Customers eat and participate in activities at a restaurant in Ho Chi Minh City - Photo: SAC STATION

Urbanization "encourages" increase in number of bars and restaurants?

Saigon Beer - Alcohol - Beverage Corporation ( Sabeco ) has released documents for the 2025 General Meeting of Shareholders, scheduled to be held at the end of April.

Accordingly, Sabeco's Board of Directors (BOD) forecasts that 2025 will continue to be a year of "golden" opportunities for the Vietnamese beer industry, thanks to the young population structure, rapidly increasing income, great potential of the "non-alcoholic beer" segment and export opportunities.

Although Sabeco's net revenue plan this year is expected to decrease slightly (reaching about VND31,600 billion), the company expects net profit to increase by 8%, to more than VND4,800 billion (equivalent to an average of more than VND13 billion per day).

ThaiBev is currently the parent company of Sabeco, Vietnam’s largest beer producer with a total capacity of about three billion liters per year. Last year, Sabeco made a profit of more than VND4,490 billion, up nearly 6%.

The entire beer industry faces many challenges, including strict control regulations such as excise taxes, advertising restrictions and rising raw material costs.

"Despite challenges from control policies and economic fluctuations, the market remains potential thanks to increasing domestic consumption and positive export prospects," according to Sabeco's Board of Directors.

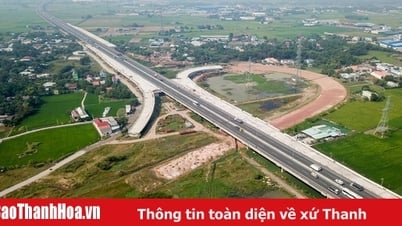

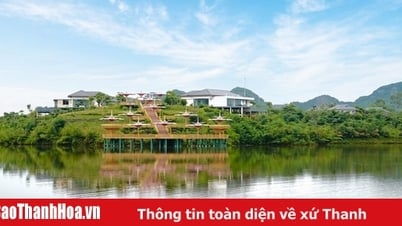

One of the key factors driving the growth of the Vietnamese beer market is urbanization.

According to Sabeco's Board of Directors, this process "encourages" an increase in the number of bars, restaurants and entertainment venues, contributing to increased domestic beer consumption.

The trillion-dollar race for advertising and promotion

In 2024, Sabeco spent more than VND 2,500 billion on advertising and promotion.

Consumer trends are increasingly demanding in terms of packaging design, product quality, etc., forcing businesses to "spend heavily and compete in advertising and promotion campaigns."

According to a report from FPT Securities Joint Stock Company (FPTS), competition in the beer industry is increasingly fierce as businesses increase advertising and promotion activities to gain market share.

For example, Heineken has regularly organized annual promotional events such as music festivals on a larger scale and expanded to many other provinces and cities.

For Habeco, the ratio of sales expenses (including advertising, marketing, promotions, etc.) to net revenue last year increased by 1.3 percentage points compared to the previous year (reaching 16.7%). Meanwhile, FPTS observed that Carlsberg tripled the number of promotional programs in 2024 compared to the same period.

In contrast, Sabeco cut spending on advertising and sales activities, as the ratio of selling expenses to net revenue last year decreased by 2 percentage points compared to 2023, to 12.7%.

FPTS estimates that about 98% of Sabeco's product portfolio belongs to the popular segment and forecasts that consumption trends will shift down to this segment.

Meanwhile, Sabeco believes that consumers are shifting from mass-market beer to premium and craft beer segments, a niche market with high growth rates, especially in large cities.

Increase in salary and bonus expensesThe remuneration of seven members of Sabeco's Board of Directors this year will increase by more than 60% compared to last year, to VND6.5 billion. The remuneration of four members of the nomination and bonus committee is expected to increase by 30%, to more than VND1 billion. One notable point is that this year Sabeco will have three members of the land committee, with an expected remuneration of about VND780 million, equivalent to the remuneration of three members of the sustainable development and risk management committee. |

|---|

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)