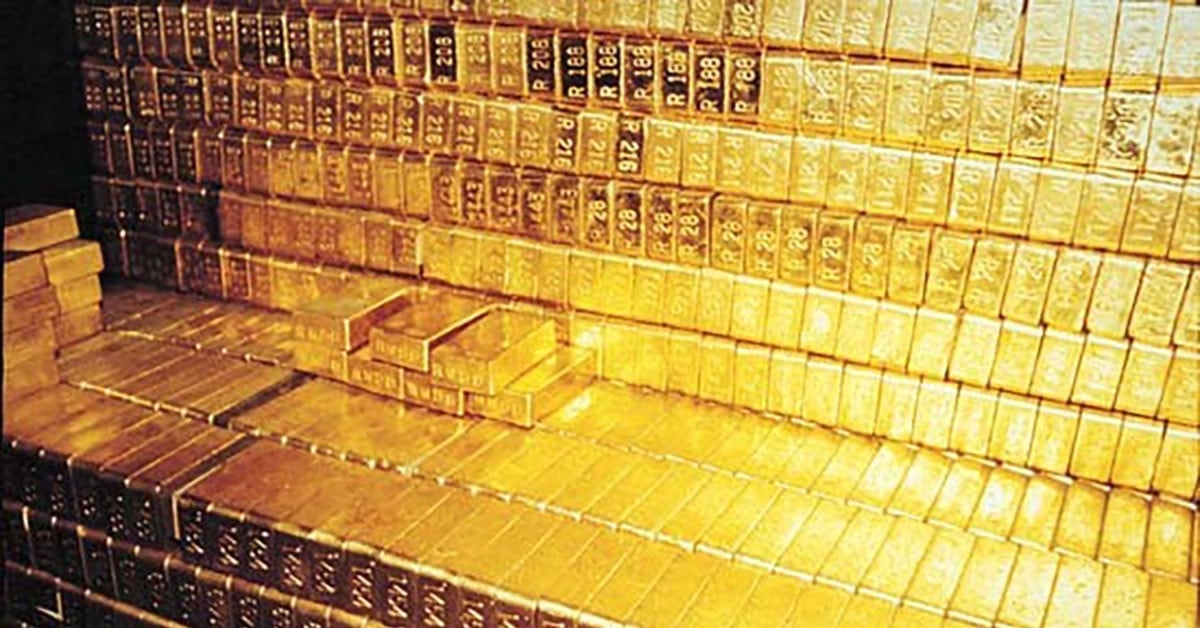

Ms. Truong My Lan and her accomplices inflated the value of mortgaged assets deposited into SCB Bank to withdraw money for various purposes.

The value of the collateral is only 1/6 of the loan.

After the Investigation Police Agency of the Ministry of Public Security initiated a case of "Fraudulent appropriation of property" occurring at Van Thinh Phat Group (VTP) on October 8, 2022, the Governor of the State Bank of Vietnam (SBV) issued Decision 61 on special control of SCB Bank. In order to conduct a review report for special purposes when the bank is under special control, all collateral assets of debts with a total balance of over VND 50 billion for corporate customers and over VND 10 billion for individual customers are re-evaluated at the request of the SBV.

As of January 3, 2023, SCB Bank signed a contract to hire Hoang Quan Valuation Company Limited to conduct asset valuation as of September 30, 2022. As a result, the value of SCB Bank's assets is VND 295,940 billion (fixed assets are VND 5,946 billion; collateral assets of outstanding loans are VND 289,994 billion).

Ms. Truong My Lan and her accomplices inflated the value of many assets mortgaged at SCB.

Regarding the loans of Truong My Lan Group - VTP Group, in the period from January 1, 2012 to October 7, 2022, there were 1,166 assets securing 1,284 loans, with a total outstanding debt (as of October 17, 2022) of VND 677,286 billion (including principal and interest), with a book value of VND 1,265 million billion. Hoang Quan Valuation Company valued 726/1,166 assets with a re-allocated revaluation value of VND 253,561 billion. Hoang Quan Valuation Company did not value the remaining 440 assets because the assets were shares, property rights, real estate without sufficient documents, legal assets, and some assets were not within the scope of revaluation.

