At the end of the trading session, silver prices continued to increase by 0.24% to 32.11 USD/ounce, bringing the increase since the beginning of 2025 to 8.5%; while platinum prices remained unchanged at 971.9 USD.

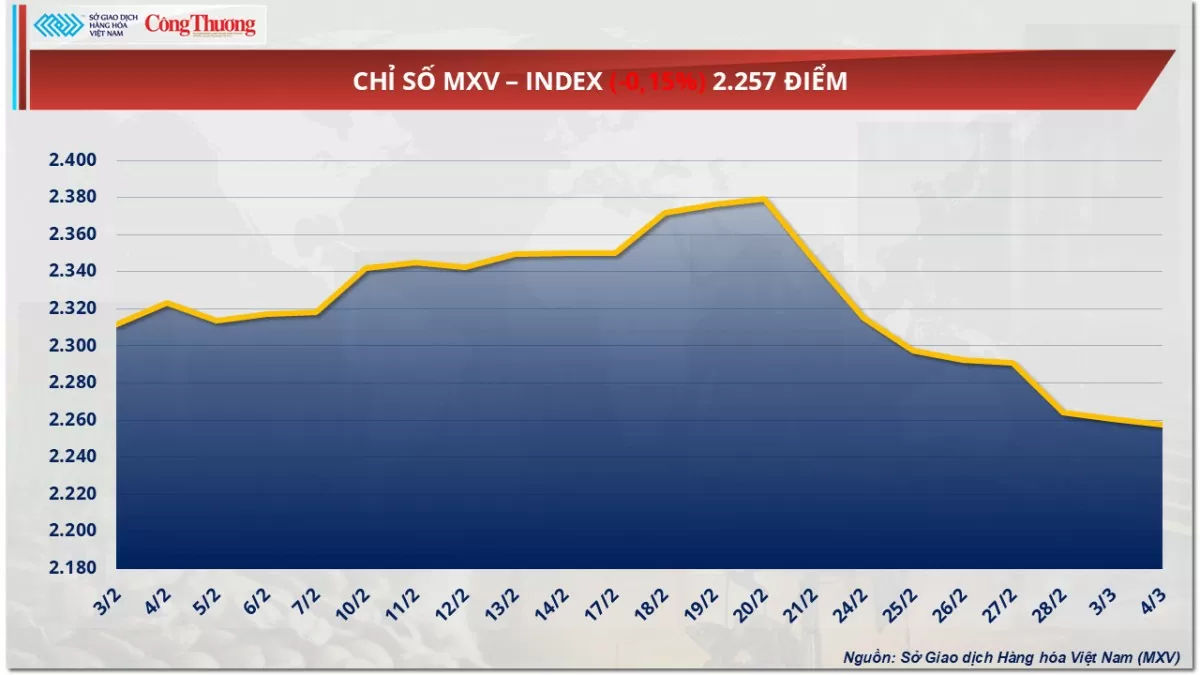

According to the Vietnam Commodity Exchange (MXV), the world raw material market continued to fluctuate in yesterday's trading session (March 4). Notably, the entire agricultural product market continued to sink deep into the red. Meanwhile, a clear divergence occurred in the metal market. At the end of the session, selling pressure continued to dominate, causing the MXV-Index to fall 0.15% to 2,257 points, marking the 8th consecutive session of weakness.

