In recent days, public opinion has been constantly stirred up by the developments and results of land auctions in suburban districts of Hanoi such as Thanh Oai and Hoai Duc, with a large number of registrations and the winning bids skyrocketing, dozens of times higher than the starting price. These developments and results raise a big question about whether or not there are signs of profiteering speculation?

Is the winning bid too high "abnormal"?

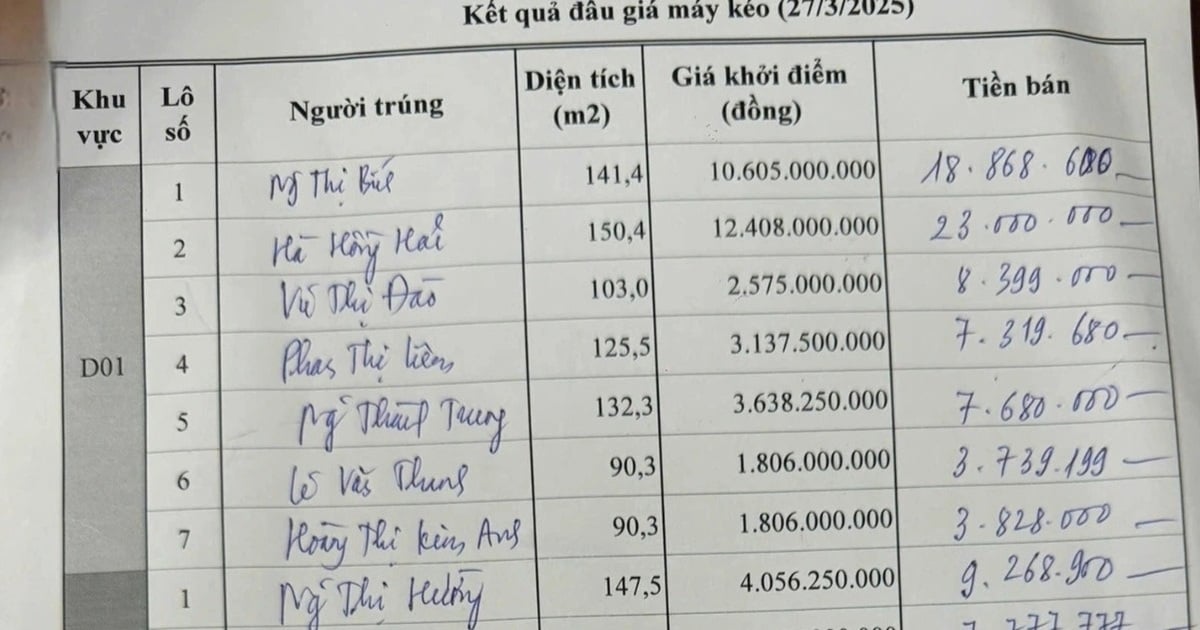

Accordingly, on August 10, Thanh Oai district successfully organized an auction of 68 land plots in Ngo Ba area, Thanh Than village, Thanh Cao commune (Thanh Oai, Hanoi), with areas ranging from 60m2 to 85m2 with starting prices from VND8.6 million/m2 to VND12.5 million/m2. The auction attracted 4,600 applications, but only 4,201 qualified applications from 1,545 people.

Notably, at the end of the auction, the corner lot with the highest winning price was nearly 100.5 million VND/m2, 8 times higher than the starting price. The regular lots had winning prices of 63-80 million VND/m2, 5 to 6.4 times higher than the starting price.

Public opinion is constantly buzzing about the developments and results of land auctions in suburban districts of Hanoi such as Thanh Oai and Hoai Duc. (Photo: VARS)

After the land auction in Thanh Oai district caused a stir in public opinion, recently, on August 19, the auction of 19 land lots in LK04 area, Long Khuc village, Tien Yen commune, Hoai Duc district, Hanoi continued to attract the attention and participation of many people.

19 plots of land were put up for auction, ranging from 74m2 - 118m2. The starting price for the auction was 7.3 million/m2. The deposit ranged from 109 - 172 million VND/plot.

After a 19-hour auction, 19 plots of land were successfully sold. The highest winning bid was 133.3 million VND/m2, nearly 20 times higher than the starting price, while the lowest lot was 91.3 million VND/m2, 12.5 times higher than the starting price.

VARS believes that the developments and results of these land auctions are both unusual and normal. Because nowadays, the line between normal and abnormal things seems to be no longer clear. The abnormal has become normal, and then it blatantly exists as an abnormal “normality”.

In fact, this is not a new phenomenon. In the first 6 months of 2024, while the land market in general was still quiet, some land auctions in some localities still attracted thousands to tens of thousands of participants, mainly investors. The auction results in some places also recorded winning prices 10 times higher than the starting price.

Explaining the reason, VARS said: Firstly, in the coming time, cash flow will certainly "pour" into auctioned land, in urban areas and residential areas when localities organize many auctions to boost budget revenue. Because this is a type of clean land, not involved in litigation disputes, with red books, infrastructure, ready to build houses for business, rent, and earn monthly cash flow.

