At the end of the trading session, Arabica coffee prices increased by 0.69% to more than 7,200 USD/ton, while Robusta coffee prices increased by only 0.12% and fluctuated around 5,000 USD/ton.

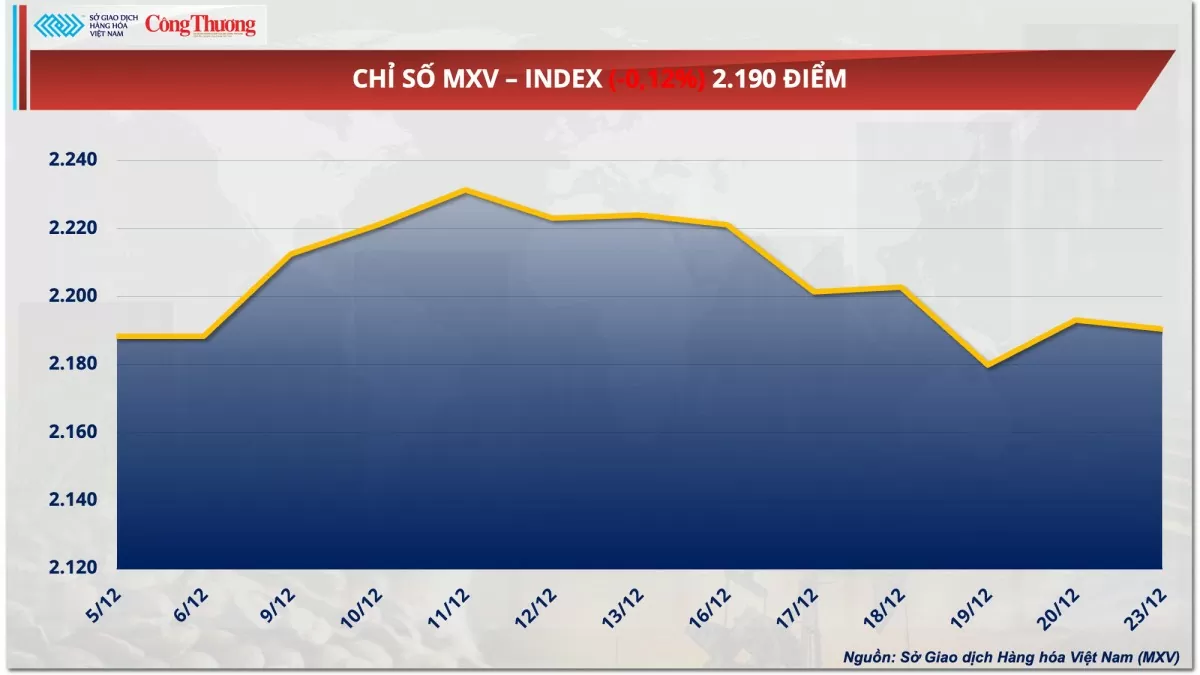

According to the Vietnam Commodity Exchange (MXV), the world raw material market fluctuated before the Christmas holiday (December 23). At the close, selling pressure dominated, pulling the MXV-Index down slightly by 0.12% to 2,190 points. Notably, all 5 energy group commodities decreased in price, of which, WTI oil price decreased for the third consecutive session. On the contrary, the industrial raw material group recorded positive signals when 6 out of 9 commodities increased in price.

