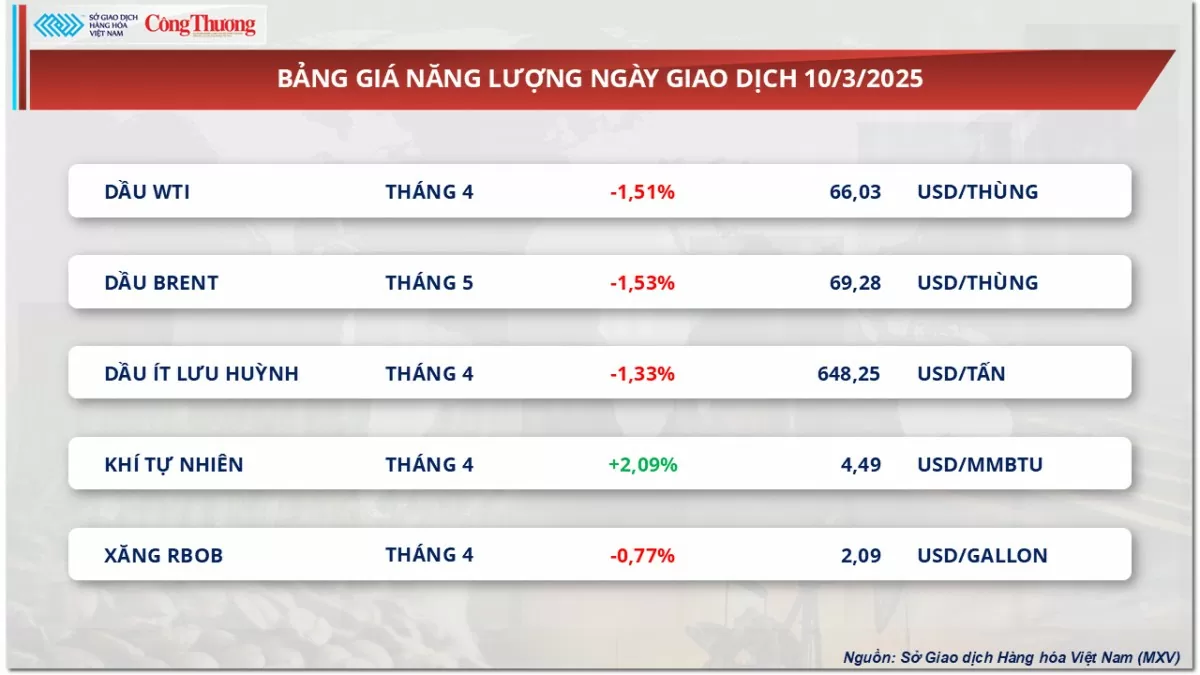

At the end of the trading session, the prices of both crude oil products decreased by 1.5%, respectively at 69 USD/barrel for Brent oil and 66 USD/barrel for WTI oil.