|

| MXV-Index |

Soybean prices extend decline into 5th session

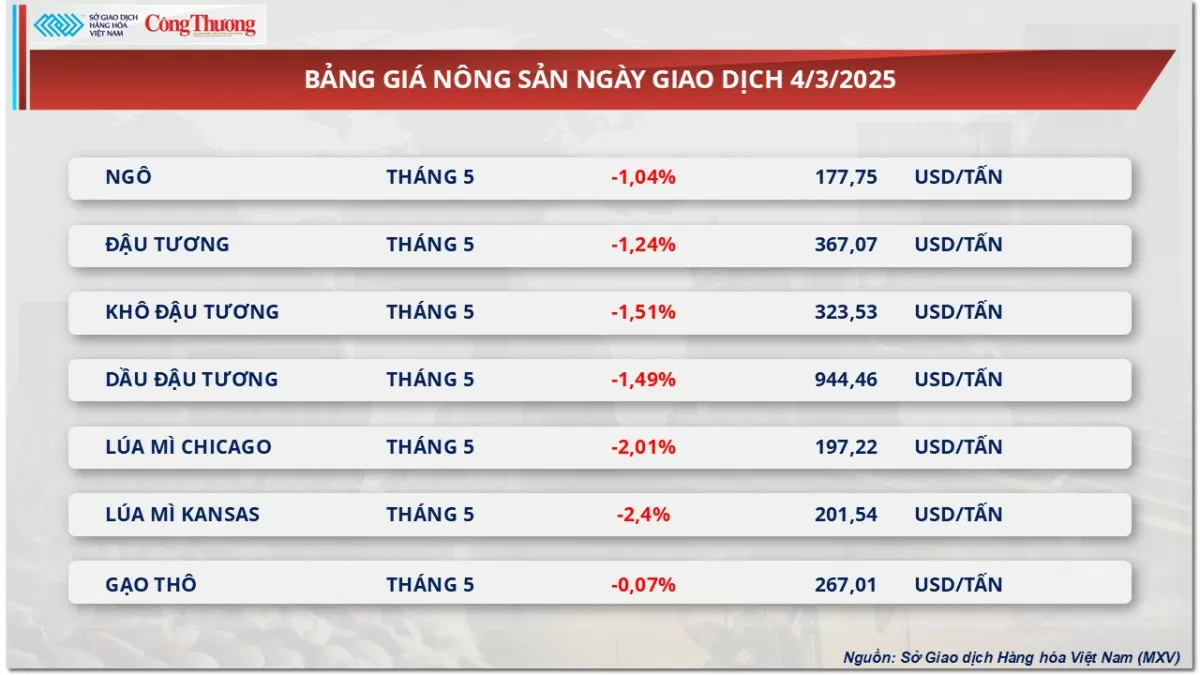

At the end of yesterday's trading session, the agricultural market continued its downward trend. In particular, soybean prices lost more than 1.2% to 367 USD/ton. The decline of soybeans has extended to the 5th consecutive session, reflecting the pessimistic sentiment that is dominating the soybean market in the context of escalating trade tensions and abundant supply from South America...

|

| Agricultural product price list |

China has bought about 4.4 million tons of soybeans from the US but has not yet received them, raising concerns that the country may cancel orders or cut back on purchases in the future. This situation has put pressure on soybean prices as investors worry about import demand from the US's largest market.

In addition to the impact of trade tensions and tariff policies, abundant supplies from South America are also contributing to the downward pressure on prices. According to Cordonnier, Brazil's soybean production is expected to reach 170 million tons, while Argentina could reach 48 million tons. Although some areas in southern Brazil and northern Argentina are still affected by drought, weather conditions have improved significantly compared to previous concerns. In Argentina, in particular, the percentage of good quality soybeans has increased by 7% in a week to 24%, indicating a positive recovery for the crop.

