Dragon Capital experts say monetary policy and the economy are bright, if corporate profits recover, the stock market will have a 30% increase.

In a recent investor meeting, Mr. Le Anh Tuan - Director of Securities of Dragon Capital Investment Fund (DCVFM), said that this year's stock market has more advantages than before, from monetary policy, macroeconomic stability to growth momentum. According to him, the market has gathered almost all the factors for growth, just waiting for the only "east wind" which is the growth of corporate profits.

"If corporate profits recover by about 20%, the stock market will certainly have a 30% increase," Mr. Tuan predicted.

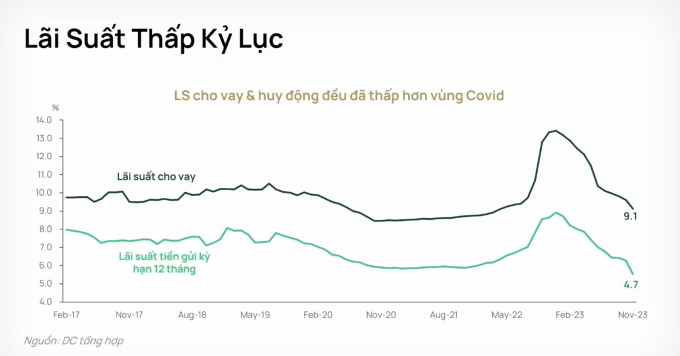

Regarding monetary policy, this expert believes that lending and deposit interest rates at lower levels than during the Covid-19 period and at record lows are the leading indicators. In the next 4-5 months, DCVFM expects interest rates to decrease by another 50 percentage points. The basis for the above forecast is that there is still room for adjustment when the operating interest rate is higher than inflation and in the coming time, the story of economic growth is more interesting.

In addition, the world is leaning towards the scenario that the US Federal Reserve (Fed) may cut interest rates 6-7 times this year, instead of just 3-4 times as previously forecast. In addition, from the end of 2023, for the first time, the number of central banks in the world cutting interest rates has been higher than the number of raising interest rates. This will be a driving force to support Vietnam's loosening monetary policy.

"In such a loose monetary policy environment, we should not expect sharp drops of 10-15% in the stock market," the expert said.

Interest rates for loans and 12-month deposits are currently at 9.1% and 4.7%, respectively, lower than during the Covid-19 period. Source: DCVFM

Regarding stability, Mr. Tuan highly appreciated the indicator of exchange rate fluctuations. DCVFM forecasts that the USD/VND exchange rate will fluctuate within the range of 3% this year, a normal level that is not worrisome, showing a certain stability of the economy. This scenario is given when the exchange rate gap between the black market and the bank is not high, and Vietnam's foreign exchange reserves are also at a large level (about 100 billion USD).

Regarding the economic recovery rate, DCVFM assessed that there has been a clearer recovery this year. This unit based on the indicator of the number of exported containers, which has increased consecutively in the last two quarters of the year, with the fourth quarter increasing by more than 10% (but compared to the very low base level last year). In addition, electricity consumption demand - an index that helps reflect production and business activities - has also increased, although still weak compared to the previous period. The indicators of air passenger volume and consumption also bottomed out from the second quarter of 2023 and started to increase at the end of the year...

According to Mr. Le Anh Tuan, Vietnam's economy is currently entering a recovery cycle. Statistics from domestic and international historical data of DCVFM show that in this cycle, investors can earn a profit of about 20% from the stock market. This performance level is higher than the period when the economy was in a prosperous period. In the recovery cycle, industries with large fluctuations such as goods and financial services, real estate, non-essential consumption, information technology, industry and raw materials are often the beneficiaries. In contrast, essential consumer goods, healthcare, energy, communications and utilities (electricity, water) are not prioritized.

Not only Dragon Capital, many other securities companies and analysis units also believe that the market will be brighter this year. Most units forecast that the VN-Index could reach around 1,300 points, or even more optimistically, 1,400 points, an increase of 15-25% compared to the end of last year. The main arguments for the forecasts of all parties also come from the low interest rate level and the expectation of increased corporate profits.

MB Securities (MBS) forecasts that market net profit will increase by 16.8% year-on-year, mainly supported by the recovery of the banking, construction materials, retail and consumer sectors. The market's profit peak will be in the last quarter of this year, mainly due to the low base of the same period in 2023.

With a similar forecast, KB Securities Vietnam (KBSV) expects 2024 to be the period when production and business activities will return to recovery momentum in most industry groups with the EPS (earnings per share) growth rate of the whole market possibly reaching 16.4%.

According to KBSV, the recovery trend of profit levels may be clearer in 2024 based on the low base level of the previous year, the support policies of the Government and the State Bank on promoting public investment, lowering interest rates starting to permeate into the business results of enterprises, a brighter picture for Vietnam's macro developments and expectations for a "soft landing" of the US economy.

Siddhartha

Source link

Comment (0)