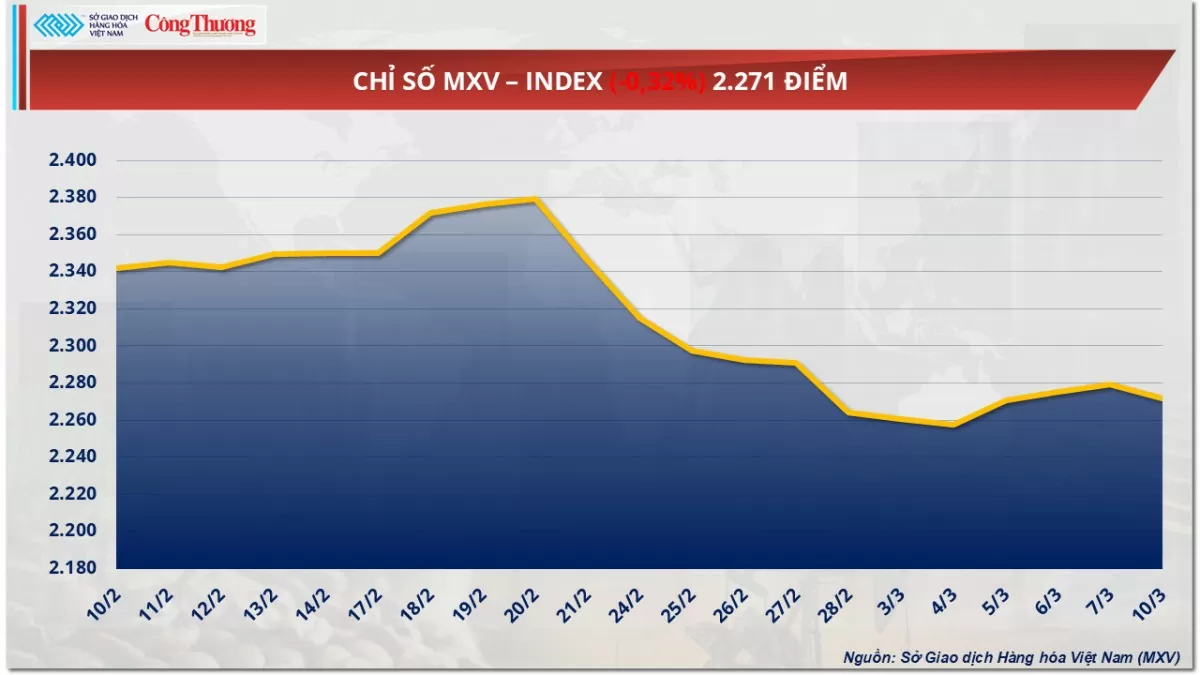

The Vietnam Commodity Exchange (MXV) said that after three recovery sessions, yesterday's closing session, the dominant selling pressure pulled the MXV-Index down 0.32% to 2,271 points. In the energy market, oil prices continued to be under pressure due to concerns about the US's tariff policy on goods from Mexico, Canada and China. In particular, the US's imposition on China - the largest soybean importer - further raised concerns about the prospect of consuming this commodity, thereby strongly affecting the agricultural market.

|

| MXV-Index |

Oil prices turn weak after two positive sessions

Red dominated the energy market in the trading session on March 10. In particular, world oil prices continued to plummet due to concerns that the US tariff policy on Canada, Mexico and China could slow down global economic growth, leading to a decrease in energy demand. At the same time, OPEC+'s decision to increase production from April further put pressure on the oil market.

At the end of the trading session, the prices of both crude oil products decreased by 1.5%, respectively at 69 USD/barrel for Brent oil and 66 USD/barrel for WTI oil. Thus, after a slight recovery session at the end of last week, oil prices continued to move away from the 70 USD/barrel mark.

|

| Energy price list |

Historically, crude oil prices have reacted in tandem with stock prices when a recession is likely. On Monday, the S&P 500 fell 2% and the Nasdaq Composite dropped more than 3%, leaving investors worried about further declines in oil prices.

On the supply side, OPEC+ has confirmed that it will increase production by 138,000 barrels per day from April, despite concerns about falling demand. However, according to Russian Deputy Prime Minister Alexander Novak, the group still leaves open the possibility of adjusting its policy if the market becomes unbalanced after increasing supply...

