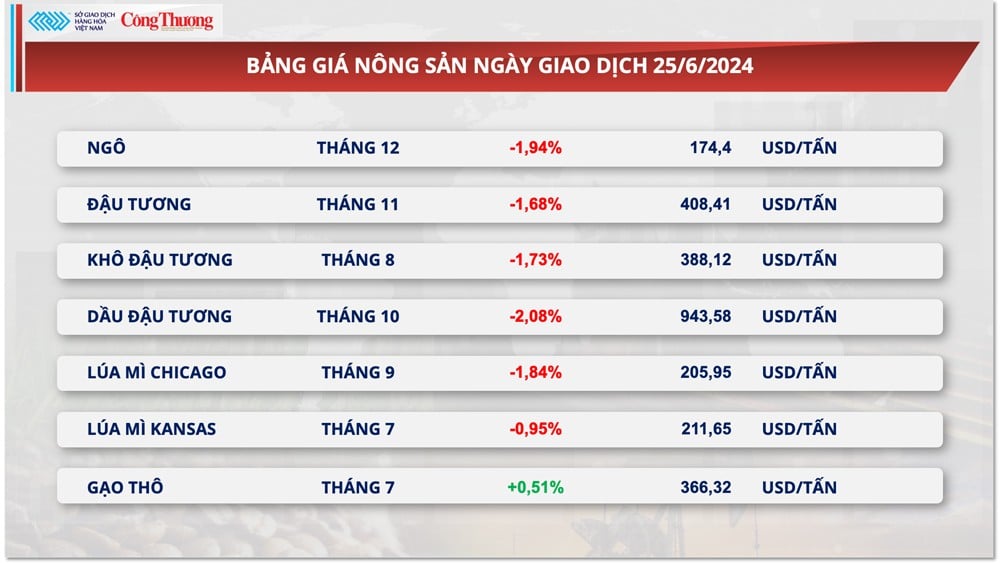

At the end of the trading session on June 25, soybean prices plunged 1.68% to $408.41/ton. In the context of relatively positive supply prospects from Argentina, the sellers dominated from the beginning of the session. The price decline was only partly reduced by the deterioration of the crop situation in the US last week.

In Argentina, the Rosario Grains Exchange (BCR) said that the intensity of La Nina later this year is forecast to be milder in the coming months, allowing the country to receive more rain than usual. This is considered a positive signal for the Argentine agricultural sector, as the country often faces hot and dry weather during La Nina periods. In 2022, Argentina suffered a historic drought due to the influence of La Nina. The end of the year is the period when soybeans in Argentina are planted and enter the initial development stage, so more rains will improve the outlook for the country's oilseed production. This is a factor that put great pressure on soybean prices yesterday.

|

| Agricultural product price list |

According to the Crop Progress report, the percentage of good/excellent quality soybeans in the US for the week ending June 23 was 67%, down 3 percentage points from a week earlier and below the market expectation of 68%. The reason for the decline in quality was due to the extreme heat conditions that crops had to endure last week, before the rains and floods that appeared over the weekend caused many soybean areas to be partially flooded. However, experts said that the rains and floods could be a positive sign, as the crops will receive the necessary amount of water for growth after a long period of facing extreme heat. Therefore, yesterday's Crop Progress report only partly helped to narrow the decline in soybean prices.

The price of two finished products, soybean meal and soybean oil, also saw red. Pressured by the weakening soybean prices, soybean meal prices fell 1.73% after closing yesterday. Meanwhile, soybean oil prices fell 2.08% due to pressure from crop prospects in Argentina, the world’s largest exporter of soybean oil.

In contrast to the world price trend, in the domestic market, yesterday (June 25), the price of imported South American soybean meal at our country's ports tended to increase slightly. At Cai Lan port, the price of soybean meal for August and September this year fluctuated around 12,150 - 12,200 VND/kg. Meanwhile, at Vung Tau port, the price was lower, fluctuating around 12,000 - 12,050 VND/kg.

FED's hawkish remarks put pressure on metals

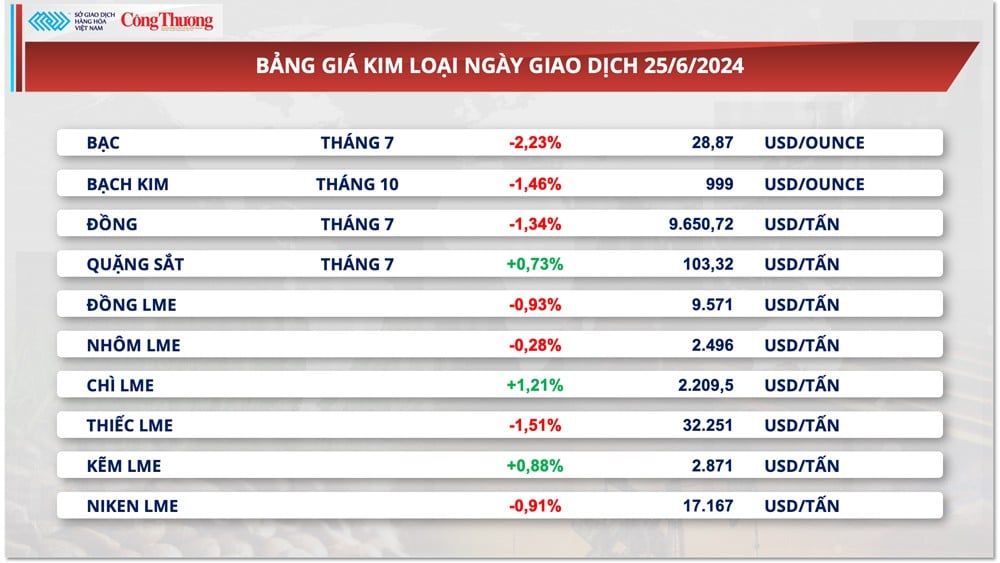

Red dominated the metal price chart yesterday, with 7 out of 9 commodities falling in price. Increased macro pressure after a series of hawkish statements from US Federal Reserve (FED) officials put pressure on the entire metal market. For precious metals, silver led the decline of the group, falling 2.23% to $28.87/ounce, the lowest level in more than a month. Platinum also fell 1.46%, closing at $999/ounce.