Metal markets move in opposite directions

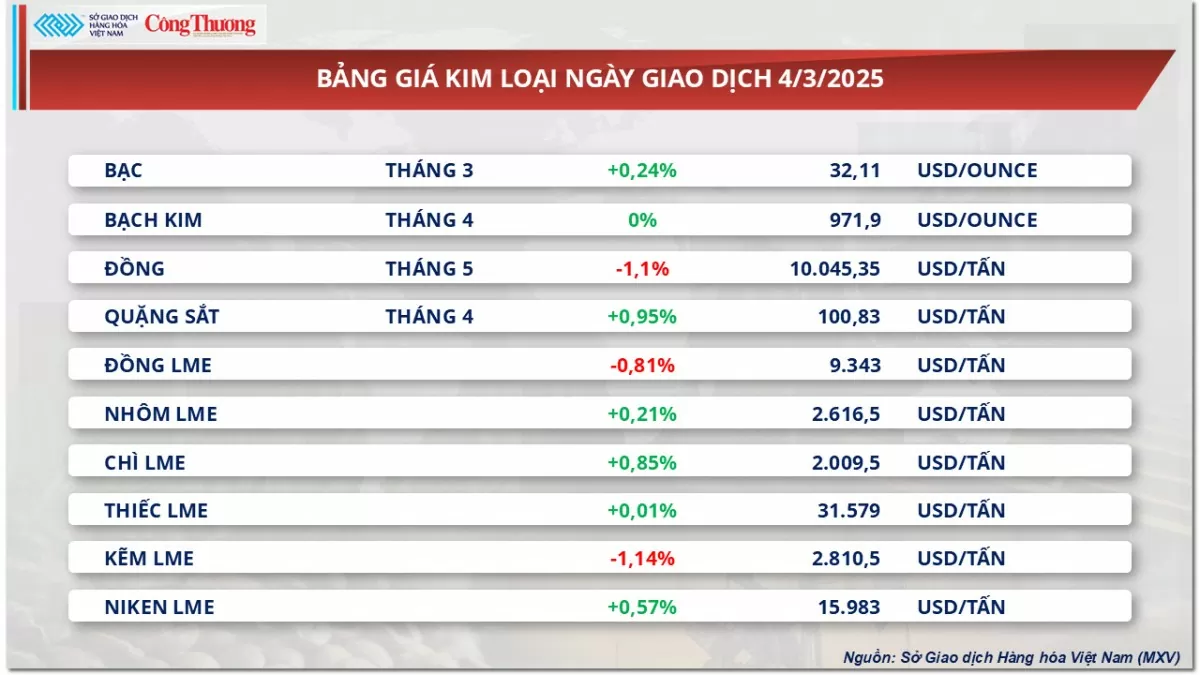

At the close of yesterday's trading session, the metal market witnessed a mixed performance after the US tightened its tariff policy towards important trading partners.

At the close of trading, silver prices continued to increase by 0.24% to 32.11 USD/ounce, bringing the increase since the beginning of 2025 to 8.5%. Meanwhile, platinum prices remained unchanged at 971.9 USD/ounce.

|

| Metal price list |

The escalating tensions have spurred a flight to safe havens like precious metals. In the base metals market, COMEX copper fell 1.1% to $4.56 a pound ($10,045 a tonne), but was still 5% higher than in February. Meanwhile, iron ore rebounded 0.95% to $100.8 a tonne...

In another development, preliminary data from the Indian government showed that finished steel imports from China, South Korea and Japan hit a record high in the first 10 months of the 2024-25 financial year. Notably, imports from South Korea increased by 11.7%, from China inched up by 3.4%, while imports from Japan jumped by 88.6%. This increase strengthens the outlook for steel consumption in India - the world's second-largest importer of crude steel.

