International experts believe that the gold market will fall to $2,680/ounce due to concerns about tax and tax cut policies after Mr. Trump is elected.

Gold market fluctuates strongly after US presidential election

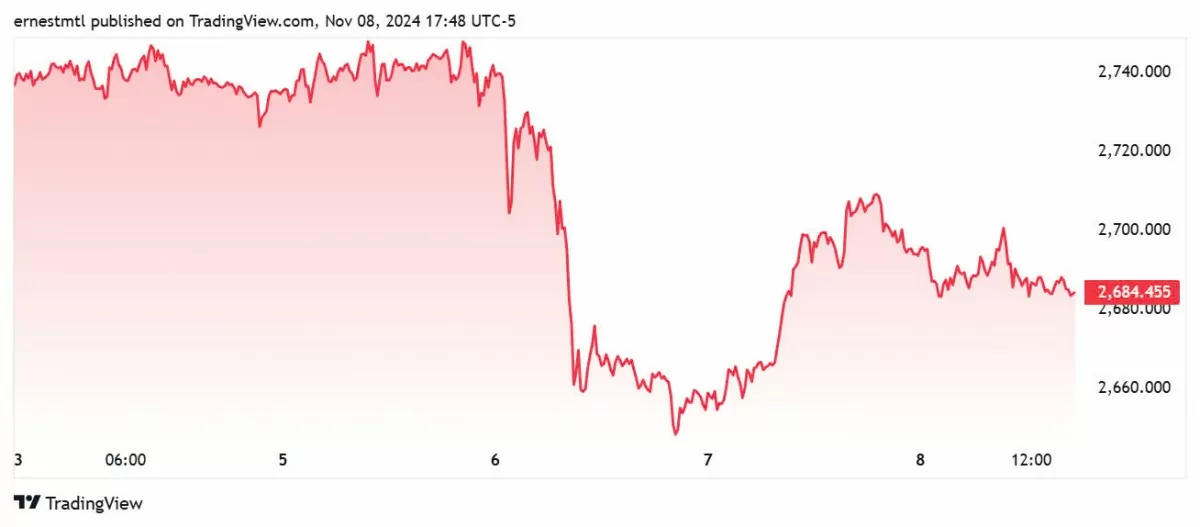

The US presidential election had a strong impact on the markets this week, including the gold market. Surprisingly, the election results were announced very quickly, gold prices fell sharply and made traders anxious about the next direction of gold.

Spot gold started the week at $2,739.34 an ounce. Prices traded in a narrow $20 range for the first half of the week, from a low of $2,726 to a high of $2,748 on Election Day morning.

|

| The gold market has been volatile over the past week. Photo: Kitco News |

The reason for the sharp drop in gold prices came around 1 a.m. ET on Wednesday, when key swing states began to be declared in favor of Republican nominee Donald Trump, making vice presidential candidate Kamala Harris’ chances of winning virtually nonexistent.

Spot gold responded by falling from $2,739 an ounce to $2,700. After a brief recovery to $2,730 an ounce, prices eventually fell sharply and broke support, falling to $2,659 an ounce when North American markets opened on Wednesday morning.

Gold prices attempted to recover in the late morning, rising to a high of $2,676 an ounce but then continued to fall as the trading day progressed. Gold prices then hit a low of around $2,648 an ounce for the week.

|

| Recent developments in world gold prices. Photo Kitco News |

The following day, gold prices began to rise more steadily as the dollar and bond yields retreated from post-election highs. Gold hit resistance at $2,700 an ounce twice in North American trading before falling to $2,690 after the Federal Reserve announced an expected 25 basis point interest rate cut.

But the story of the week was not over. During a press conference following the Federal Open Market Committee (FOMC) meeting, a tense exchange between Fed Chairman Powell and reporters sent gold prices soaring to $2,707 in a matter of minutes. After two failed attempts to break $2,710, gold fell to $2,680, where it remained through Friday’s trading session.

What do experts predict will be the price of gold next week?

