Profits slide for 3 consecutive quarters

As a reputable unit operating in the field of foundation and underground construction, Fecon is currently on a long slide in business activities in 2023.

In the first quarter of 2023, the company recorded net revenue of VND 609.1 billion, gross profit of VND 122.9 billion. Profit after corporate income tax reached VND 2.8 billion. However, in return, the company recorded a loss after tax for parent company shareholders of up to VND 7 billion.

Entering the second quarter of 2023, net revenue reached 674 billion VND, gross profit 124.9 billion VND. Net profit from business activities decreased compared to the previous quarter, only 3.9 billion VND. Fecon lost after tax 1.4 billion VND in this quarter.

Fecon's profits decreased in the first 3 quarters of the year (Photo TL)

In the most recent third quarter of 2023, Fecon's revenue only reached 547.6 billion VND, down 17.6% over the same period. Gross profit was only 80.1 billion VND, causing the company to have a net loss from its main business activities of 655 million VND. At the end of the third quarter, Fecon only made a symbolic profit of 213 million VND, down 71.5% over the same period.

According to the company's explanation, the reason is that the construction time of large projects was extended, leading to high cost of capital and a decrease in the project's gross profit margin. In addition, the great impact of the interest rate increase at the end of 2022 caused interest expenses to increase while financial revenue did not increase correspondingly, causing profits in the period to decline.

Fecon's accumulated revenue in the first 9 months of the year reached 1,830.3 billion VND, while its after-tax profit was only 1.6 billion VND. The company has only completed 48.2% of its revenue plan and 1.2% of its annual profit plan.

Increasing debt, increasing pressure on interest costs

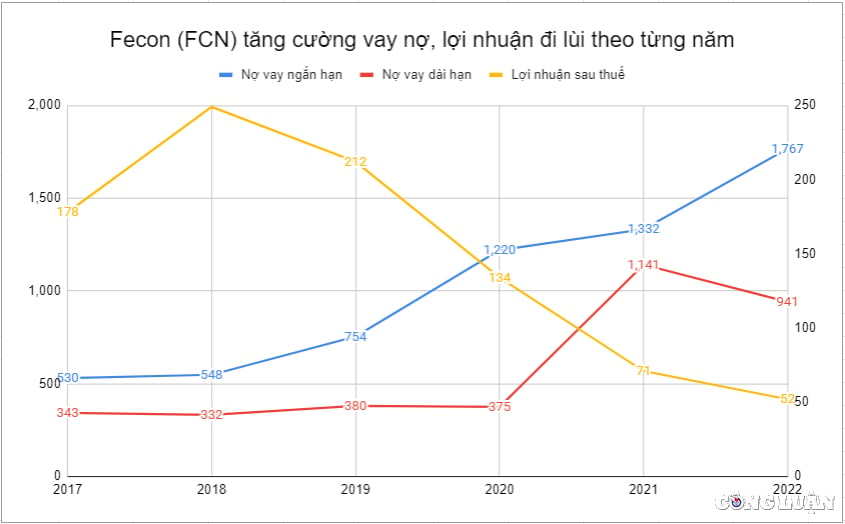

As Fecon explained in its Q3/2023 business results, the pressure of interest rates is currently affecting Fecon's profits. In fact, Fecon's short-term debt from 2017 to 2022 has been continuously escalating. The amount of short-term debt increased from 530 billion to 1,767 billion VND in just these 5 years.

At the end of the third quarter of 2023, the company's short-term debt continued to increase by 11.6%, recording VND 1,971.2 billion. Long-term debt decreased slightly to only VND 904 billion. However, total short-term and long-term debt still increased by VND 467 billion compared to the beginning of the year.

Debt has increased while Fecon's profits have decreased continuously over the past 5 years.

Increasing debt to expand business operations is not too strange. However, since 2018, with the increase in debt, Fecon's profits have only decreased, not increased.

In 2018, Fecon's after-tax profit was recorded at VND249 billion. In the following years, Fecon's after-tax profit continuously decreased to only VND52 billion in 2022.

By 2023, the business situation became even more gloomy when the company only recorded an accumulated profit of 1.6 billion VND, equivalent to completing 1.2% of the annual profit plan. If there are no unexpected developments, Fecon will almost certainly break its 2023 business plan.

Business is gloomy, will Fecon get bogged down with a series of new projects?

Pressure from increasing debt is causing profits to decline, Fecon has just won 4 more large contracts worth up to 500 billion VND including:

The package "providing, constructing mass piles and testing piles" at the Nhon Trach 3&4 power plant project with a total value of 179 billion VND; the package "constructing the southern diaphragm wall of station 11" worth more than 62 billion VND under the pilot urban railway project (metro line 3) of Hanoi City; a contract worth 75 billion VND at the Vung Ang II thermal power plant project (Ha Tinh); the package "constructing the section Km91+800 - Km114+200" worth 147 billion VND.

This has led many investors to wonder where Fecon plans to deploy capital to implement such large-scale newly-bid projects? Will the company get "bogged down" and profits continue to decline in 2024?

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)