World rubber prices continue to rise

According to information from the latest Agricultural-Forestry-Fisheries Market Bulletin issued on February 29 by the Import-Export Department (Ministry of Industry and Trade), in February 2024, rubber prices at key trading floors in Asia increased compared to the previous month, the market was supported by high crude oil prices, increased demand from China and weather concerns in the leading rubber producing country Thailand.

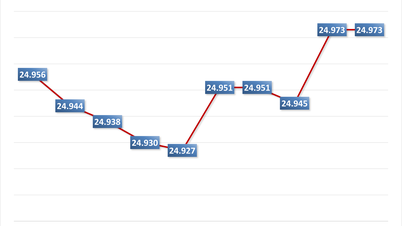

At the Osaka Commodity Exchange (OSE) in Japan, rubber prices rose sharply to their highest level in the past 7 years. On February 28, 2024, the price of RSS3 rubber for near-term delivery was 301.3 yen/kg (equivalent to 2.0 USD/kg), up 7.9% compared to the end of January 2024 and up 43.3% compared to the same period in 2023. Price developments of RSS3 rubber delivered at the Osaka Exchange from December 2023 to present (Unit: Yen/kg).

|

| In February 2024, rubber prices on key exchanges in Asia increased compared to the previous month. Illustrative photo |

On the Shanghai Futures Exchange (SHFE), rubber prices rose sharply after the Lunar New Year holiday. On February 28, 2024, the RSS3 rubber futures price for near-term delivery was 13,835 yuan/ton (equivalent to 1.92 USD/kg), up 2.6% from the end of January 2024 and up 12.4% from the same period in 2023. As of February 25, 2024, the natural rubber inventory in the Qingdao General Trading and Bonded Zone was 666,100 tons, down 9,600 tons (equivalent to a decrease of 1.4%) from the previous period. Rubber price movements on the SHFE from December 2023 to present (Unit: yuan/ton).

In Thailand, rubber prices continue to increase. On February 27, 2024, RSS3 rubber was offered at 79.66 baht/kg (equivalent to 2.21 USD/kg), up 9% compared to the end of January 2024 and up 47.1% compared to the same period in 2023. The Thai Meteorological Department warned that harsh weather conditions in the country's main rubber-producing regions from March 1, 2024 to April 1, 2024 could affect rubber latex harvest output.

Exports flourish, rubber industry sets target of over 3 billion USD in 2024

In February 2024, the price of raw rubber latex nationwide remained stable compared to the previous month. At rubber companies, the purchase price of raw rubber latex remained around VND 270-305/TSC. Of which, Phu Rieng Rubber Company maintained the purchase price at VND 285-305/TSC, stable compared to the end of last month. Binh Long Rubber Company maintained the purchase price at VND 285-295/TSC. Ba Ria Rubber Company maintained the purchase price at VND 283-293/TSC. Mang Yang Rubber Company maintained the purchase price at VND 270-278/TSC, stable compared to the end of last month.

It is estimated that Vietnam's rubber exports in February 2024 reached about 110 thousand tons, worth 161 million USD, down 47.7% in volume and 45.7% in value compared to January 2024; compared to February 2023, down 16.1% in volume and 12.9% in value.

|

| Exports flourish, rubber industry sets target of over 3 billion USD in 2024. Illustrative photo |

The decrease was due to the traditional Tet holiday in both Vietnam and China in February, which slowed down Vietnam's rubber export activities. The average rubber export price in February 2024 was 1,464 USD/ton, up 3.8% compared to January 2024 and up 3.8% compared to February 2023.

In the first two months of 2024, rubber exports are estimated to reach about 320 thousand tons, worth 458 million USD, up 20.4% in volume and 24.5% in value over the same period in 2023.

In January 2024, the main types of exported rubber were natural rubber and synthetic rubber blends (HS 400280), Latex, SVR 10, SVR 3L, SVR CV60, RSS3... Of which, natural rubber and synthetic rubber blends were exported the most, accounting for 63.42% of the country's total rubber exports, with 133.39 thousand tons, worth 193.42 million USD, down 26.8% in volume and 25.8% in value compared to December 2023.

However, compared to January 2023, it still increased by 42.3% in volume and 51.9% in value. Of which, exports to China accounted for 99.86% of the total volume of natural rubber and synthetic rubber exports of the whole country, with 133.21 thousand tons, worth 192.74 million USD, down 26.8% in volume and down 25.9% in value compared to December 2023.

In January 2024, most types of exported rubber grew well in both volume and value compared to January 2023, notably: Latex, SVR 20, RSS3, recycled rubber, SVR 3L, SVR 10...

Regarding export prices, in January 2024, the average export prices of most rubber varieties increased compared to January 2023, notably: Latex, SVR 5, RSS1, RSS3, SVR 20, SVR 10, mixture of natural rubber and synthetic rubber (HS 400280), SVR CV50...

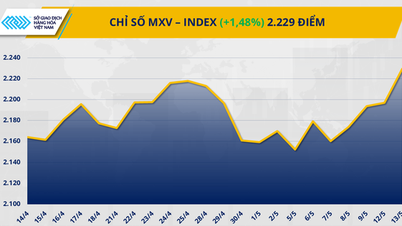

In the global market, natural rubber prices have risen to a seven-year high due to growing demand from China's electric vehicle industry coupled with poor production in Thailand. In 2024, the rubber industry aims to export rubber worth 3.3-3.5 billion USD.

According to statistics from the Indian Ministry of Commerce, in 2023, India imported 1.18 million tons of rubber (HS 4001; 4002; 4003; 4005), worth 2.13 billion USD, down 4.1% in volume and 21.6% in value compared to 2022. Indonesia, South Korea, Thailand, Vietnam and Malaysia are the 5 largest markets supplying rubber to India.

In 2023, Vietnam was the fourth largest rubber supplier to India with nearly 110.35 thousand tons, worth 161.06 million USD, down 19.6% in volume and 37.7% in value compared to 2022. Vietnam's rubber market share in India's total rubber imports accounted for 9.35%, down from 11.14% in 2022. In the Indian market, Vietnam's rubber market share narrowed, while the rubber market share of Indonesia, Thailand, Korea, and China increased compared to 2022.

Source

Comment (0)