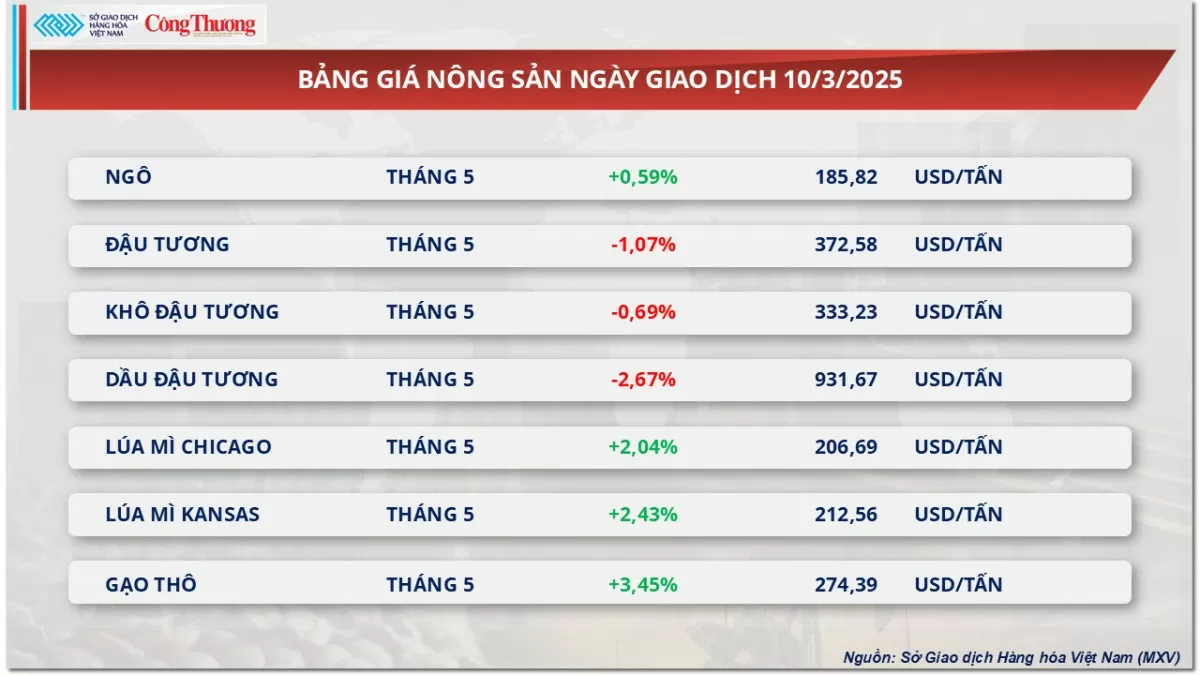

Soybean prices under pressure from vegetable oil market

At the end of the first trading session of the week, the agricultural market was relatively volatile. In particular, soybean prices were under great pressure, falling more than 1% to 372 USD/ton, reflecting investors' cautious sentiment in the face of new fluctuations in the vegetable oil market along with negative fundamental factors continuing to weigh on prices.

|

| Agricultural product price list |

One of the main factors that put pressure on soybean prices was China’s decision to impose a 100% tariff on Canadian canola oil imports. The move sent Canadian canola prices tumbling by 6%, while palm oil rose by 3%. Sharp swings in alternative vegetable oil products weighed on soybean oil prices, sending the commodity down more than 2% to $931 per tonne.

Soybean oil is an important by-product in the soybean processing process, so the decline in the price of this commodity has indirectly put pressure on the price of raw soybeans, reducing the attractiveness of soybeans in the market.

The soybean market has also been affected by negative sentiment globally, especially concerns about China’s economic outlook. New data released over the weekend showed signs of consumer price deflation in Asia’s largest economy, raising concerns about the possibility of weakening demand for agricultural imports.

As the world's largest soybean importer, any signs of economic slowdown from China could directly impact U.S. soybean export prospects and prices, adding further pressure to the market.

In addition, the strong liquidation of net long positions by hedge funds in the agricultural market is also an important reason for the decline in soybean prices. According to the latest weekly CFTC report, the group of "Managed Money" speculators sold a net of more than 43,000 soybean contracts in the week ending March 4. This move shows that investors are showing more caution due to uncertainties about trade policy and the global economic outlook. The sell-off from hedge funds not only puts direct pressure on prices but also weakens the overall sentiment in the market.

The soybean market is also under pressure from increased supplies in South America, especially Brazil, as the harvest in this region is strong. With abundant production, supplies from Brazil and Argentina are expected to create great competition for US soybean exports, reducing the ability to consume in the international market and pushing prices lower in the coming time.