|

| MXV-Index |

WTI oil prices extend decline into third session

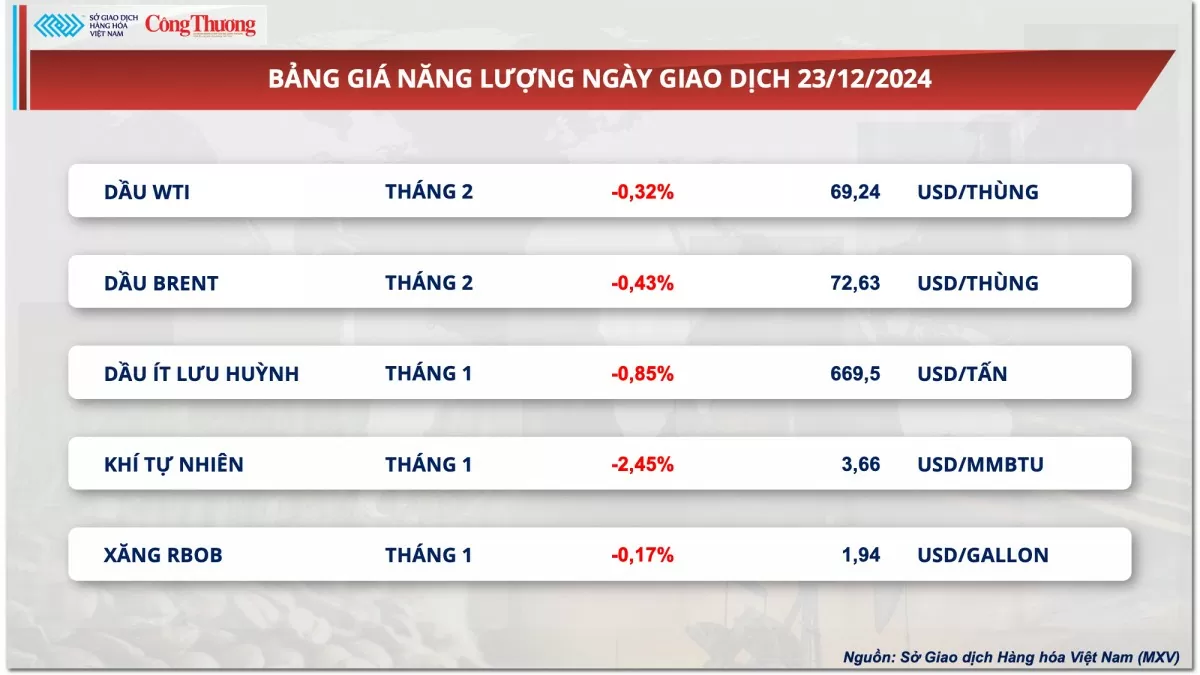

Energy markets closed on Monday, with both oil prices weakening and trading thin ahead of the Christmas holiday due to concerns about oversupply in 2025 and a stronger US dollar.

At the end of the session, Brent crude oil price decreased by 0.32% to 69.24 USD/barrel. Meanwhile, WTI crude oil price decreased by 0.43% to 72.63 USD/barrel.

|

| Energy price list |

In a December report, analysts at Macquarie Bank predicted that the oil glut will continue to grow next year, pushing the average price of Brent crude from $79.64 a barrel this year to $70.50 next year. Meanwhile, concerns about European supply have eased as disruptions to Russian oil flows to Europe via the Druzhba pipeline have been resolved and restarted.

Oil prices fell yesterday as the US dollar rebounded to near two-year highs. This makes oil more expensive for importers using other currencies, raising the risk of a decline in oil demand and adding further downward pressure on prices during the session.

On the other hand, yesterday's decline in oil prices was tempered by the pressure on Europe and the Panamanian government from newly elected US President Donald Trump. Accordingly, Mr. Trump threatened to impose tariffs on the European Union (EU) if the EU did not increase oil and gas imports from the US, thereby helping the market to expect more oil demand in the future.

In addition, in a social media post on December 21, Mr. Trump opposed the high fees applied to US ships passing through the Panama Canal, and suggested that ownership of the canal should be transferred to the US. The move has raised concerns about instability in this important oil transportation route. As of 2023, the amount of oil transported through the Panama Canal reached 2.1 million barrels/day, equivalent to 2% of the total global oil supply.