|

| Metal price list |

In a speech yesterday, Fed Governor Michelle Bowman said the Fed needs to keep its policy interest rate steady for a while to control inflation. She also emphasized that the Fed is ready to increase borrowing costs if necessary. Agreeing with this view, earlier on Monday, San Francisco Fed President Mary Daly also said she did not support cutting interest rates, at least until policymakers are confident that inflation has fallen to 2% sustainably.

These tough statements from officials indirectly increased concerns that the FED was not in a hurry to lower interest rates, causing the USD to rise in yesterday's session. The Dollar Index recovered 0.13% to 105.61 points. Higher borrowing costs combined with interest rate risks pushed silver and platinum prices down.

For base metals, the rising US dollar also weighed on prices. COMEX copper fell 1.34% to $9,650.72 a tonne, its lowest level in more than two months.

Meanwhile, sluggish demand remains the main factor weighing on copper prices. Copper inventories on the London Metal Exchange (LME) have now exceeded 172,000 tonnes, a six-month high and up 67% from mid-May. In China, inventories on the Shanghai Futures Exchange remain at a two-year high.

The slowdown in Chinese manufacturing activity is likely to continue to hamper consumption of copper and other industrial metals, experts predict. Copper prices are expected to fluctuate between $9,500 and $9,900 per tonne until new economic data from China is released.

In line with the price trend, LME nickel prices also fell nearly 1% to $17,167/ton, the lowest level since early April, due to oversupply. According to data from the LME, nickel inventories here are at 92,000 tons, up 40% compared to the beginning of this year.

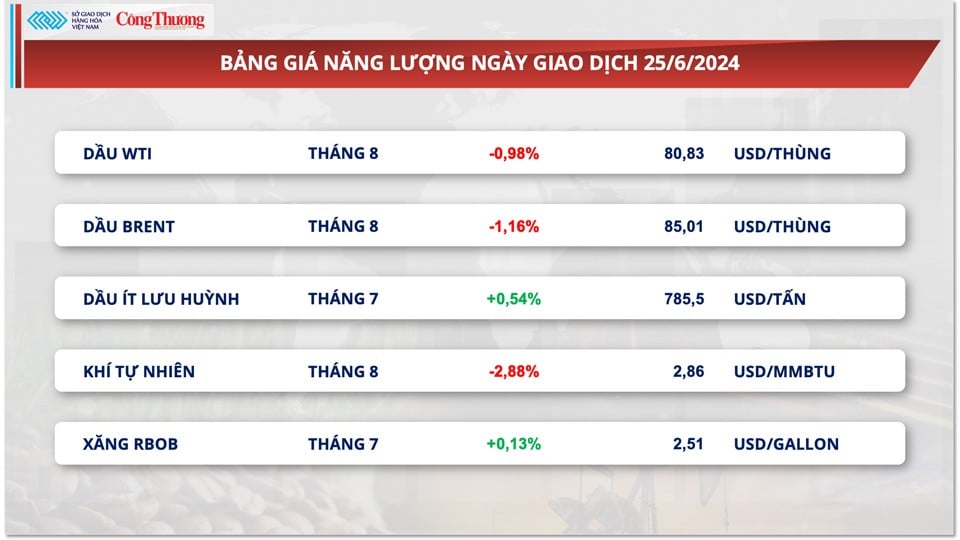

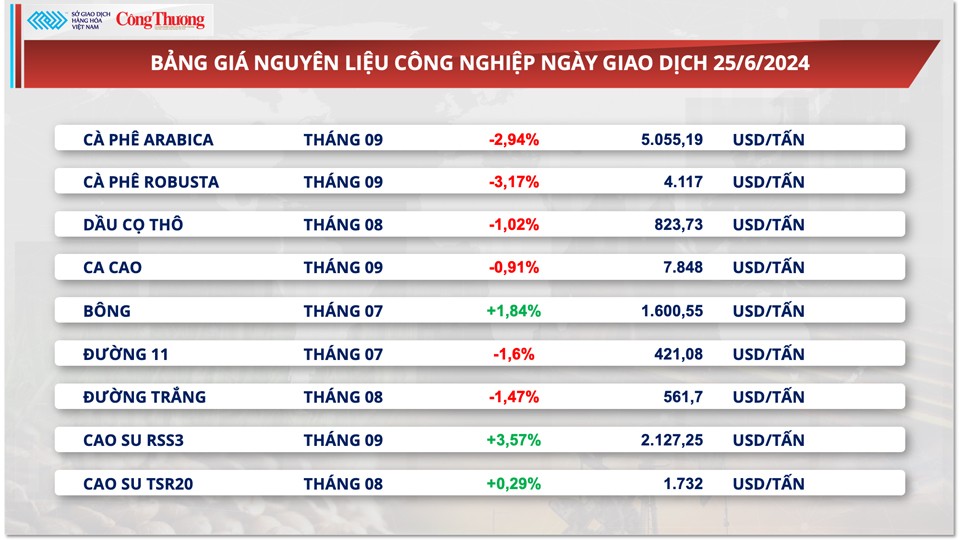

Prices of some other goods

|

| Energy price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2662024-gia-hang-hoa-nguyen-lieu-the-gioi-dong-loat-lao-doc-328243.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)