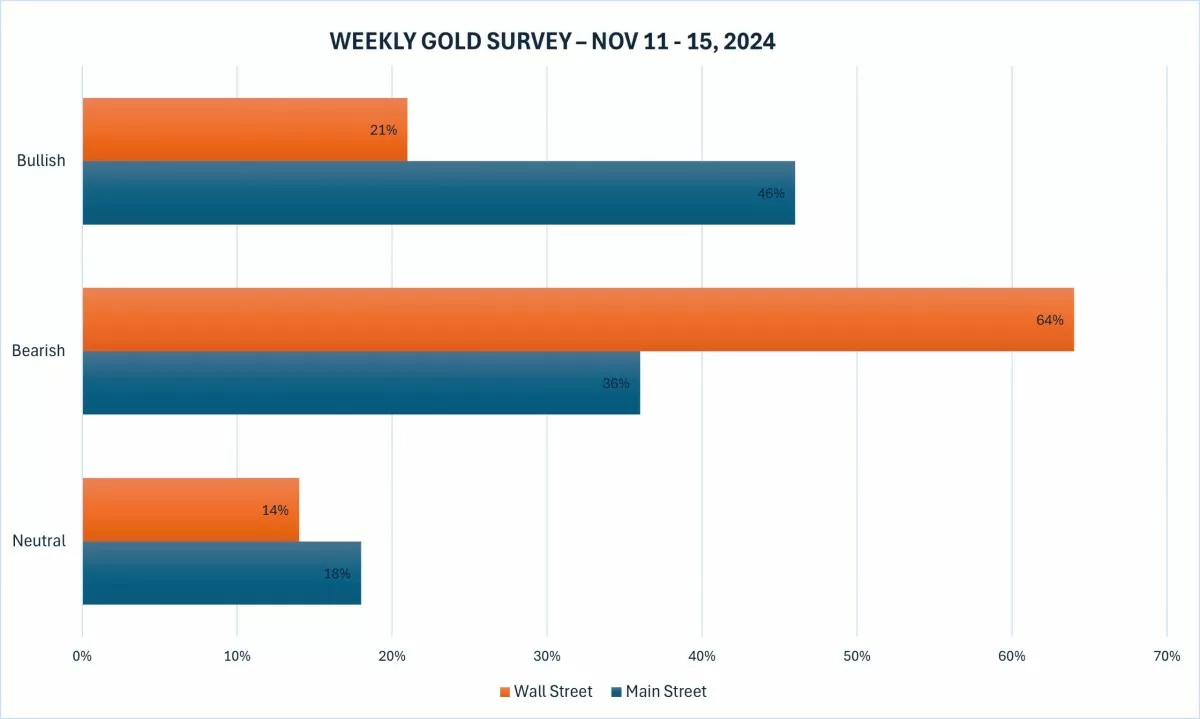

The latest Kitco News weekly gold survey shows that sentiment among industry professionals as well as retail traders has turned quite bearish after many months.

|

| Latest Kitco News Weekly Survey. Photo: Kitco News |

Darin Newsom, senior market analyst at Barchart.com, said prices will fall: " While I think the market will find some new long-term hedging from investors, December futures have yet to break out of their near-term downtrend on the daily closing chart. This opens up the possibility of further declines early next week. It is interesting to note that December gold futures found some support near the previous closing high of $2,676.30 (October 11) this week, having posted a daily closing low of exactly $2,676.30. Perhaps it is just a technical anomaly, but interesting nonetheless ."

According to David Morrison, senior market analyst at Trade Nation, technical charts show that gold will fall further.

" Gold prices fell on Wednesday as Trump was elected US President. Much of the sell-off was likely due to the surge in the US dollar following the news. This was likely due to a sharp rise in bond yields as investors feared that the tax cuts and tariffs Trump promised would lead to a surge in inflation ," said David Morrison.

Since then, the US dollar and bond yields have returned to more reasonable levels, Morrison said. " Gold prices remained in the $2,635-$2,675/oz range, which was resistance in the last week of September and the first week of October. Gold prices tried to break back above $2,700/oz but failed to hold. Instead, gold prices fell in Asia-Pacific trading before finding support at $2,680/oz ."

" Silver is also under pressure despite trying to push above $31 an ounce ," Morrison noted. " It will be interesting to see how both gold and silver perform in the coming week. Will the uptrend be re-established or should traders prepare for another pullback? Looking at the daily MACD lines on both metals, we see momentum to the downside."

" Prices will go lower ," said Adam Button, chief currency strategist at Forexlive.com. " I think there will be some post-election correction, but I will be watching closely for signs of who will be the next Treasury Secretary. Trump nominated Mnuchin on November 29 and Biden picked Yellen on November 23. So maybe not next week but soon, if the nominee is John Paulson, a big gold speculator, I expect gold prices to rise ."

On the contrary, James Stanley, senior market strategist at Forex.com, sees gold prices going up: " Gold prices look shaky after the election, but could rally to $2,650/oz on the spot and push back to $2,700/oz. Normally, I would be bearish on a price situation like this, but given how strong gold has been this year, I'm not ready to reverse ."

Source: https://congthuong.vn/chuyen-gia-pessimistic-ve-tinh-hinh-thi-truong-vang-trong-tuan-toi-357887.html

Comment (0)