Coffee prices rise as Brazil forecasts lower output in 2025-2026 crop

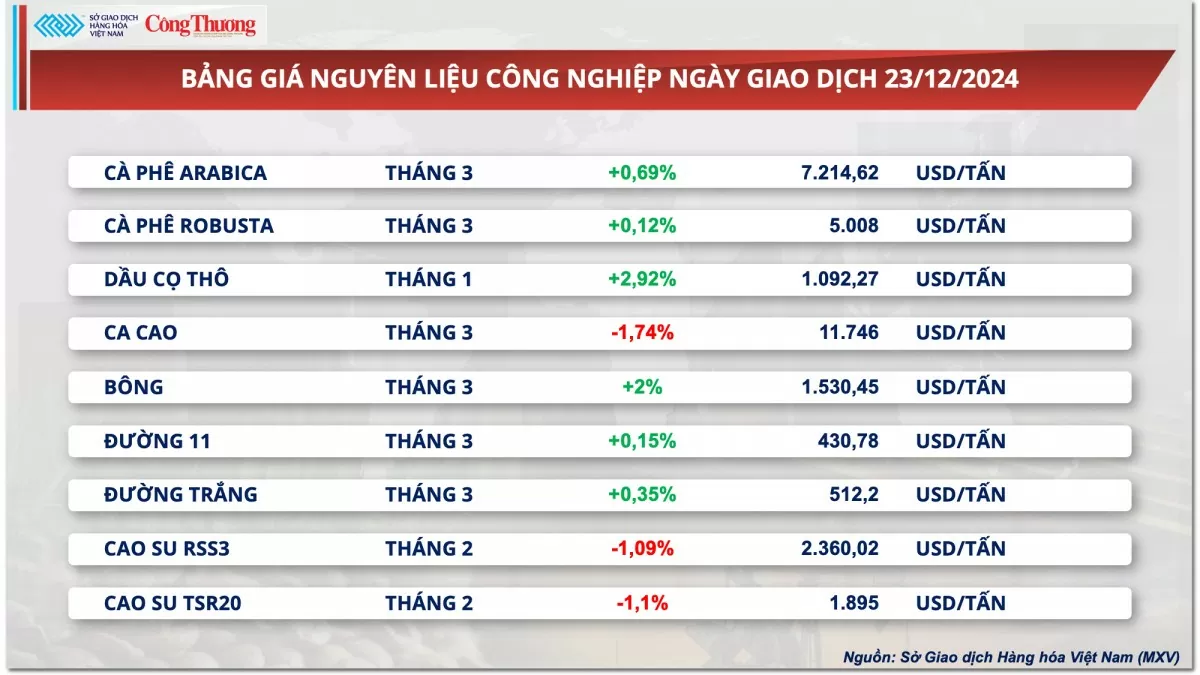

According to MXV, at the end of the first trading session of the week, the industrial raw materials group recorded positive developments with most items increasing in price. In particular, coffee prices fluctuated in the market.

Specifically, Arabica coffee prices increased by 0.69% to over 7,200 USD/ton, while Robusta coffee prices only increased slightly by 0.12% and fluctuated around 5,000 USD/ton.

|

| Industrial raw material price list |

The outlook for Brazil's coffee supply in the 2025-2026 crop year continues to receive negative forecasts from analysts. According to Safas & Mercado, Brazil's total coffee output in the 2025-2026 crop year is expected to reach 62.45 million 60-kg bags, down 5% compared to the previous crop year. Of which, Arabica coffee output will only reach 38.25 million bags, down sharply by 15%, while Robusta coffee will reach 24.10 million bags. Organizations such as Volcafe, Expana and Hedegpoint have also lowered their forecasts for Brazil's coffee output in the 2025-2026 crop year, especially for Arabica coffee.

Bad weather in Brazil’s main Arabica coffee growing region has added to supply concerns and helped keep prices high. Minas Gerais, Brazil’s largest Arabica-producing state, received just 43.2 mm of rain last week, 17% below the historical average, according to the Somar Meteorological Agency.

However, the rise in coffee prices yesterday was limited by the high USD/BRL exchange rate. The strengthening of the Dollar Index together with the weakening of the Brazilian Real pushed the USD/BRL exchange rate up by 1.78%. This exchange rate difference could boost the export activities of Brazilian producers.

Coffee sales in Brazil remain positive, supported by high prices and stable international demand. Safras & Mercado said that sales of Brazilian coffee in the 2024-25 crop year as of December 11 had reached 79% of the expected output, 10 percentage points higher than the same period in 2023 and 6 percentage points higher than the five-year average. The Brazilian Coffee Exporters Association (CECAFE) recorded coffee exports in the first 11 months of 2024 reaching a record 46.4 million bags, up 3.78% from the previous record in 2020 and up 32.2% compared to the same period in 2023.

In the domestic market, coffee prices in the Central Highlands and the Southeast this morning (December 24) were recorded at 120,500 - 121,300 VND/kg, unchanged from yesterday. However, compared to the same period last year, coffee prices have now doubled.