Particularly attractive in the context of the recent years, Hanoi has had almost no new projects, the supply of land is also forecast to become increasingly scarce when the new Law on Real Estate Business prohibits the subdivision and sale of land in 105 cities and towns, forcing businesses to build houses on land for sale in these areas. Meanwhile, the demand for real estate, including the demand for buying for living and investment among people, is very strong and is constantly increasing.

Second, the price increased dozens of times, which sounds very unusual, but in fact it is due to the low starting price of the auctioned land. Specifically, previously, the regulations for determining land prices allowed the hiring of consultants.

The land auctioned at the August 10 auction in Thanh Oai district was also hired for consulting, the consulting determined the starting price from 40-45 million VND/m2. However, Decree 12 (Decree amending and supplementing a number of articles of Decree 44 guiding the implementation of the 2013 Land Law), currently Decree 71 (Decree regulating land prices, issued by the Government on April 27, 2024) has removed the regulation on hiring consultants, switching to determining by coefficient K multiplied by the city's land price list.

Meanwhile, according to Decision 46 dated July 18, 2024 of the Hanoi People's Committee, the land price adjustment coefficient of Thanh Oai district is 2.35. The current effective land price list issued in 2020 fluctuates between 3.6 - 5.3 million VND/m2. Therefore, when multiplying these two coefficients together, it only gives a price of 8.6 - 12.5 million VND/m2.

Safe products with low starting prices and low deposits (from 100 to 200 million VND) create great appeal to buyers. Therefore, it is not difficult to understand why this auction attracted thousands of registrations. Such a large number of participants is completely normal.

High taxes on land accumulation

VARs believe that this high winning price reflects the normal reality of the supply-demand gap, when the number of participating applications is many times greater than the number of land lots in the auction.

However, the fact that land prices in locations with unremarkable infrastructure and utilities, in a suburban area with the potential for normal price increases, are up to more than 100 million VND/m2, equal to land prices in urban areas and densely populated areas, is abnormal, far exceeding the actual value. It is the result of unhealthy purposes.

Specifically, many investors participating in these auctions are people with a "profession" in land auctions. They often participate with the "simple" purpose of "surfing", not caring about the real value, just winning and then buying and selling immediately to make a profit or are ready to forfeit their deposit if the market does not respond.

VARs proposes high taxes on land accumulation. (Photo: VS)

Or the more “dangerous” purpose is to create a land “fever”. These individuals take advantage of the auction deposit to inflate the prices of related land plots. They even disregard the risks, legalize the price by paying in full according to the winning bid, to use this price as a basis to stimulate land prices in outlying districts, causing land prices in many places to escalate, even to a virtual “fever”.

The consequence of these situations is that the already high real estate prices have increased even more, making the dream of owning a home increasingly distant for people, especially young people. The high auction prices "far exceeding" the real value not only cause difficulties for the appraisal of assets for subsequent auctions at the auction location but also in many places across the country.

Along with the spread of media, when seeing real estate prices maintain an upward trend for a long enough period of time, the FOMO (fear of being left behind) mentality will "rise", investors will expect prices to continue to increase, then make risky decisions.

This decision is also motivated by the perception that the adjustment of land price tables in the coming time in localities will indirectly push up land prices. As a result, many investors have their capital tied up, creating abandoned land, negatively affecting the recovery process, developing in a safe and healthy direction.

In order for auctions to be transparent and to increase budget revenue, the State needs to soon have additional mechanisms to control speculative activities. To solve the problem of speculation and price increases, thereby reducing urban housing prices, it is necessary to change people's thinking about housing, so that housing is a place to live, solving people's living needs, not an accumulated asset.

By imposing taxes on those who accumulate and speculate instead of those who buy real estate for living purposes or to organize production and business, the factor of accumulated assets will be reduced.

Tax rates may increase gradually for real estate transactions where the seller has a short holding period or if the real estate owner does not put the real estate into business activities or does not carry out construction after receiving the land...

Taxing real estate in the right direction will limit or eliminate the motivation for people to speculate in real estate because with interest costs and other opportunity costs, owning speculative real estate becomes riskier. Buying and selling real estate to make a profit, or creating virtual supply and demand to inflate real estate prices gradually becomes meaningless.

Idle money from the people will therefore be channeled into production and business sectors, creating products and added value for society. This will help the real estate market develop more healthily and effectively in the long term, instead of land fever and price turmoil.

Source: https://www.congluan.vn/de-xuat-danh-thue-cao-doi-voi-chu-dat-dau-gia-khong-su-dung-dat-post309107.html

![[Photo] Brazilian President visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/723eb19195014084bcdfa365be166928)

![[Photo] Prime Minister Pham Minh Chinh and Brazilian President Luiz Inácio Lula da Silva attend the Vietnam-Brazil Economic Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/f3fd11b0421949878011a8f5da318635)

Comment (0)