Vietnam is an attractive market for investors, but the expected “capital winter” will continue, forcing businesses to build long-term value and find opportunities to connect with suitable investors. Currently, not only businesses are trying to find capital flows, but investors are also trying to build portfolios and potential investment orientations.

What attracts investors?

According to the General Statistics Office, as of June 20, 2023, foreign investment capital, including total newly registered capital, adjusted capital and capital contribution to buy shares nationwide, reached over 13.43 billion USD. Total investment capital decreased but the decrease narrowed compared to the same period last year, showing a positive signal in attracting FDI.

The processing and manufacturing industry continues to be a “magnet” attracting FDI capital with more than 8.46 billion USD, accounting for nearly 63% of the total registered investment capital. Next are the finance and banking sectors; real estate business; professional activities, science and technology...

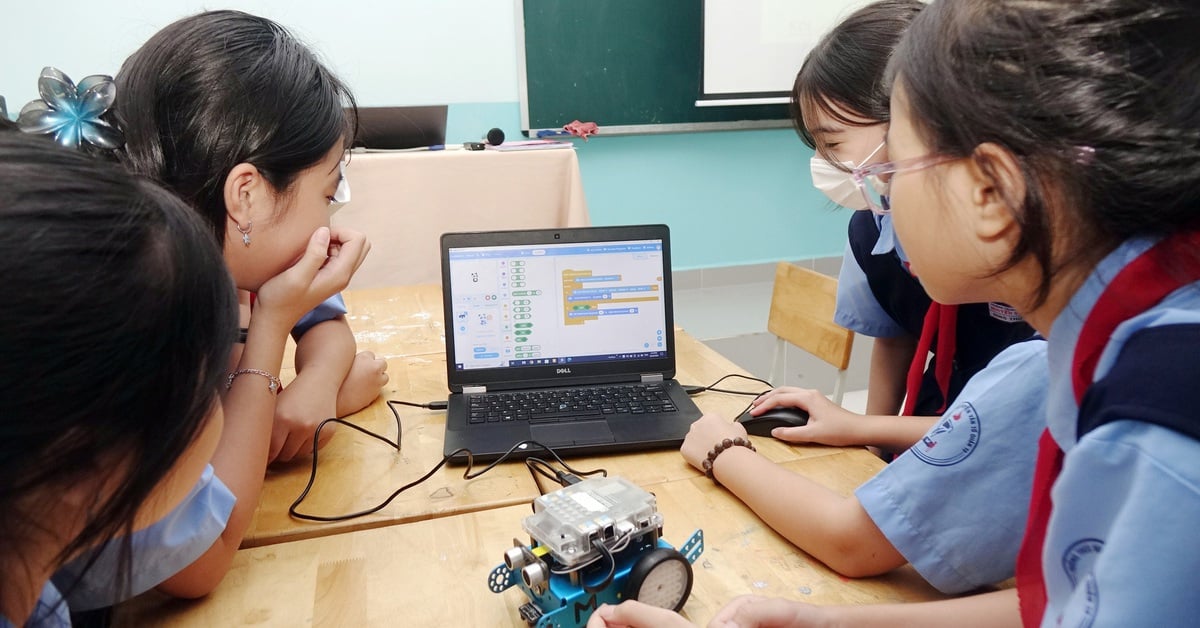

The development of startups is also a bright spot attracting investment. The total investment capital poured into Vietnamese startups reached 634 million USD, through 134 deals, according to the Vietnam Innovation and Technology Investment Report 2023 released in March this year.

On the side of investors attending InnoEx this year, Ms. Nguyen Khanh Van - Director of Private Equity Investment, Thien Viet Securities JSC (TVS), one of the early stage investors of technology unicorn MoMo, said that the company does not believe that technology is a prerequisite for the success of a startup, but rather the applicability of those technologies in a large enough potential market.

In addition to the requirements on team and development stage, Ms. Van expects startups to be able to demonstrate the suitability of the solution in Vietnam: “Proven solutions in other developing markets in Southeast Asia are one of the good indicators. Can you think and make appropriate changes when bringing those models to Vietnam with its own characteristics in terms of people and culture? Will Vietnam's legal framework and macro-economy create favorable conditions for the development of this solution in the long term? Those are the questions I ask before deciding to invest.”

TVS said the company can invest venture capital from $1-5 million for startups at the Series A stage, as well as have the capital to provide short-term loans according to business needs.

According to Ms. Nguyen Khanh Van, the three most important and never-ending factors for investors to decide to invest are: Business model, Potential market size, and human factor, including the Founder and key management team.

2023 - a "test of fire" time for businesses

The attractiveness of the Vietnamese market to investors is still very large, but the macro context makes 2023 considered a testing time for businesses. Since the beginning of the year, bank interest rates have increased, combined with many complicated developments in the world situation, causing investors to gradually reduce their capital sources. In a challenging context, businesses need more opportunities to connect and find suitable investors. There are many success stories between business units and investors when they have a common "touch point".

According to Mr. Nguyen Ngoc Tue - Investment Director of Banking - TVS, in the context of cautious investors, businesses need to demonstrate the factor of "innovation" to attract them to invest. Innovation is not necessarily developing a new industry, you just need to improve the production process or provide services and prove it is effective, the product will be noticed.

In addition, in the Investment Zone within the framework of InnoEx, investors also discussed the trend of impact investing. Investors agreed that investing in this field requires more effort as well as more thoroughness in measuring and demonstrating the impact of the solution on society. Therefore, convincing investors to invest is also more difficult than technology solutions in other fast-growing fields.

“While venture capital and private equity have seen a massive decline of 40-50% in recent years, impact investing has only seen a 7% decline. This shows that this is a resilient sector during the crisis. Impact investors still have a lot of capital available to allocate to the really quality startups they are looking for in the market,” said Angela Tay, an investor at AgFunder.

Ms. Angela Tay advised founders to also expand their approach to investors not only in Asia but also in Europe and America because the majority of investors in this field are appearing more on the other side of the hemisphere.

InnoEx 2023 is organized by the Ho Chi Minh City Young Entrepreneurs Association (YBA), Ho Chi Minh City Youth Startup Support Center (BSSC), IBP Investment Promotion and Business Support Joint Stock Company, taking place at the end of August in Ho Chi Minh City. Many impressive activities took place within the framework of the InnoEx 2023 event such as the Business and Pioneer Leaders Forum - InnoEx Forum, Green Economic Forum - Green Summit, Vietnam CEO Forum, Startup Wheel Competition; Exhibition, Investment Forum, Education and Training and Connecting Talents in the Innovation Ecosystem.

With more than 20,000 attendees, InnoEx 2023 also opens up a space for investment connections and in-depth innovation connections dedicated to about 70 investment funds, banks, Vietnamese and international financial institutions, and more than 200 businesses and startups from 52 countries and territories.

Le Thanh

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)