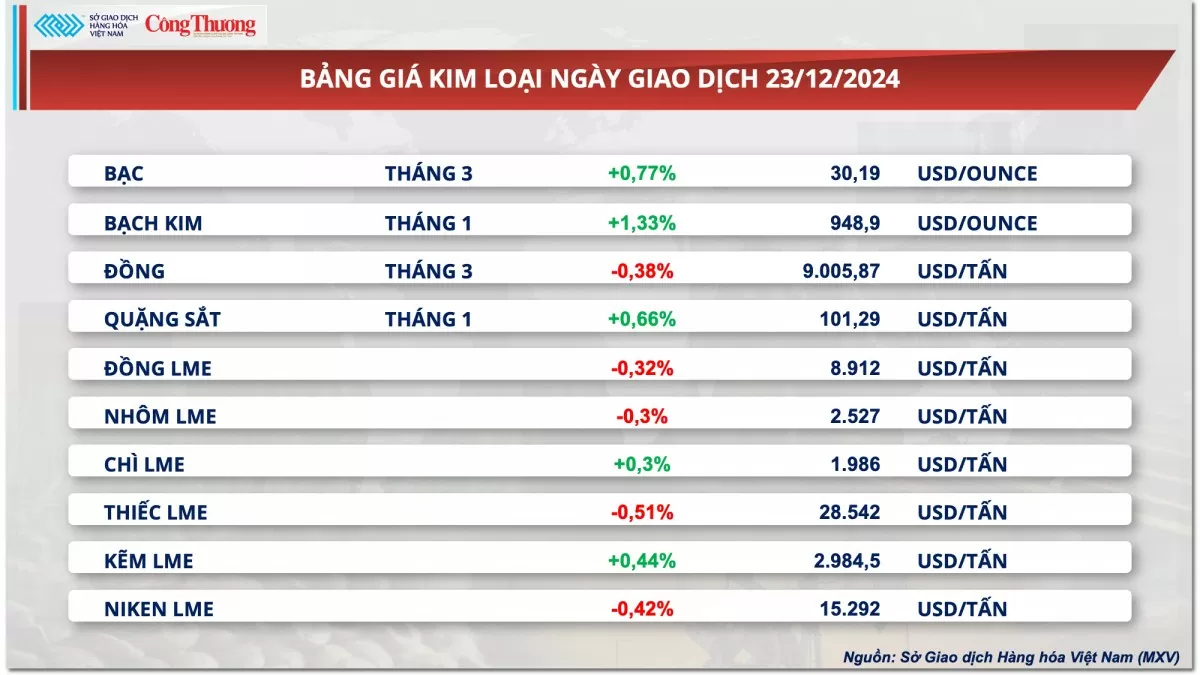

Prices of some other goods

|

| Metal price list |

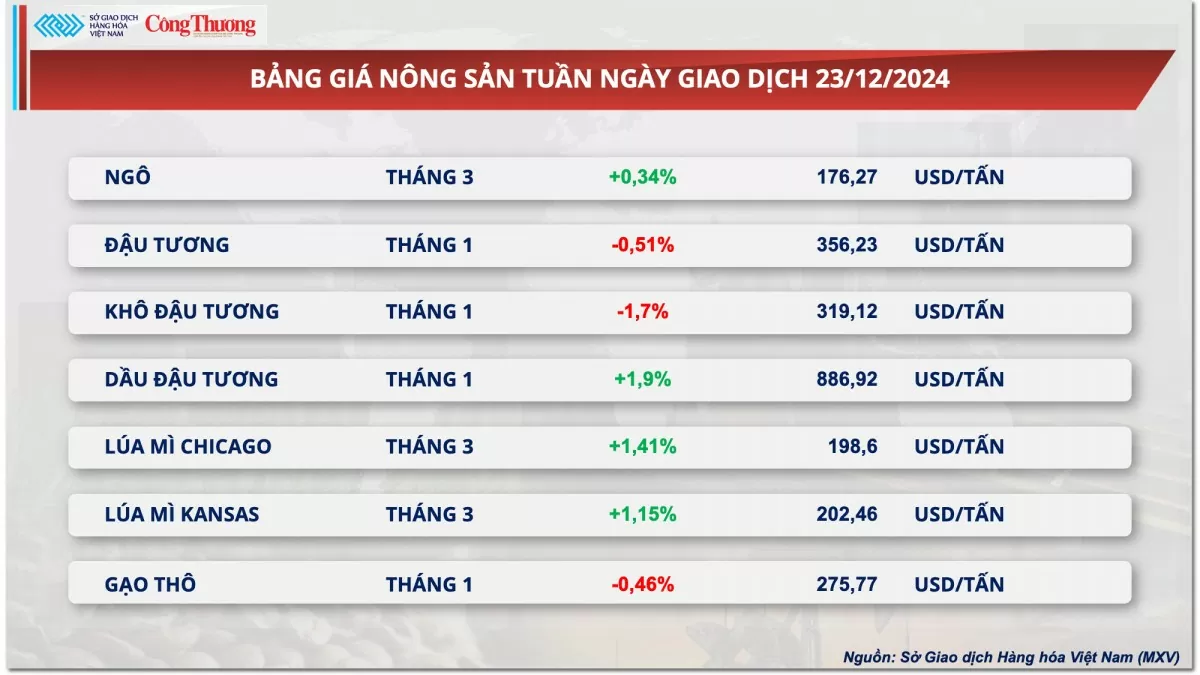

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-2412-gia-ca-phe-robusta-tang-nhe-dao-dong-quanh-moc-5000-usdtan-365856.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)