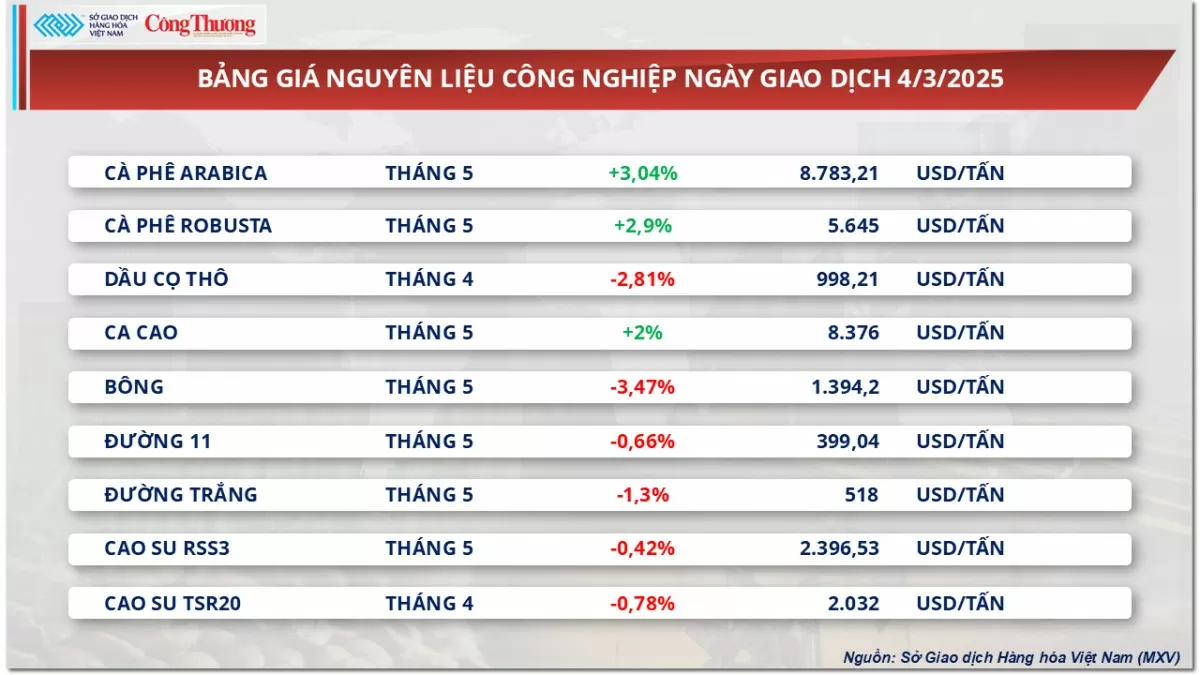

Prices of some other goods

|

| Industrial raw material price list |

|

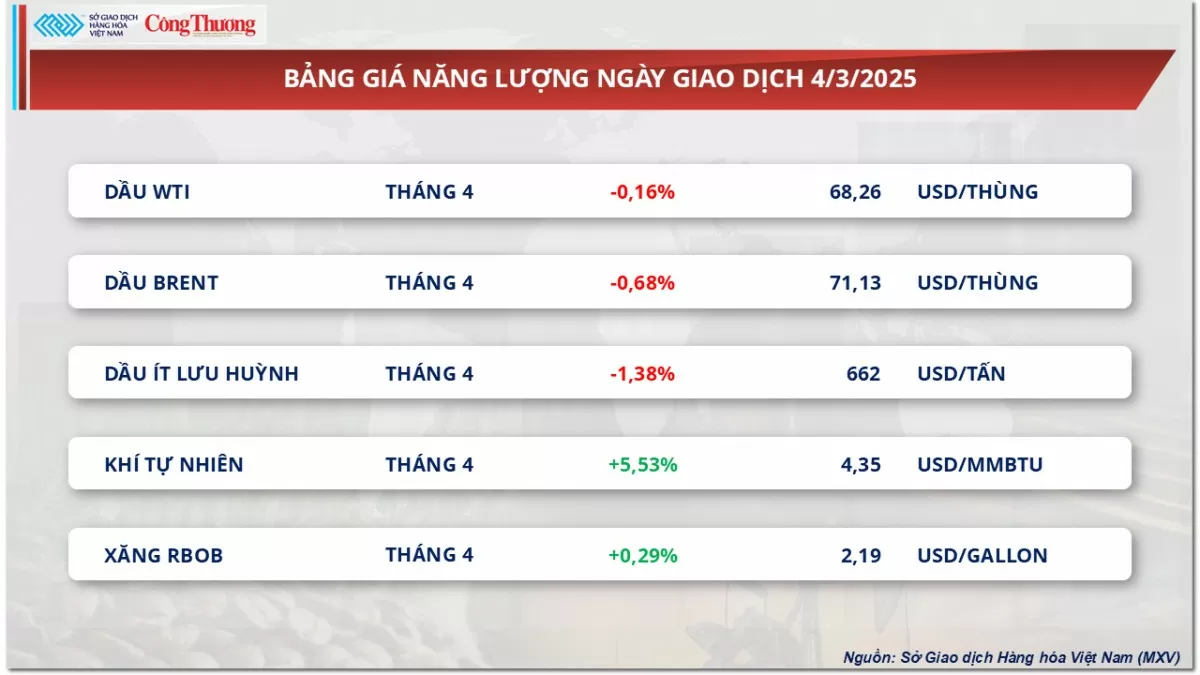

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-gia-bac-tiep-tuc-tang-len-3211-usdounce-376794.html

Comment (0)