Bau Duc's secretive daughter

Ms. Doan Hoang Anh, daughter of Mr. Doan Nguyen Duc (Bau Duc), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAG), has just announced her registration to buy 2 million shares, from August 20 to September 18. The purpose of the purchase is to increase the ownership ratio.

If the transaction is successful, Mr. Duc's daughter will own 13 million shares, accounting for 1.23% of the charter capital. Based on the market price of the shares, Mr. Duc's eldest daughter may spend about 20 billion VND to make the transaction. Ms. Hoang Anh's assets on the stock market at that time are equivalent to over 130 billion VND.

Since the beginning of the year, Mr. Duc's daughter has been continuously buying and selling HAG shares. In January 2024, Ms. Hoang Anh bought another 1 million shares. On February 15, Ms. Hoang Anh sold 2 million shares, reducing her ownership to 0.97%.

On May 9, she registered to buy 2 million shares, with an amount of about 26.9 billion VND.

Ms. Doan Hoang Anh is the daughter of Mr. Duc but is quite secretive. In August 2021, Doan Hoang Anh became a shareholder of HAGL when she spent nearly 21 billion VND to buy 4 million shares.

In 2020, Mr. Duc's daughter attracted attention when she and Mr. Thang's son opened the Ong Bau coffee chain.

Chairman of the Board of Directors Doan Nguyen Duc is currently the largest shareholder at HAG, owning 30.26% of capital, equivalent to nearly 320 million shares.

Chairman Tran Duy Hung's son sells 47 million shares

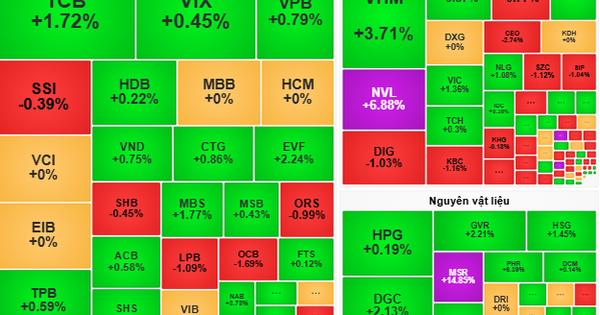

On August 26, Mr. Nguyen Duy Linh announced that he had sold all of the more than 47 million SSI shares of SSI Securities Corporation. The transaction was conducted from August 19-23 by negotiation. After the transaction, Mr. Linh officially no longer holds shares in SSI Securities.

Mr. Nguyen Duy Linh is the son of Mr. Nguyen Duy Hung, Chairman of the Board of Directors of SSI. Mr. Hung currently holds 11.7 million shares, equivalent to 0.77% of charter capital.

On the other hand, NDH Investment Company Limited, a company related to Mr. Nguyen Duy Hung, announced that it had purchased 32 million shares as previously registered. The transaction was completed from August 21-23.

After the transaction, NDH increased its ownership in SSI from 94.23 million shares (equivalent to 6.23%) to 126.23 million shares (equivalent to 8.35%). Mr. Nguyen Duy Hung is also the Chairman of the Board of Directors and the legal representative of NDH.

Chairman's son sells all shares

At Viet Thai Electric Cable Joint Stock Company (VTH), Mr. Nguyen Duc Manh, son of Mr. Nguyen Duc Tuong, Chairman of the Board of Directors, sold all 1.3 million shares (accounting for 16.22%) between July 29 and August 1.

Similarly, Chairman of the Board of Directors Nguyen Duc Tuong also registered to sell all of the more than 2.6 million shares he was holding from August 8 to September 5 to reduce his ownership ratio.

If the sale is successful, Mr. Tuong and his son will no longer hold more than 49% of capital at Viet Thai Electric Cable.

Meanwhile, Mr. Tran Van Hung, a member of the Board of Directors, wants to buy 1.9 million new shares from August 8 to September 5 for investment purposes. If successful, Mr. Hung will hold more than 24% of the capital.

Phat Dat Chairman's Daughter Registers to Sell Shares

Ms. Nguyen Thi Minh Thu, daughter of Mr. Nguyen Van Dat, Chairman of the Board of Directors of Phat Dat Real Estate Development Corporation (PDR), has just announced information about registering to sell nearly 1.1 million shares, from September 6 to October 4, by order matching or negotiation method.

Ms. Thu said the purpose of the sale is to solve personal financial needs. If the transaction is successful, Ms. Thu will still own nearly 6 million shares, equivalent to 0.68% of capital.

Provisionally calculated according to PDR stock price on August 30, Ms. Thu can earn about 23 billion VND.

Previously, Ms. Thu registered to sell the above number of shares from June 20 to July 19 but did not trade due to changes in financial plans.

Source: https://vietnamnet.vn/ai-nu-kin-tieng-nha-bau-duc-con-trai-chu-tich-ssi-chot-thuong-vu-lon-2317537.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)