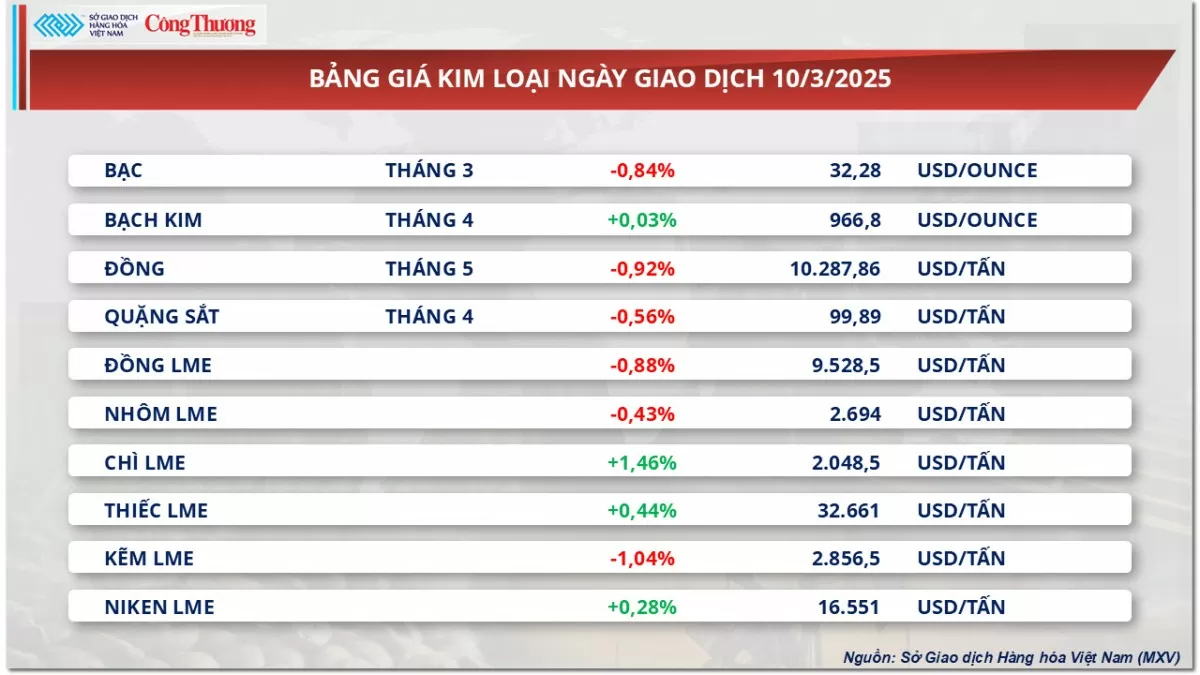

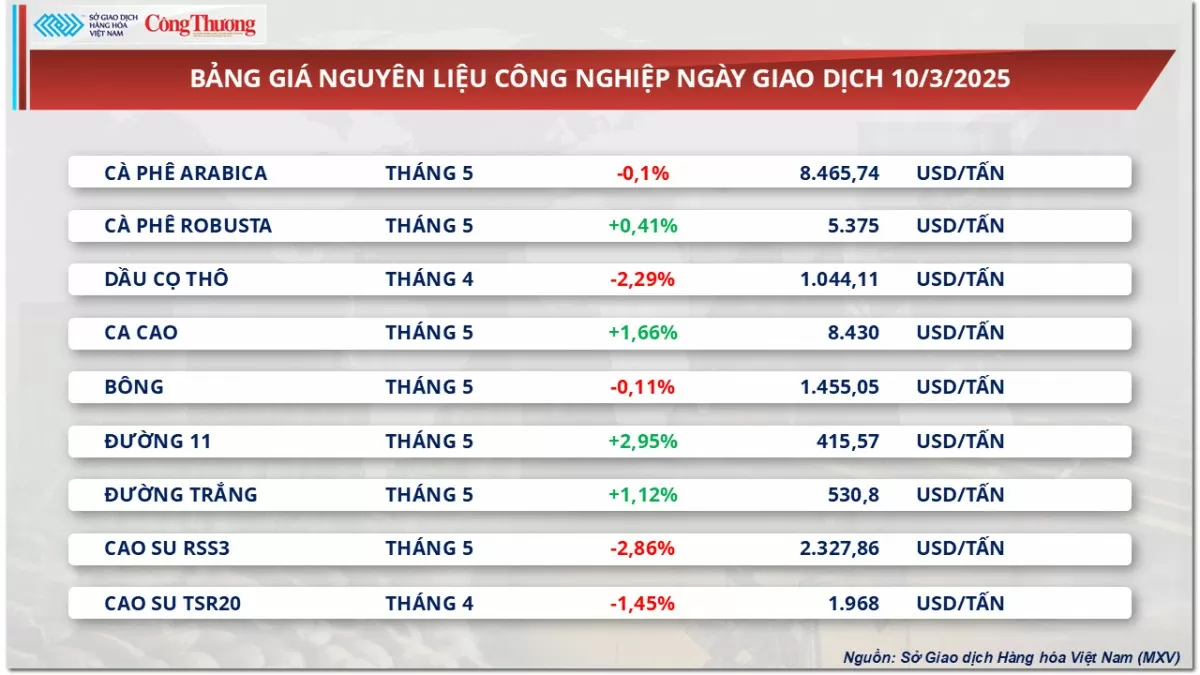

Prices of some other goods

|

| Metal price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/gia-dau-quay-dau-suy-yeu-sau-hai-phien-tich-cuc-377679.html

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)