|

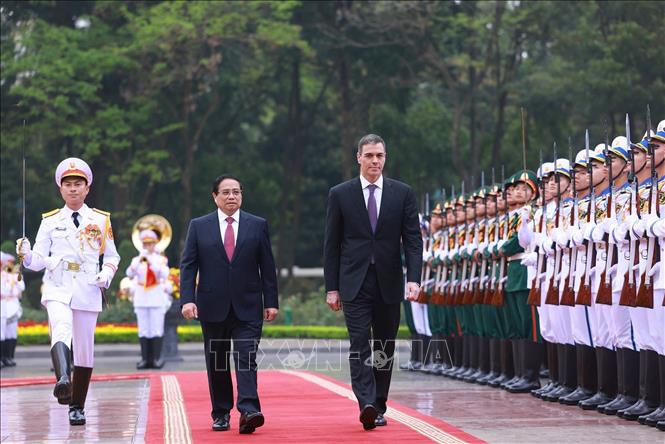

Vietnam will establish an investment support fund to encourage and attract strategic investors and multinational corporations. This is an important solution to ensure that foreign investment flows do not change direction. (Source: Investment Newspaper) |

Keep your promise to investors

Finally, the concerns and impatience of foreign investors were resolved when the National Assembly passed a Resolution on the application of additional corporate income tax in accordance with the regulations on preventing global tax base erosion right before the closing session of the 6th Session of the 15th National Assembly. Accordingly, Vietnam will implement the global minimum tax and apply the standard domestic minimum tax (QDMTT) of 15% from 2024.

And more importantly, in the Resolution of the 6th Session, the 15th National Assembly agreed in principle, assigning the Government in 2024 to develop a Draft Decree on the establishment, management and use of the Investment Support Fund from global minimum tax revenue and other legal sources to stabilize the investment environment, encourage and attract strategic investors, multinational corporations and support domestic enterprises in a number of areas requiring investment incentives, and report to the National Assembly Standing Committee for comments before promulgation.

This means that, in parallel with additional tax collection, Vietnam will implement additional incentive policies to retain and attract foreign investors, especially the "big guys".

Thus, the Government has kept its promise to foreign investors. Earlier this year, at the Vietnam Business Forum (VBF), the investor community had many recommendations on the issue of implementing global minimum tax. What they wanted to know was a clear message and policy responses from the Vietnamese Government regarding the implementation of global minimum tax.

At that time, Prime Minister Pham Minh Chinh said that the Government was closely following reality and referring to the experiences of other countries to soon have a suitable policy on global minimum tax, striving to issue it this year, creating opportunities for foreign enterprises to operate smoothly and contribute more to Vietnam, but without affecting the interests of investors.

The same message has been repeatedly emphasized by Minister of Planning and Investment Nguyen Chi Dung. According to the Minister, Vietnam will prepare new incentive policy packages to support investment in the context of the global minimum tax being applied in 2023, in order to increase the competitiveness of the investment environment and harmonize the interests of all parties.

And now, that promise has been fulfilled. Although there is still much work to be done, especially in the drafting of the Decree on the establishment, management and use of the Investment Support Fund, the quick steps of the Government and the National Assembly of Vietnam can be said to have made an important contribution to building trust among foreign investors.

Keep capital unchanged

Earlier this year, when discussing this issue, Ms. Dao Thi Thu Huyen, Deputy General Director of Canon Vietnam, said that one of the reasons why Canon invested in large-scale production in Vietnam was to enjoy tax incentives. Therefore, if Vietnam does not have timely countermeasures against the application of global minimum tax, it is very likely that the Group will consider allocating production to another base with a more competitive advantage.

And not only Canon, many other “big guys” have also mentioned that if the global minimum tax is implemented, their competitiveness in Vietnam will decrease. And this could lead to the withdrawal of investments from Vietnam by the parent corporation.

It is very clear that if investment incentives are “disabled”, while other countries are willing to provide additional incentives, for example in cash, Vietnam will “lose steam” not only in competing to attract new investment, but also in expanding investment. Even the risk of shifting production to other countries is not impossible.

Therefore, in order to retain and continue to attract foreign investment, so that capital does not change its flow, it is necessary to quickly develop a Draft Decree on the establishment, management and use of the Investment Support Fund. Along with that, as the Resolution of the National Assembly, it is necessary to conduct a comprehensive review to complete and synchronize the system of policies and laws on investment incentives, meeting the requirements of national development in the new situation.

In fact, right before the Draft Resolution on the application of additional corporate income tax under the regulations on preventing global tax base erosion was passed, when reporting and clarifying, Mr. Le Quang Manh, Chairman of the National Assembly's Finance and Budget Committee, said that the Government has not yet made a comprehensive assessment of the incentive system and investment incentives, including incentives through corporate income tax and non-tax measures to develop alternative plans after the global minimum tax is applied.

In addition, the Corporate Income Tax Law has not been amended and this will affect new investors. Therefore, in the long term, the measure that needs to be taken is to quickly amend the Corporate Income Tax Law. At the same time, there needs to be new investment support policies to replace ineffective tax incentives so that investors can feel secure about the investment environment in Vietnam; thereby attracting large, strategic investors and supporting domestic enterprises.

From another perspective, expert Tran Hoang Ngan said that, in addition to considering additional incentives, including financial incentives, to attract and retain foreign investors, it is necessary to continue investing in upgrading the national socio-economic infrastructure; supporting human resource training, especially high-quality human resources in the fields of high technology and green economy; supporting and facilitating administrative procedures. These are issues that foreign investors are very interested in.

Source

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)