Vietnam's stock market had the strongest increase in Asia today, when the VN-Index increased sharply to nearly 1,270 points.

The strongest increase in more than 3 months

Today's session (December 5) witnessed a breakthrough in the Vietnamese stock market when the VN-Index increased by more than 27 points, returning to the 1,260-point zone, closing the session at 1,267 points. The entire HOSE floor had 347 stocks increasing, 6 times higher than the number of stocks decreasing.

This is also the session that marked the strongest increase in the past 3 and a half months.

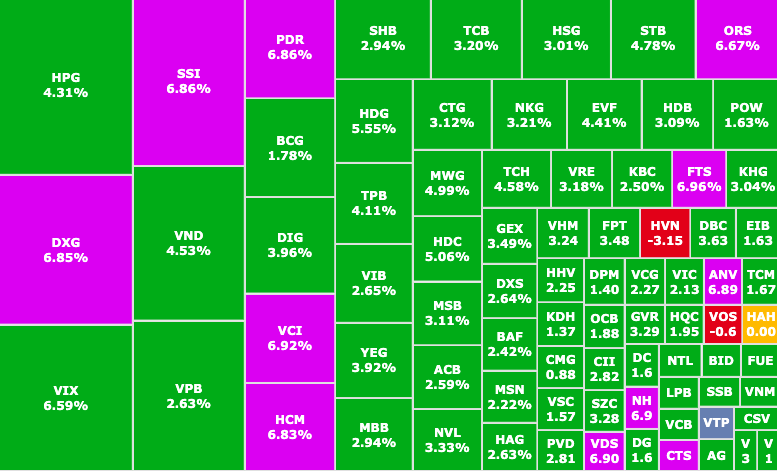

The rapid development appeared in the afternoon session, the "green color" from large stocks spread throughout the market, starting from the securities and banking groups, followed by real estate, steel, chemicals, fertilizers, information technology and retail.

The VN30 index reached an increase of nearly 40 points, of which 29 codes increased, only 1 code decreased, which was BVH (Bao Viet Group, HOSE).

Large-cap stocks lead the market to surge (Photo: SSI iBoard)

The group of securities stocks with the best performance today after a long period of adjustment, with many even hitting the ceiling, includes: SSI (SSI Securities, HOSE), VCI (Vietcap Securities, HOSE), HCM (HCMC Securities, HOSE), VIX (VIX Securities, HOSE),...

Liquidity has since recovered strongly, returning to the threshold of 21,000 billion VND after a long period of stagnation since October.

Today's positive results partly came from foreign investors as they continued their net buying streak, with VND760 billion in the entire market, concentrated in the HPG (Hoa Phat Steel, HOSE), FPT (FPT, HOSE) and MSN (Masan, HOSE) groups, creating momentum for large-cap stocks. At the same time, helping to spread positive sentiment throughout the market.

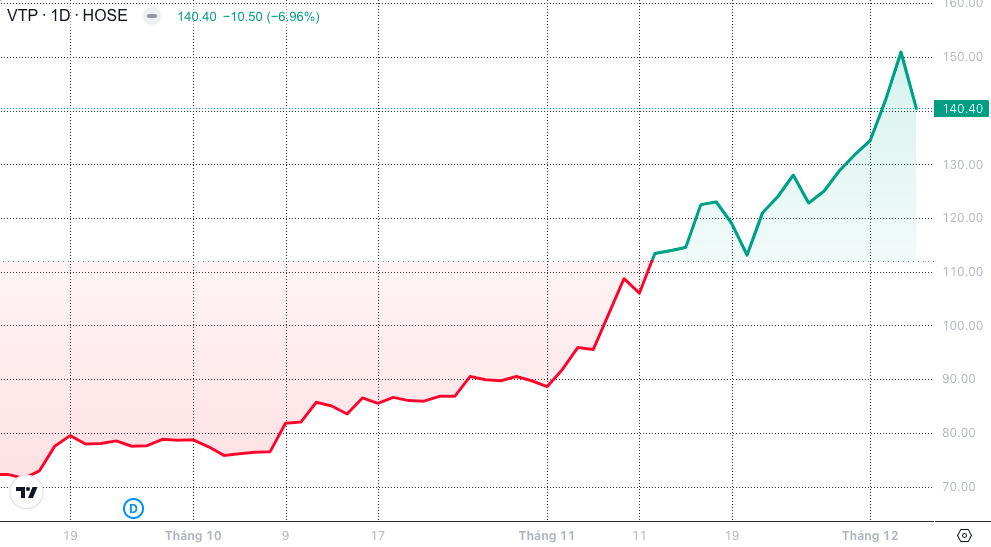

However, going against the trend, 'Viettel family' stocks turned around and fell sharply.

While HVN decreased by 3.15%, to a market price of VND26,150/share, a series of Viettel stocks were under pressure to take profits.

VTP hit the floor due to profit-taking pressure (Photo: SSI iBoard)

Specifically, VTP (Viettel Post, HOSE) dropped to the floor by 7%, to 140,000 VND/share. VGI (Viettel Global, HOSE) dropped by 3.6%, to 88,200 VND/share. Finally, CTR (Viettel Construction) dropped by 2.6% to below 130,000 VND/share.

This move is believed to come from profit-taking pressure after the strong increase of Viettel stocks in recent times. Notably, VTP recorded an increase of more than 60% in the past month.

The total capitalization of Viettel's 3 stocks quickly "evaporated" more than 11,700 billion VND in today's session. Of which, VGI alone lost more than 10,000 billion VND, but this still did not "shake" Viettel Glonal's position as the top enterprise with the largest capitalization on the floor.

Differentiation will tend to increase in the coming time.

Explaining today's developments, Mr. Dang Van Cuong, Head of Investment Consulting, Mirae Asset Securities, said that the market is receiving positive signals from external factors.

First is the news about Vietnam's emerging market upgrade from FTSE, showing a clearer roadmap, creating expectations for foreign capital participation when the upgrade is completed. In addition, the large-scale net buying action of foreign investors reached more than 666 billion VND in today's session, focusing on large-cap stocks, which pushed the market's excitement to a climax.

Therefore, according to Mr. Cuong, the market has never lacked cash flow; what is lacking is whether the reason is good enough and convincing enough to promote cash flow more strongly.

Investment opportunities will be based on forecasted Q4/2024 and full-year 2025 business results.

The unexpected breakthrough today has significantly improved investor sentiment, opening up opportunities for the market to continue its upward momentum. However, the divergence will tend to increase more clearly in the coming sessions.

Currently, there is nothing new in the macroeconomic information, economic figures are still on track, so the forecast of business results in the fourth quarter of 2024 and the whole year of 2025 will be the argument for investment opportunities and the destination of cash flow.

In particular, opportunities may come from industries with stories such as retail, thanks to the recovery of the general purchasing power of the market; the materials industry thanks to the recovery of prices and output when many public investment projects are deployed and accelerated to completion.

Differentiation will not only occur between economic sectors in the market but also between individual companies in the industry, so investors need to analyze and select carefully.

In addition, some other opinions say that investors should take advantage of the opportunity to take profits on stocks that have reached their target price.

Source: https://phunuvietnam.vn/vn-index-tang-vot-gan-30-diem-nha-dau-tu-nen-lam-gi-20241205174318898.htm

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)