Multinational companies paid a record nearly $327 billion in dividends in the first quarter, helped by generosity from the financial and oil and gas sectors.

The global economy may be slowing, but dividends paid by multinational companies are not, according to a study by UK asset management firm Janus Henderson, released on May 24. Specifically, the total amount of dividends paid by companies globally in the first quarter of 2023 reached a record $326.7 billion, up 12% compared to the same period in 2022.

The strong growth is due to a strong 2022 for many companies, such as banks, which are benefiting from rising interest rates, along with oil and gas companies. However, Janus Henderson said it was also due to the size of the $28.8 billion in special dividend payments, the highest in a quarter since 2014.

Maersk containers in Algeciras, Spain, January 19. Photo: Reuters

One example is the $11.7 billion dividend paid by shipping giant Maersk after a year of extraordinary profits, which puts the Danish conglomerate at the top of the world’s dividend payers, ahead of mining giant BHP (UK) and pharmaceutical company Novartis (Switzerland).

Another example is Volkswagen’s $6.3 billion payout following Porsche’s IPO. These special dividends were more than enough to offset the mining giant’s 20% dividend decline. Falling metal prices and an uneven recovery in China have been a drag on earnings.

BHP and Rio Tinto both cut their dividends earlier this year. Elsewhere, sportswear company Adidas AG cut its dividend. Swedish real estate company SBB even suspended its dividend, signaling turmoil in the sector.

In Q1, Europe saw dividend growth of 36% compared to the same period in 2022, more than four times the growth in North America (8.6%) and more than double the growth in Japan (17.7%). Europe was also home to 96% of dividend payments that increased or remained stable in the first three months of the year.

However, Janus Henderson expects dividend growth to slow in the coming period. The risk of recession is rising in Europe and the US, as central banks' interest rate hikes appear to be peaking. Companies with solid balance sheets, growing earnings and expansion potential are favoured.

Conversely, it is uncertain whether some companies that have been generous with dividends will be able to do so in more difficult times. Recent banking woes, for example, have also made investors wary of the financial sector.

The concern now is how sustainable growth can be for companies that pay high dividends, said Luke Barrs, CEO of Goldman Sachs Asset Management. While dividends are a valuable asset, the only way companies can maintain that over time is by continuing to grow their underlying operating earnings, he said.

In addition, inflation, higher financing costs and weaker economic conditions in some places will certainly weigh on shareholder returns, not just dividends. “After two years, almost all the low-hanging fruit from the pandemic recovery has been realized,” said Ben Lofthouse, head of research at Janus Henderson.

Still, the momentum in the first quarter and the size of the special dividend prompted Janus Henderson to raise its full-year forecast, now expecting total dividends in 2023 to be $1.64 trillion, up 5.2% from 2022.

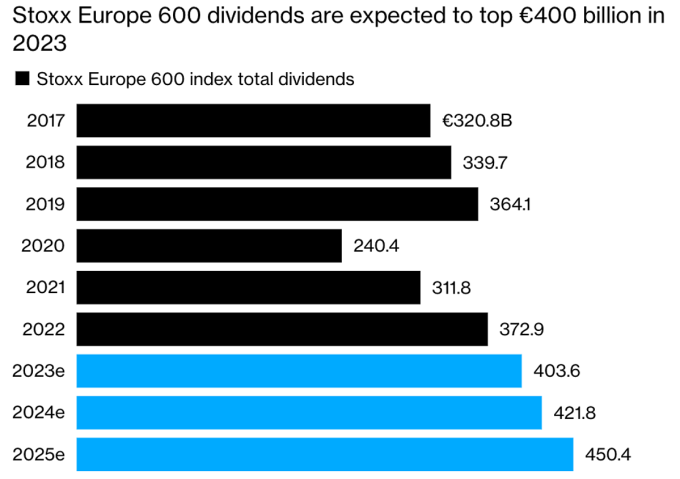

Total dividend payments of Stoxx Europe 600 companies over the years and forecasts for 2023, 2024, 2025. Unit: billion euros. Source: Bloomberg

Similar to the first quarter performance, Europe is expected to continue to increase dividend payments in the second quarter. According to Bloomberg forecasts, European companies are on track to achieve their largest annual dividend payouts ever. Companies in the Stoxx Europe 600 are expected to pay as much as 400 billion euros ($432 billion) in dividends by 2023.

Phien An ( according to Le Monde, Bloomberg )

Source link

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)