Supply concerns over the risk of Israel-Iran conflict pushed Brent and WTI oil prices to their highest since October 2023.

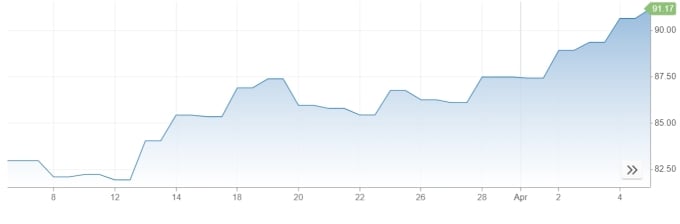

At the close of trading on April 5, Brent crude oil increased by 0.6% to 91.17 USD per barrel. US crude oil also increased by 0.4% to 86.9 USD. Both prices are the highest in 6 months.

Both Brent and WTI have risen more than 4% this week, as Iran said it would retaliate against Israel for the killing of an Iranian general in a strike in Syria earlier this week. Israel has not yet claimed responsibility for the attack.

Iran is OPEC's third-largest oil producer. "If Iran were to directly attack Israel, it would be unprecedented. The domino effect in the chain of geopolitical risks shows no signs of ending," Phil Flynn, an analyst at Price Futures Group, told Reuters.

Brent oil price movements over the past month. Chart: CNBC

In addition, a NATO official said on April 4 that Russian oil refineries could lose 15% of their capacity due to recent attacks by Ukraine. This would impact Moscow's gasoline output.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) decided this week to keep their production policy unchanged. They also put pressure on some members to comply with the policy of reducing oil production.

"The tightening of regulations on members could cause OPEC+ production to fall further in the second quarter. Tightened supply will cause inventories to decline next quarter," analysts at ANZ commented.

Meanwhile, the US employment report for March released on April 5 showed a stronger-than-expected labour market. The 303,000 new jobs created could boost oil demand, but it is also likely to delay the US Federal Reserve’s interest rate cut this year.

Analysts at JPMorgan expect global oil demand to increase by 1.4 million barrels a day in the second quarter. Meanwhile, oil services firm Baker Hughes estimated on April 5 that U.S. energy companies have reduced the number of rigs operating for three consecutive weeks, to the lowest since early February, which is seen as an indicator of future oil and gas production.

Ha Thu (according to Reuters)

Source link

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)