According to the financial report of the fourth quarter of 2024 of Bao Viet Group (stock code: BVH), this enterprise invested more than 231,000 billion VND in finance, equivalent to 9.1 billion USD converted. Of which, short-term financial investment reached nearly 104,000 billion VND and long-term investment was worth more than 127,000 billion VND.

What is Bao Viet Group's investment portfolio?

Short-term financial investments include trading securities and investments held to maturity.

In trading securities, the company holds a portfolio worth VND3,660 billion, an increase of nearly VND400 billion compared to the same period last year. Of which, stocks account for VND3,287 billion, fund certificates account for VND292 billion and bonds account for VND81 billion.

The company is holding stocks such as ACB with VND810.6 billion, CTG with VND387.7 billion, VNM with VND416.1 billion, VNR of Vietnam National Reinsurance Corporation with nearly VND266 billion. The investment in these stocks has not changed compared to the previous year. In addition, the company holds stocks of other listed companies worth VND1,326 billion.

Bao Viet also holds more than VND80 billion in unlisted stocks, including VND28.8 billion of MBLand Corporation, VND24 billion of Ca Mau Seafood Joint Stock Company and VND27.2 billion of other companies.

The fund certificate portfolio is all from units in the Bao Viet ecosystem such as BVPF, BVBF, BVFED, along with other fund certificates such as E1VFVN30.

In terms of bond investment, Bao Viet mainly holds bonds of HDBank with more than 50 billion VND, the rest are bonds of other units. In 2023, Bao Viet's financial report showed that this enterprise held bonds of a series of other units such as 3C Computer - Communication - Control Joint Stock Company, Phu Quoc Tourism Investment and Development Joint Stock Company, TNS Holdings Trading and Service Joint Stock Company, Bao Viet Commercial Joint Stock Bank, but by the end of 2024, according to the financial report, they no longer existed.

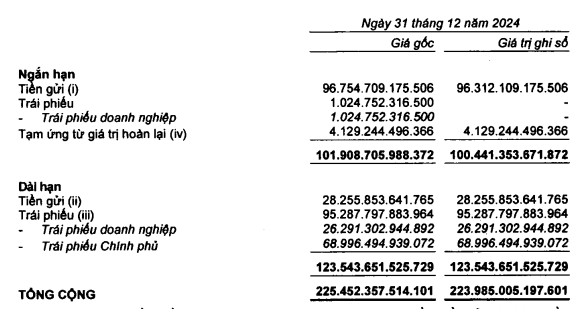

The investment held to maturity is worth VND100,441 billion. This includes VND96,312 billion in short-term bank deposits with an original term of over 3 months and a maturity of no more than one year, with an interest rate of up to 10.4% per year. Along with that is VND4,129 billion in advances from the redemption value.

Bao Viet's held-to-maturity investments (Screenshot).

Bao Viet's long-term financial investment is worth VND 127,648 billion by the end of 2024.

Of which, deposits account for VND28,256 billion. The explanation shows that this amount receives interest rates from 4.8%/year to 9%/year.

Bonds accounted for VND95,288 billion, including VND26,291 billion of corporate bonds and VND68,996 billion of government bonds. The bonds have interest rates of up to 8.9%/year.

The remaining VND 2,887 billion is invested in joint ventures and associates and VND 1,279 billion is contributed capital to other units. Of which, Bao Viet is investing the most in BAOVIET Bank (VND 1,913 billion), Trung Nam Phu Quoc (VND 431 billion), Tokio Marine Vietnam (VND 315 billion), SSG Group (VND 225 billion), International Finance Tower Project (VND 170 billion), VEAM (VND 293 billion)...

How does Bao Viet Group do business?

In the fourth quarter of 2024, the original insurance premium revenue was nearly VND 11,200 billion and the reinsurance premium was VND 66 billion, almost unchanged compared to the same period last year. The reinsurance ceding cost was VND 861 billion, up 2%, causing the net insurance revenue to decrease by 1%, to VND 10,500 billion.

Revenue from financial activities recorded VND 12,684 billion, down 6.34% compared to 2023.

Bao Viet's compensation costs in the last quarter of last year decreased by 8%, other costs decreased by 13% and large fluctuation reserves decreased by 80%, causing total insurance business costs to decrease more sharply than revenue, with a decrease of 9% compared to the same period.

The company's insurance business returned to gross profit of nearly VND56 billion, a positive change compared to the gross loss of VND839 billion in the same period. Bao Viet reported net profit of more than VND536 billion, up 27% over the same period.

Insurance business gross loss decreased, Bao Viet's whole year net profit increased by 17% (Illustration photo: Tien Tuan).

In 2024, Bao Viet earned more than VND 2,085 billion in net profit, up 17% over the previous year. Gross loss from insurance business activities decreased sharply by VND 1,558 billion, to a loss of nearly VND 981 billion, thanks to insurance costs decreasing more sharply than revenue and financial operating profit remaining the same compared to the same period, approximately VND 10,600 billion.

In 2024, Bao Viet set a target of after-tax profit of VND 1,150 billion, an increase of 3% compared to 2023. Thus, the group achieved 103% of the plan.

High-level personnel changes at Bao Viet Group

Previously, the extraordinary annual general meeting of shareholders of Bao Viet Group held on December 26, 2024 approved the contents of adding members to the Board of Directors for the 2024-2029 term.

Specifically, the list of candidates appointed to the Board of Directors of Bao Viet Group for the 2024-2029 term includes 10 members. Of which, Ms. Tran Thi Dieu Hang still holds the position of Acting Chairwoman of the Board of Directors.

There are 2 newly elected members of the Board of Directors, Mr. Nguyen Quang Phi and Mr. Nguyen Thua Nhat. In addition, Bao Viet Group added 3 independent members to the Board of Directors, Mr. Duong Tri Thanh, Mr. Trinh Hong Quang and Ms. Ngo Thi Thu Trang.

Bao Viet Group also approved the dismissal of Mr. Kazuhiko Arai from the position of Member of the Board of Directors from December 26, 2024 due to the end of his term.

Previously, on November 27, 2024, Bao Viet Group announced a change in senior personnel, in which the positions of Acting Chairwoman of the Board of Directors and Acting General Director were assigned to Ms. Tran Thi Dieu Hang and Mr. Nguyen Xuan Viet until the personnel were completed.

Along with that, Bao Viet Group dismissed Mr. Nguyen Dinh An, Member of the Board of Directors, from the position of Acting General Director, and appointed him as Vice Chairman of the Board of Directors from November 27, 2024 until the personnel is completed.

Another important change that was also approved was the change of the head office address from No. 8, Le Thai To Street, Hang Trong Ward, Hoan Kiem District, (Hanoi) to No. 7, Ly Thuong Kiet Street, Phan Chu Trinh Ward, Hoan Kiem District (Hanoi).

By the end of 2024, Bao Viet Group will have a charter capital of VND 7,423 billion. The two founding shareholders are the Ministry of Finance and the State Capital Investment Corporation (SCIC). The strategic shareholder is Sumitomo Life. Bao Viet's joint venture company is Tokio Marine Vietnam. The company has 5 affiliated companies: BAOVIET Bank, Bao Viet SCIC, Long Viet, Trung Nam Phu Quoc, PLT.

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

Comment (0)