Vietnam Dairy Products Joint Stock Company (Vinamilk, stock code: VNM) recently announced that it will hold its 2025 Annual General Meeting of Shareholders on April 25 in the form of an online meeting.

In the meeting documents, the Board of Directors submitted to the General Meeting of Shareholders for approval the cash dividend payment level in 2024 at 43.5% of par value, equivalent to VND 4,350/share, an increase of 5% (ie VND 500) compared to the level approved at the General Meeting of Shareholders in 2024.

On the stock market, Vinamilk is one of the few businesses that pay high cash dividends, around 40%.

Thus, with more than 2.08 billion VNM shares in circulation, it is estimated that the total amount Vinamilk will pay in dividends in 2024 is more than VND 9,400 billion.

Previously, Vinamilk had provisionally paid 2024 dividends at a rate of 20% in September 2024 and February 2025 with an amount of VND 4,180 billion. Thus, the remaining amount that Vinamilk will spend is more than VND 5,220 billion.

Vinamilk's revenue over the years

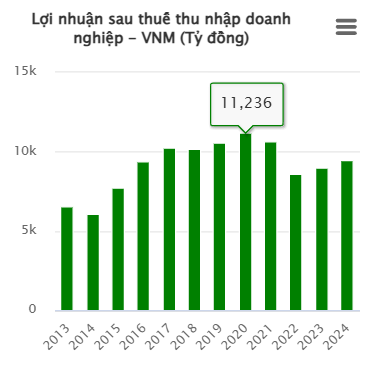

Vinamilk's after-tax profit over the years

Accordingly, the General Meeting of Shareholders assigned the Board of Directors to decide on the dividend level and the time for payment of the remaining dividends in 2024 within 6 months from the date of closing of the General Meeting.

At the congress, Vinamilk will dismiss Mr. Lee Meng Tat and Mr. Hoang Ngoc Thach from the Board of Directors from April 25, 2025.

Thereby, the congress will also elect two additional members of the Board of Directors for the 2022-2026 term.

Mr. Lee Meng Tat is the representative of foreign shareholder F&N Dairy Investments, which is holding 17.69% of the company's capital.

F&N Dairy Investments Pte. Ltd is an investor in the beverage group of Thai billionaire Charoen Sirivadhanabhakdi and this enterprise began investing in Vinamilk since 2005.

Mr. Hoang Ngoc Thach is a representative of the State Capital Investment Corporation (SCIC), the enterprise holding 36% of Vinamilk's capital.

Regarding business situation, in 2024, Vinamilk will achieve revenue of VND 61,824 billion, an increase of 2.2% compared to 2023 and profit after tax of VND 9,453 billion, an increase of 4.8% over the same period.

In 2025, Vinamilk plans to continue growing with revenue of VND 64,505 billion, up 4.3% and profit after tax of VND 9,680 billion, up 2.4%.

If the plan is completed as planned, Vinamilk will maintain a 4-year streak of continuous revenue and profit growth from 2022.

Source: https://nld.com.vn/vinamilk-muon-nang-co-tuc-tien-mat-nam-2024-196250329152849332.htm

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

Comment (0)