Of the 726 assets valued, according to SCB's assessment, 517 assets have sufficient legal mortgage or pledge to be valued when making risk provisions, the allocated value according to the submission and/or mortgage/pledge contract is VND 179,196 billion. The remaining 209 assets do not have sufficient legal conditions (no mortgage or pledge contract, mortgage contract has not been notarized, assets have not registered for secured transactions as prescribed...). Therefore, SCB cannot proceed with the disposal of the assets, and do not have sufficient conditions to be valued when making risk provisions.

Quick view 8pm November 20: Former SCB leader takes 5.2 million USD to bribe | Karaoke bar struggles to hold on

Thus, after re-evaluating the assets securing the debts of Ms. Truong My Lan and her accomplices, the value of the assets has decreased significantly.

Typical examples of assets that are not legally sufficient and have inflated values are loans related to the collateral of the Mui Den Do project. Specifically, SCB Bank has disbursed 137 loans to 100 customers related to the collateral of the Mui Den Do project with an outstanding debt of VND 133,710 billion (including principal and interest), accounting for 22% of the total outstanding principal of the Truong My Lan group - VTP Group at SCB. Accordingly, the collateral on the books is VND 584,487 billion, of which the collateral is capital contribution and shares of VND 433,473 billion; property rights arising from the Mui Den Do project are VND 147,650 billion; real estate and other property rights are VND 3,363 billion.

However, when Hoang Quan Valuation Company re-evaluated the price, the value was determined to be VND 22,003 billion; the collateral assets were capital contributions and shares that could not be valued (because the shares had been valued on property rights arising from the Mui Den Do project at VND 18,317 billion); property rights arising from the Mui Den Do project were VND 18,317 billion; other real estates were VND 3,686 billion. In which, SCB Bank assessed that the collateral assets had sufficient legal basis to set up risk provisions with a value of VND 17,597 billion, of which property rights arising from the Mui Den Do project were VND 17,597 billion, and other real estates were VND 0.

Valuation company colluded to inflate the value of mortgaged assets

According to the investigation agency, in order for Truong My Lan and her accomplices to withdraw and appropriate money from SCB Bank through borrowing tricks, there was the assistance of valuation companies.

The valuation companies colluded with the subjects at SCB Bank to issue valuation certificates to legalize the documents of Truong My Lan group and VTP Group. Those are Tam Nhin Moi Company, MHD Company, Thien Phu Company, E XIM Company, DATC Company did not perform valuation work but issued valuation certificates at the request of SCB Bank to collude, legalize loan procedures, and inflate the value.

The investigation results of the case determined: In essence, the act of putting collateral into SCB is just a method and trick to commit a crime. There are many collaterals that have no legal value, do not meet the conditions to be mortgaged but are still valued, inflated in value, and mortgaged at SCB Bank as a loan option.

Specifically, 684 out of 1,284 loans did not have mortgage procedures when disbursed; many loans were disbursed first, then the loan documents and collateral were legalized. In addition, there were 201 loans that had not been approved for lending by competent authorities.

For example, one of the issuances of certificates of inflated value according to the investigation results is that Vo Tan Hoang Van - former General Director of SCB Bank - directed Le Van Chanh - former Director of SCB Valuation and Assets - to receive the asset valuation file from the Re-Valuation Department and transfer it to Le Kieu Trang - Deputy Director of E XIM Company and asked Kieu Trang to conduct the valuation, sign the appraiser so that E XIM Company could issue 17 certificates of inflated asset value for SCB to use as collateral, securing loans for 11 customers. The total amount disbursed for the above 11 loans is more than VND 1,140 billion; the total debt repayment obligation up to October 17, 2022 is more than VND 1,550 billion (including outstanding principal and interest). Meanwhile, the value of collateral allocated to secure these loans according to the valuation of Hoang Quan Valuation Company and the legal eligibility assessment of SCB is only nearly 565.7 billion VND.

The defendants at SCB Bank all confessed that they only signed legal procedures, did not conduct appraisals and assessments of loans according to the provisions of law and SCB's lending procedures. Therefore, the investigation agency determined that the entire principal amount of more than VND 415,666 billion that Truong My Lan and her accomplices used to legally borrow money to withdraw from SCB, which still has outstanding debts, is the amount that Truong My Lan appropriated from SCB Bank...

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)